How Much Debt is Too Much? Comparison and Levels of Debt

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about the debt you have? You’re at the right place. Each month, more than 12,000 people visit this site looking for guidance on debt topics.

This article will help you understand:

- How your debt compares to your income

- The difference between ‘good’ and ‘bad’ debt

- How to reduce your payments

- The meaning of toxic debt and how to calculate your debt load

- When it’s time to worry about your debts

We understand how it feels to be unsure about debt; some of us have been there too. It can be stressful, but knowing where you stand can help a lot.

We’re here to help you understand your debts and what you can do about them. Let’s get started!

When is it time to start worrying about your debts?

Reports show that an average person in the UK has a certain amount of debt. That said, the time to start worrying about debts is when you find that you owe in excess of £6,000!

However, it’s estimated that one in six people in the UK is more than £10,000 in debt before they start to worry about things.

In short, if you’re worried about how much you owe, don’t just ignore things but seek advice from one of the leading charities. Alternatively, you could talk to an independent debt adviser!

My debts come to more than my income – is that a problem?

Yes. If your debts amount to more than you earn, it’s a problem. Your financial situation could quickly spiral out of control with missed payments making things worse.

You should go over your monthly spending habits and try to cut out what you don’t need. In short, you should focus on paying for necessities only!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you keep using credit cards?

Using a credit card to buy groceries can be useful provided you can pay off the amount as soon as a statement arrives. Otherwise, you may find you’re just getting into more debt.

If you already have too much debt, try not to use your credit cards unless in an emergency. Make a note of your monthly grocery spending and cut out what you don’t really need!

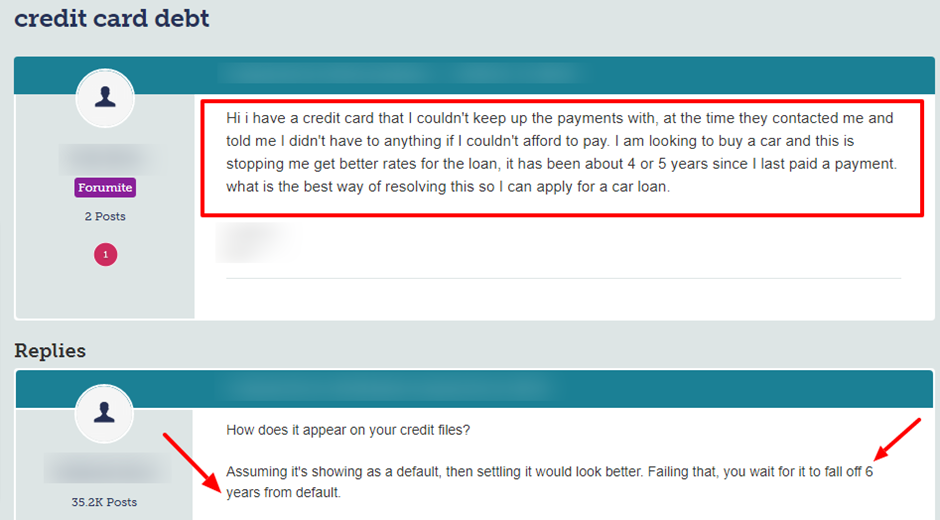

Having too much credit card debt is never good and in the long run, could have a negative impact on your ability to get better rates on future loans.

Check out what happened to one person who posted this message on a popular online forum:

Debt Versus Income

One great way to find out if you’ve got too much debt is to compare them to your earnings. If you find that your debts make up more than 40% of your annual earnings, you could soon find out it’s too high!

Then of course, there’s the sort of debt you’ve got that needs to be factored into your calculations. For example, is the debt good, bad or toxic?

Although it may sound a little strange, certain debts are deemed a little better than other debts.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What is deemed ‘good’ debt?

Good debt has a low or fixed interest rate attached to it. Moreover, it’s when an original loan was used to obtain an item that increases in value. Good examples of this are the purchase of a business or property.

It’s also worth noting that ‘good debt’ has another value which is that the interest paid is tax deductible.

What is considered ‘bad’ debt?

Bad debts fall into another category where high or variable interest rates are attached to them. Plus, an original loan is used to purchase something that loses value or has no value at all once obtained.

For example, getting a loan to go on holiday. Another example of ‘bad debt’ is having high-interest credit card debt.

What is toxic debt?

Toxic debt is the worst debt of all. It includes taking out loans where you end up paying a lot more for something than it’s actually worth. A good example is taking out a payday loan.

Other examples include loans to buy cars or other items of value which you won’t want to part with.

How do you calculate your debt load?

Calculating whether you have too much debt is very much an individual thing because it depends on several factors.

For argument’s sake, if your debts equal less than 36% of your annual earnings, then the amount could be seen as ‘affordable’.

However, if the amount you owe is between 36% and 42% of your annual earnings, you should consider trying to pay off some of your debt.

One way to do this is to pay off some of your debt using what’s known as the ‘snowball’ method. It involves paying off the smallest debts first and then focusing on the largest.

If your debts are between 43% and 50% of your annual earnings, you’ve got too much debt! You may want to think about getting some debt advice from one of the leading UK charities if this is the case.

If your debts amount to over 50% of your annual earnings, you’re in too much debt and therefore deemed ‘high risk’. You may want to seek some advice from an expert if this is the case.

I’ve listed three of the main UK charities that provide free debt advice in the table below:

| Name of charity | Link to charity |

| National Debtline | https://nationaldebtline.org/ |

| Citizens Advice | https://www.citizensadvice.org.uk/debt-and-money/help-with-debt/ |

| StepChange | https://www.stepchange.org/ |

Source: Moneysavingexpert

Should you ignore debt collectors when they get in touch?

It’s never a good move to ignore debt collection agencies because the problem just gets worse, not better.

When an original creditor thinks you can no longer afford to repay what you owe, things can escalate quickly. They could pass your details to a debt collector or start legal proceedings against you.

The best way to beat debt collectors when they contact you is to respond to them and check whether the debt is yours. Or if it’s statute barred and therefore, legally unenforceable!

Plus, you get to negotiate with a debt collector if the debt is yours!

» TAKE ACTION NOW: Fill out the short debt form

What can you do if you’re not sure how much you owe?

You should go through all your credit cards, loans and other payments to calculate how much you owe.

It can be a tedious chore that you keep putting off. But once you get all the information together, you’ll have a better understanding of what you can do to get back on track financially.

Are debt collectors chasing you for payment?

If you’re being chased by debt collectors for payment, there are things you can do to make the problem less stressful.

Take a look at my other posts on how to deal with three of the leading debt collection agencies in the UK:

- How to deal with PRA Group debt collectors

- Do I have to pay Global Debt Recovery?

- Should I pay Lowell Portfolio, debt collectors?

Lastly, how much debt is too much?

It would be fair to say that most people have at some point in time been in debt. Especially today when the cost of living is hurting many people’s pockets!

If you are worried that the amount of debt you have is spiralling out of control, there are people who can help you. For example, leading UK charities offer free debt advice and independent debt management companies are there to help people in debt too.

In short, there are debt solutions worth considering. But you should seek expert advice before choosing which solution is best for you. The wrong debt solution could just make your situation worse!

Need more advice about debts?

Then why not check my other post on how to get out of debt so you get your life back on track.