How Do Debt Collectors Find You in the UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Feeling worried about debt can be really hard. If you owe money, you might be scared about what will happen when the debt collectors find you. This can be even scarier if you’ve moved house.

But don’t worry; you’re not alone. Every month, over 12,000 people visit this site seeking advice on debt matters.

In this simple guide, we’ll help you understand:

- How debt collectors find people who owe money in the UK

- If you have to pay the money to debt collectors

- Ways to make your repayments smaller

- How debt collectors can see your credit report

- What happens when your debt has a court order attached to it

We understand how stressful this can be; some of our team have been in the same boat. So, we know how to help you.

Ready to learn more about debt collectors in the UK and what you can do if you owe money? Let’s dive in!

How do debt collectors find you UK?

Debt collectors are persistent and will go out of their way to find you when chasing a debt. Whether they purchased the debt or they’re instructed by a company, getting your details is easy.

All debt collectors need to do is check with the original creditor. For example, if you defaulted on a phone bill, debt collectors just have to get the info from one of your bills.

How do debt collectors find you when you’ve moved?

It can be harder for debt collectors to find you when you’ve moved house several times! But they are experts when it comes to tracking people down. For instance, a debt collector can check public databases which tells them your new address.

Another method debt collectors often use to track people down is to gain access to credit reports. But it’s expensive and the cost can add up when debt collectors need to track down a ton of debtors!

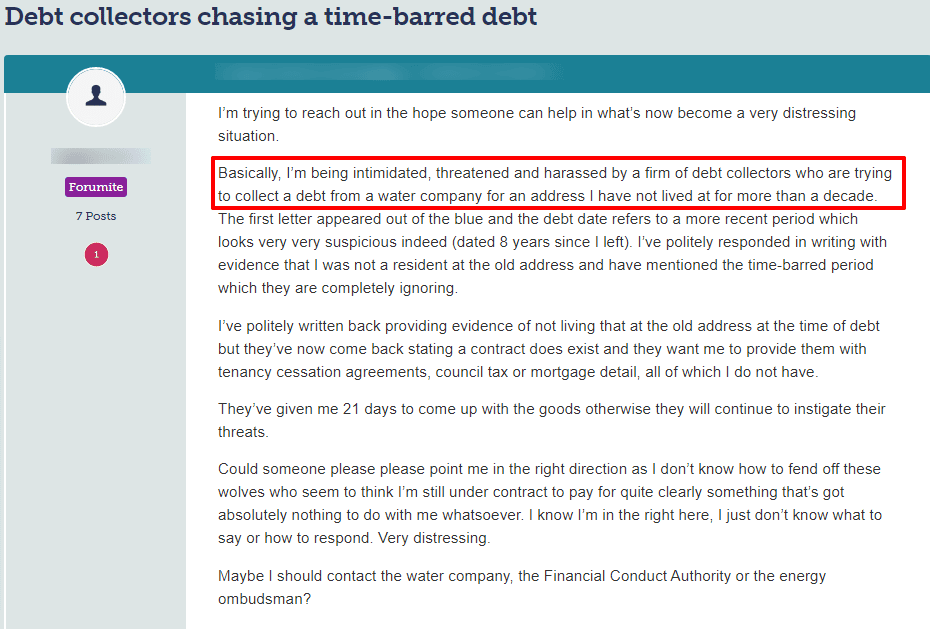

Check out what happened to one poor person when debt collectors contacted them:

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How hard is it for debt collectors to find you?

It can be pretty hard for debt collectors to find you. Especially when the population in the UK is well over 60 million people. It can be likened to finding a needle in a haystack!

Moreover, many people are hard to trace because they don’t have many financial commitments or pay bills!

Because it can be hard to trace you when you owe money, debt collectors use a scattergun technique! It’s an approach that sees debt collectors sending out letters to all the addresses they think a debtor might be at.

The hope is that one letter will get a response and maybe, even a payment!

The real downside to a scattergun technique is that lots of innocent people are suddenly incredibly worried about things!

» TAKE ACTION NOW: Fill out the short debt form

How do debt collectors find your bank account UK?

If the debt collector has purchased a debt, they can get access to your bank account by making an application to the courts for an ‘order to obtain information’. That said, you’d have to attend court to give the information under oath.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How often do creditors find people?

Debt collection agencies have various means and tools they can use to find people in the UK. Some are legal and some are definitely not! That said, if a person has moved several times over several years, it makes it harder for them to be found.

If, however, a debtor only moved house once and regularly pays utility bills etc they can easily be found!

Do you have to pay debt collectors?

You might not have to pay debt collectors.

If you genuinely can’t afford your debt repayments then looking into whether you could have your written off might be just what you need.

If you want to find out whether you qualify for having debt written off or payments lowered then fill out the short form below.

What should I not tell debt collectors?

There are things you should avoid telling a debt collector which I’ve listed here:

- Your personal financial information

- Social Security number

- Details of properties you own

- Admit liability

Who can you report debt collectors to?

You can report a debt collection agency when they use intimidating tactics when they contact you.

I’ve listed the contact details for the Financial Ombudsman Services here:

| Financial Ombudsman Services | https://www.financial-ombudsman.org.uk/make-complaint |

| Telephone number enquiries | 08000234567 |

| [email protected] |