Do I Have to Pay Global Debt Recovery on behalf of Cabot?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with debt can be tough. You might feel worried if you’ve had a letter from Global Debt Recovery on behalf of Cabot. But don’t fret; you’re not alone. Every month, over 12,000 people come to this site for guidance on debt issues, just like you.

In this article, we’ll talk about:

- Who Global Debt Recovery are and why they might contact you.

- How to know if the debt is really yours.

- Steps to take if the debt is too old to enforce.

- What happens if you choose to ignore the debt collector.

- Your rights and how to move forward with Global Debt Recovery.

We know that dealing with debt collectors can be hard as some of our team members have been in your shoes. They’ve struggled with debt and had to deal with debt collectors. So, we know how to help. Let’s get started to learn more about dealing with Global Debt Recovery.

Why would Global Debt Recovery contact you?

Global Debt Recovery likely contacted you about a Cabot Financial debt because Cabot passed your information on to them.

Or maybe GDR purchased the debt from Cabot!

Is the debt really yours?

Once you’ve established whether the debt is statute-barred or not, the next step is to find out if you owe the money!

You should write to Global Debt Recovery as soon as possible asking them to ‘prove the debt’.

They should provide you with hard proof you owe any money. It’s not to you to prove you don’t!

You should never accept a debt collector’s word for it. GDR must send you copies of an original credit or other agreement if they haven’t already!

Plus, the copies must be authenticated either by the original creditor or an authorised person!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is the debt too old to enforce?

You should always check whether a debt is too old to enforce because it’s statute barred. A court won’t hear a case where a debt is too old so you don’t risk getting a County Court Judgement either!

However, not all older debts are statute barred because they need to meet specific criteria. That said, it’s worth establishing if the debt GDR is chasing you for is too old to enforce.

Should you ignore the debt collector?

No. Don’t ignore Global Debt Recovery when they get in touch with you. Even if you know the debt isn’t yours or that it’s too old to enforce!

Ignoring a debt collector just makes the situation worse and more stressful further down the line.

You should write back to GDR to tell them they’re chasing the wrong person. Or to tell them the Cabot debt is too old to enforce.

But don’t bin the letter and think the problem will just go away because it won’t.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when you ignore a debt collector?

When you bin a letter from a debt collector whether you owe the money or not, the problem remains. Plus debt collection agencies are notoriously persistent and will chase you for payment no matter what!

You could be missing out on the following when you ignore Global Debt Recovery:

- Establishing the debt is statute-barred which means it’s too old to enforce through the courts – more on this later

- Determining that Global Debt Recovery is chasing the wrong person because the outstanding debt is not actually yours

- Being offered a payment plan by GDR if the debt is proven to be yours

- Having some of it wiped off if Global can prove you owe the money

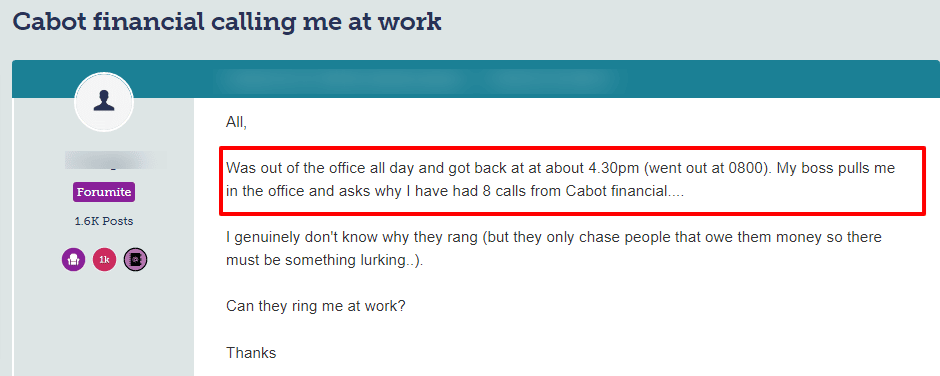

Check out what happened to one person who posted this message on a forum:

Source: Moneysavingexpert

Will Global Debt Recovery start court proceedings?

Yes. You could face a court hearing if you ignore and don’t pay a proven debt. You’d get lots of threatening letters then a Letter Before Action notice.

If you don’t respond to the notice or ignore it, a debt collector could advise their client to take you to court!

You may not realise the following happens:

- A court issues an order for you to pay the amount owed and a County Court Judgement is registered on your credit file

- The judge issues an order for enforcement agents (bailiffs) to visit you at home

- Enforcement agents have the right to seize your possessions to recover the money owed

- Your possessions could be sold at an auction

- A judge could issue an attachment order on your earnings or even on your bank account

It’s worth noting that if Global Debt Recovery purchased the Cabot debt, they could take you to court themselves.

The threat of court action may just be a tactic to scare you into paying. But it could also be a genuine threat!

What can’t Global Debt Recovery do?

Global Debt Recovery must follow the law and the CSA Code of Practice when they contact you over an alleged Cabot debt.

There are things they can do and say and things that are unlawful. For example, a debt collector cannot legally do any of the following:

- Force their way into your property

- Clamp vehicles, or seize possessions

- Visit you at your place of work unless you agreed to them doing so

- Discuss the problem with your employer

- Talk to your neighbours, a family member or your friends about an alleged debt you owe

- Urge you to borrow more money to pay what’s owed on the debt

- Harass you with phone calls, texts, and emails

- Threaten you

- Pretend their powers are the same as bailiffs (court-appointed enforcement officers)

- Show you documents and papers that look like they were issued by a court

Debt collectors must respect your privacy and if they don’t, GDR would be breaching the UK’s privacy laws!

Moreover, all accredited and authorised debt collection agencies must follow the law. If they don’t, you can report them to the Financial Ombudsman Service (FOS).

» TAKE ACTION NOW: Fill out the short debt form

Can you stop GDR from contacting you?

No. It’s not possible to prevent a debt collection agency from contacting you over an alleged debt. They have the right to get in touch but they must follow the law!

However, you can write back to a debt collector telling them how you’d like to be contacted. For example, it’s a good idea to send a letter to them by registered post asking them to only contact you in writing.

Global Debt Recovery must respect your request, but if they don’t and they harass you with phone calls, you can report them to the FOS.

However, you should first file a complaint with the debt collector and then lodge one with the Financial Ombudsman Service.

It’s worth noting that harassment is against the law and you could receive compensation if the FOS rules in your favour!

Can you complain about Global Debt Recovery?

Yes. You have every right to file a complaint with Global Debt Recovery’s head office. You should allow them the time to put things right.

However, when you feel GDR isn’t dealing with your complaint correctly, you can then report the debt collection agency to the Financial Ombudsman Service!

Your complaints must be made in that order!

How do you contact Global Debt Recovery?

I’ve listed ways you can contact Global Debt Recovery in the table below:

| Website | https://globaldebtrecovery.co.uk/gdr2/ |

| Phone | 0208 336 7000 |

| SMS | 07837 207 809 |

| Opening hours | Mon to Thurs 8 am – 6 pm, Friday 8 am – 4 pm, Saturday 9 am – 12 pm |

| [email protected] | |

| Post | PO Box 123D, New Malden, KT3 4LW |