What Happens If You Ignore Debt Collectors? In-depth Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When you get a call or letter from a debt collector, it can be very worrying. You might be thinking, “Should I pay or ignore them?”

You’re not alone. Every month, over 12,000 people visit this site seeking advice on debt matters.

In this article, we’ll help you to understand:

- If debt collectors will stop if you ignore them

- What happens when you don’t pay debt collectors

- Whether a debt collector can take you to court

- How to deal with debt collectors, and what to do when they contact you

- How to get free debt advice

Many of us have been in your shoes, dealing with debt collectors. We understand how you feel and are here to help.

Ready to find out more about dealing with debt collectors and what to do if you can’t pay your debts? Let’s dive in!

What should you do when debt collectors contact you?

You should stay calm when debt collectors contact you. Try not to go into panic mode although it can be hard not to. Always try to communicate with them to sort out an affordable repayment plan.

Debt collectors must be open to setting up a way for you to clear the debt that won’t be too much strain on your finances!

If you’re not comfortable talking to a debt collector face-to-face, tell them you’d prefer to do things over the phone. Or in writing!

Ask the debt collectors to ‘prove the debt’ is yours which gains you some time if you need time to get your finances in order. If the debt remains unproven, you won’t have to pay it!

What happens when you ignore debt collectors?

Ignoring debt collectors is never a good idea and just leads to further stress, anxiety and financial headaches!

For instance, you may have to deal with the following situations when you ignore a debt collector:

- The debt collector will persistently contact you and they’re good at their jobs! The more you ignore them, the harder they’ll attempt to get in touch with you

- Debt collection agencies are quick to report you to credit agencies when you ignore their correspondence. In short, it’ll harm your credit worthiness making it really hard to borrow, get a mortgage or a credit card

- The debt won’t magically go away. In fact, the opposite is true because it’ll just get larger because interest could be added to the amount you owe

- You could miss out on the chance to write off some or all of the debt!

- You may miss out on setting up an affordable repayment schedule which could get you out of your financial troubles

- You may have to face court proceedings and you could even get sued by the creditor

- A County Court Judgement (CCJ) could be served against you

- Your possessions could be seized by an Enforcement Agent (bailiff) or an order put on your wages!

- The debt may not be yours – it could be someone else!

- You won’t know what legal actions are being served against you!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do I have to answer the door to debt collectors?

If you’re nervous about opening a door to a debt collector, speak to them through an upstairs window or through the letterbox instead.

You’re not obliged to open the door to a debt collector.

Next, ask for proof of identification and note down their name. If the debt collector makes you nervous or uncomfortable, you’re within your rights to ask them to leave.

You can deal with them over the phone or in writing instead!

Moreover, only speak to a debt collection agency when you’re happy to do so. You should discuss the debt and try to sort out an affordable way to pay it off.

Creating a monthly budget and providing a debt collector with a copy of it is another good move worth considering.

» TAKE ACTION NOW: Fill out the short debt form

Will debt collectors give up?

Just because you bury your head in the sand, doesn’t mean debt collectors give up chasing you for money owed. In fact, although you may gain a little time, the problem just doesn’t go away!

There’s no real benefit to ignoring letters from debt collectors other than that. In short, debt collection agencies are persistent. Even more so when they’ve bought the debt off a third party!

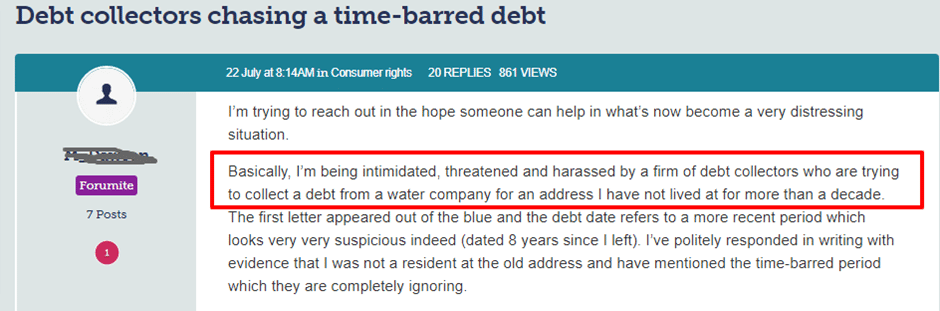

That said, the debt may be time-barred. In this case, it’d be a mistake to ignore the debt collector because you’d miss out on not paying!

Check out what happened to one person below:

Source: Moneysavingexpert

Will a debt collector take you to court?

Yes. If you persistently refuse to deal with the debt, you could end up in court. You’d face proceedings to recover the debt. Moreover, Enforcement Agents (bailiffs) will eventually contact you.

Your possessions are at risk of being seized and sold at auction!

Can you refuse to deal with debt collectors?

No. If you owe money and debt collectors are asked to recover the amount, you can’t refuse to deal with them. Unless the debt collector does something against the law, that is.

When a debt collector doesn’t abide by the law when they contact you and use worrying tactics, contact the head office and complain. Next, file a complaint with the Financial Ombudsman and the Financial Conduct Authority (FCA).

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can a debt collector do?

Debt collectors can do the following when they contact you:

- They can visit you at home

- Discuss your debt with you discreetly and set up a realistic repayment schedule

- Ask you to pay them directly

What can’t a debt collector do?

There are things that debt collectors can’t do which I’ve listed here:

- Visit you at your place of work

- Use threats, or intimidation, or cause trouble/disturbance

- Force entry into your home

- Refuse to leave when you ask them to

- Take your possessions

- Clamp your vehicle

- Infer they are Enforcement Agents (bailiffs) which is a criminal offence!

- Discuss your debt with other people which breaches your privacy!

Should you pay debt collectors directly?

According to StepChange, the debt charity, you should try to pay your creditor directly rather than the debt collector when they visit you at home. That said, if you pay them on the doorstep, make sure you get a receipt!

Also, it’s worth noting that when you pay a debt collector once, they could well return again for more payments! Something you should try to avoid at all costs!

Thanks for reading my post. I hope the information clears up any confusion about what happens if you ignore debt collectors!