4 Tips on Spotting a Fake County Court Business Claim Form

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a County Court Business claim form can be quite scary. But don’t worry. This article is here to help you understand if the claim form you received is true or fake.

Every month, over 12,000 people visit our site for advice on debt topics, so you’re not alone.

In this article, we’ll talk about:

- How to know if a County Court Business claim form is real or fake

- What happens if you can’t pay

- What a County Court claim form means for you

- How to deal with a fake County Court claim form

- Where you can get free debt advice in the UK

We understand that getting a claim form can make you worry about money and debt. You might be thinking about not being able to pay and what will happen if you can’t.

We’re here to support you, give you the facts, and help you know what to do next. So, let’s get started.

Fake or Real County Court Business claim?

You may receive a County Court Business claim form and wonder if it’s fake or real. You aren’t alone because some unscrupulous debt collection agencies try to trick people into paying by using similar-looking documents!

The problem is that many people find it hard to distinguish real documents from fake ones. That said, the differences between a real and the fake one may be minor, but they are there!

It’s what differentiates a real CCB claim form from a fake one.

A real County Court Business claim form is sent to you when a judge registers a County Court Judgement (CCJ) on your credit file. It’s a court-issued document that shouldn’t be ignored!

However, a fake form, although very similar, has some differences which include not including a response pack.

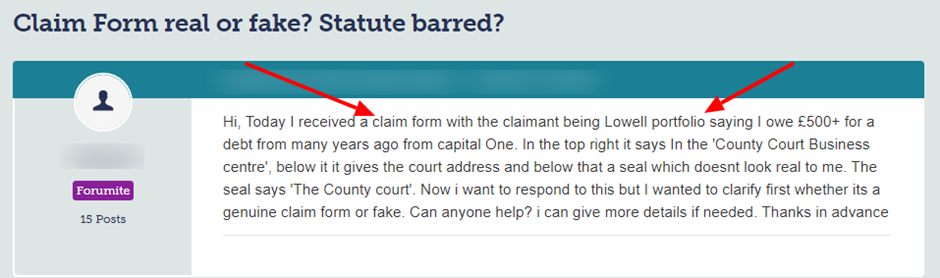

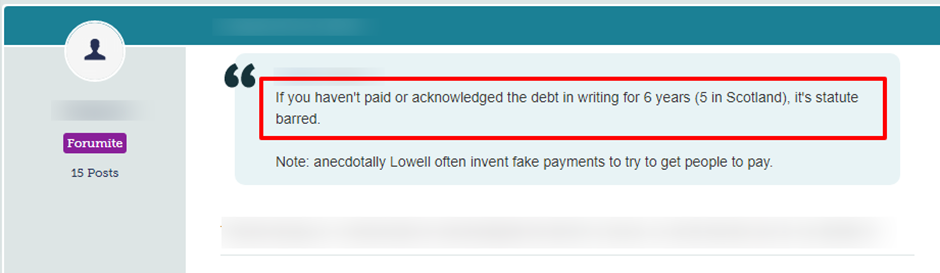

Check out the message one concerned person posted about a debt collection agency on a popular forum:

Source: Moneysavingexpert

Who issues fake County Court claim forms?

You’d likely get a fake County Court claim from debt collection agencies. It’s one of the ways that several debt collectors try to recover debts they purchased.

Not all debt collection agencies use this unscrupulous method, but some do!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Why would you be sent a fake County Court claim form?

You’d get a fake County Court claim form for several reasons which I’ve listed here:

- A creditor passed your details to a debt collection agency in an attempt to recover the money you allegedly owe

- A debt recovery company purchased the debt and is now chasing you for the money

Chances are the debt collection agency used a document that looks very much like it was court issued when it was not!

How to spot a fake claim form

As mentioned, unscrupulous debt collection agencies are known to use documents that seem to be court issued. These documents, however, have very minor differences which can be hard to spot.

That said, there are ways to spot if a County Court claim form is legit or fake. You could:

- Check your credit history to see whether you’ve got a CCJ registered on your credit file

- Check the address on the claim form you were sent to make sure it’s from a Government address. If the address isn’t a government one, the document is fake

- If you’re asked to settle the debt immediately, the claim form is fake

- If the claim form provides a way to pay and asks you to pay money into a bank account, the document is fake

A real claim form contains a response pack and other additional documents. A fake document does not!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What should you do if you get a fake County Court claim form?

You should always check whether a claim form is fake or not. The problem is that many people fall for the deception thinking the document issued by the court.

A fake claim form insists that a CCJ is registered against you and therefore, you have to pay no matter what your circumstances.

A real County Court claim form won’t insist that you pay the full amount, but rather assess the best way to settle the debt.

In short, before a CCJ is registered against you, the claim form offers you the chance to negotiate how you can pay back the debt. You’d never be asked to pay the full amount ‘immediately’!

How should you deal with a fake County Court claim form?

You don’t have to do anything if you suspect a County Court Business claim form may be fake. That said, if the letter is from a debt collection agency, you shouldn’t ignore it either.

But you should report the debt collector to the Financial Conduct Authority (FCA) if you believe they crossed the line by using a fake document.

It’s also worth noting that there are some fake claim forms out there which are not from debt collectors but from scammers. These fake claim forms are dangerous because the senders are just trying to get you to pay a non-existent debt and your banking details!

Can I ignore a claim form from the County Court Business Centre?

No. It’s never a good move to ignore official-looking letters. Once you’ve established the claim form is real and not fake, you have two choices.

You can:

- Admit owing the money by filling out the Admission Form, or

- Dispute the claim by filling out the Defence and Counterclaim Form

If you don’t respond to a County Court claim form, a CCJ is issued against you by default. It’s wiser to respond to a debt collection agency when they contact you because the debt might not even be yours!

Can you find out who gave you a CCJ?

Yes. You can find out who applied to the court to issue a judgement against you by contacting the relevant court. You’d have to provide the case number before you can retrieve the claimants’ details.

Where can I get free debt advice in the UK?

Yes. Several UK charities provide essential debt advice to people who are struggling to stay on top of their debts. Their advice could be invaluable when it comes to getting out of debt and your life back on track.

I’ve listed some of the major charities that offer free debt advice in the table below:

| Name of Charity | Link to Charity Website |

| Citizens Advice | https://www.citizensadvice.org.uk/ |

| National Debtline | https://nationaldebtline.org/ |

| Stepchange | http://www.stepchange.org/ |

| MoneyPlus Advice | https://moneyplusadvice.com/ |

Can you be given a CCJ without knowing?

You may discover that a County Court Judgement (CCJ) is registered on your credit file and you knew nothing about it.

That said, if you don’t check your credit score from time to time, bailiffs could show up at your door!

Lastly, tips on spotting a fake County Court Business claim form (Recap)

There are reports of debt collection agencies using documents that are very similar to court-issued claim forms. It’s a deceitful tactic to trick unsuspecting people into paying money owed.

That said, some scammers use fake County Court claim forms to get you to pay non-existent debts. Moreover, they get your bank details if you respond to them!

The first thing to do when you get a CCB claim form is to check whether you really have a County Court Judgement on your credit file. If you don’t, the claim form is fake!

If however, the claim form is genuine, you have two options which are to admit the claim or dispute it. But never ignore it because the consequences could be expensive!