Do I Have to Pay Overdales Debt? CCJ Warning

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If Overdales, a debt collecting company, has sent you a letter, you may be asking, “Do I have to pay Overdales debt?”

Don’t worry. This article will help answer this question and many others you might have. We’ll look at:

- Who Overdales is and if they are a real company.

- How to handle a debt letter from Overdales.

- Ways to lower your repayments.

- What happens if the debt is too old to enforce.

- What Overdales can legally do and how to stop them from contacting you.

Dealing with debt can be tough. It can make you feel worried and unsure, but you’re not alone! Every month, over 12,000 people visit this site for advice on debt problems.

We understand what you’re going through; some of our team have been in your situation before. That’s why we’re here to help you learn more about how to deal with Overdales and their debt collection.

Can you ask Overdales to prove the debt is yours?

Yes. You have every right to ask Overdales to prove the debt belongs to you! Even if you think you may owe money, ask the debt collector to prove it anyway.

Overdales can simply tell you over the phone or in person that you owe the money. They must provide written proof and if it’s a copy of a contract/agreement, the copy must be authenticated!

What happens when Overdales can’t prove the debt?

You may not have to pay if Overdales can’t prove the debt is yours. A debt collector can’t simply say they know it’s yours. Without authenticated proof, they can’t make you pay and debt collectors can’t continue chasing you.

You can complain to Overdales if they continue to pursue you over something they can’t prove is yours. Next, you can lodge a complaint with the Financial Ombudsman Service (FSO).

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How should you deal with an Overdales debt letter?

You could receive a letter from Overdales, or they could contact you by phone. If all else fails, a representative could show up at your door!

Chances are you got a Letter Before Action (LBA) from Overdales which you shouldn’t ignore!

Instead, check the details in the LBA are correct and that they are yours! Then check how old the debt happens to be. If a debt is at least 6 years old, it could be statute barred and therefore unenforceable.

However, if the debt is current, write to Overdales asking them to ‘prove’ the debt is yours. Make sure you send the letter to the debt collector by registered post and keep a copy for your records!

Don’t admit, agree, sign or pay anything to Overdales until they reply to you in writing!

What happens if the debt is too old to enforce?

A debt that’s at least six years old is deemed statute barred and therefore, it can be enforced. Courts won’t hear cases that involve older debts and you can’t be given a CCJ for not paying!

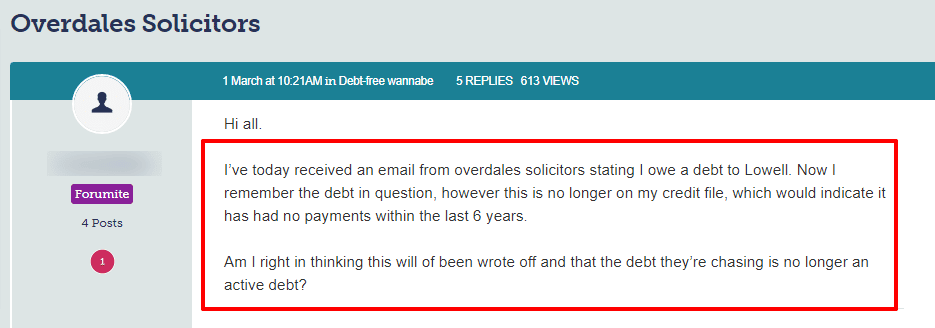

Check out what one person was chased for by Overdales:

Source: Moneysavingexpert

But the following criteria must be met for debts to be unenforceable:

- You had no contact with the creditor or paid anything toward the debt in the last six years

- You didn’t admit owing the money in the last six years and neither did a representative or yours

- There isn’t a current CCJ registered against you over the debt

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should you pay Overdales?

No. Not before Overdales has proved the debt is yours to pay and that it’s not statute-barred.

That said, you may have to pay if Overdales successfully proves you owe the money! In this case, seek advice from an independent debt adviser.

Don’t admit, agree, sign or pay anything to Overdales until they do!

However, seek advice sooner rather than later or Overdales may advise their client to begin legal action. Debt collectors must allow you enough time to seek advice and consider your options.

They can’t force you to pay without first proving the debt. Nor can they refuse to allow you the time to discuss your situation with a debt charity or a specialist debt adviser!

What can Overdales legally do?

There are actions a debt collector may take and some which are against the law and their Code of Practice.

» TAKE ACTION NOW: Fill out the short debt form

A debt collector may:

- Contact you over a debt you allegedly owe. Whether by phone, text, email or in person if all other methods fail

- Talk to you about a debt you allegedly owe but they must remain polite and understanding

- Ask that you pay them directly instead of paying the original creditor

A debt collector cannot do:

- Talk about your alleged debt with your family members, friends, neighbours or employer. This would breach the UK’s privacy laws

- Pretend they are enforcement officers (bailiffs) which is a criminal offence

- Clamp your vehicle

- Seize your possessions

- Encourage you to take out a loan to pay an alleged debt

- Use confusing legal jargon

- Show you documents that appear to be court-issued when they are not

- Visit you at your place of work

- Threaten or harass you with constant calls

Will Overdales start court proceedings?

Overdales won’t take you to court, but the law firm could advise their client that it’s worth starting legal proceedings. Ultimately, it’s the original creditor’s decision but with a law firm behind them, they just might!

Moreover, Overdales shouldn’t threaten legal action if they have no intention of taking you to court!

Can you stop Overdales from contacting you?

No. But you can tell them when and how they can contact you. In short, you should write to Overdales dictating when they can call you and how you want to be contacted.

Debt collectors must respect your request and when they don’t, their actions could be seen as harassment. It’s against the law!

How do you contact Overdales?

I’ve listed the contact details for Overdales here:

| In writing | PO Box 1399, Bradford, BD5 5GA |

| By phone | 03331 110 800 |

| By text | 07860 020977 |

| By email | [email protected] |

| Website: | https://www.overdales.com/ |