How Long Can Someone Stay Without Paying Council Tax?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Council tax is a key part of living in the UK. This article is here to help you understand how long someone can stay without paying council tax.

We know that paying bills can be tough, especially when money is tight. Don’t worry; in this article, we’ll delve into important questions about council tax:

- What council tax is, and who needs to pay it

- When and how to pay council tax

- Who may not have to pay council tax and how to prove it

- What happens if you don’t pay your council tax

- How to contact a council authority if you can’t pay

Each month, over 12,000 people visit this site for advice on debt topics; you’re not alone. Some of our team have faced debt issues too, so we truly understand your worries.

Don’t be scared about debt – we’re here to help you make sense of it all. Let’s start by understanding more about council tax.

How long can someone stay without paying council tax?

If you live alone and you’re already benefiting from the 25% council tax discount and someone moves in, you’d likely lose the discount.

You’re supposed to inform the local authority as soon as someone moves in with you when you claim the single occupancy discount.

However, it’s best to check with the council first because the person who moves in could be disregarded by the authority. In short, they may not have to pay council tax.

That said, it’s always best to seek advice from a solicitor if you’re not sure what to do.

Can you get fined if you don’t inform the council?

Yes. You could be fined if you don’t inform the local authority that someone has moved into your home and you claim the single occupancy discount.

The fine can be anything up to £1,000!

However, if the person who lives with you is a lodger and they pay council tax for their own home, it shouldn’t affect your single occupancy discount.

» TAKE ACTION NOW: Fill out the short debt form

Could you go to prison for non-payment of council tax?

Yes. If you succeeded in avoiding all legal action against you over an unpaid council tax debt, you could be sentenced to 90 days in prison!

You’d be summoned to court and if you don’t attend, the court would issue an arrest warrant!

However, if you attend the court hearing and a judge deems you wilfully refused to pay your council tax, you could receive a custodial sentence.

That said, if you were experiencing financial hardship and couldn’t afford to pay your council tax, it’s unlikely you’d be sent to prison.

What months don’t you pay Council Tax?

You don’t have to pay Council Tax for 2 months in the year. In short, you could opt to pay 10 monthly installments. It means the payments aren’t taken for February and March.

However, it depends on which payment option you set up with your local authority!

When do you pay council tax?

You’d get a council tax bill annually and have the choice to pay it in full straight away, or you can opt to pay the amount in monthly installments. Some people like to pay their council tax every three months which is also allowed.

How is council tax calculated?

The amount you pay in council tax is calculated on the value of a property that’s not being used for business purposes.

In England, the actual value of a house for council tax purposes is based on the property’s price had it been sold on the open market on 1st April 1991.

However, in Wales, it’s based on the property’s value on 1st April 2003 and in Scotland, it’s different too!

As such, the council tax bands for England are as follows:

| Band | Value on 1 April 1991 (England) |

| A | up to £40,000 |

| B | £40,001 to £52,000 |

| C | £52,001 to £68,000 |

| D | £68,001 to £88,000 |

| E | £88,001 to £120,000 |

| F | £120,001 to £160,000 |

| G | £160,001 to £320,000 |

| H | more than £320,000 |

Please note that the council tax bands above only apply to England.

Is anyone exempt from paying council tax?

Yes. Some people don’t have to pay council tax because they’re deemed ‘exempt’. If a person is exempt from paying, they’re ‘disregarded’ by the local authorities.

I’ve listed them below:

- Anyone who is under the age of 18

- People on apprenticeships (specific schemes)

- Anybody who is 18 or 19 years of age and they’re in full-time education

- Full-time students who attend college or university

- Anyone who is under 25 years of age and receiving funding from the Education & Skills Funding Agency

- Student nurses

- Foreign language aids who are registered with the British Council

- The seriously mentally impaired

- Live-in carers for a person who isn’t a partner, spouse or child under the age of 18

- Diplomats

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Who can apply for a council tax discount?

People who live alone in a property can apply to their local authority for a council tax discount which means they get 25% off their bill.

A local authority would also consider offering a 25% discount if other people living in the property are ‘disregarded’.

How do you prove you don’t have to pay council tax?

If someone is taking part in one of the apprentice schemes, they wouldn’t have to pay council tax.

However, a local authority would need to see proof which means getting an employer to provide a declaration stating:

- The person won’t receive more than £195 per week

- The training provided would lead to the person receiving an accredited qualification that’s recognised by the Office of Qualifications & Examinations Regulations. In Scotland, it’s the Scottish Vocational Education Council

If you’re providing lodgings for a full-time student, they wouldn’t have to pay council tax as they can apply to be exempted.

However, a student’s course must:

- Last for a minimum of 12 months

- Involve a minimum of 21 study hours a week

When the student is studying for qualifications up to A levels and they’re under 20 years of age, their course must:

- Last for a minimum of 3 months

- Involve a minimum of 12 study hours a week

It’s also worth checking with your local council if there’s someone in your home who is a part-time student. You may still qualify for the 25% discount.

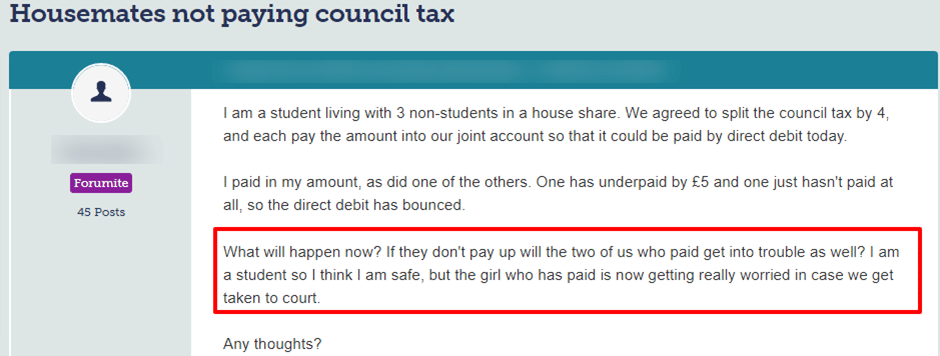

Check out what one student asked about non-payment of council tax on a popular forum:

Source: Moneysavingexpert

What happens when you don’t pay your council tax?

A local authority will chase you for payment if you fall into council tax arrears.

The council will:

- Send you payment reminders to clear your council tax arrears. You typically have to pay the arrears within seven days. After this, another letter is sent to you. This time you’d be asked to pay the full years’ worth of council tax which could be hundreds of pounds and you’d be taken to court for non-payment

- Pass your details to a debt recovery company that’ll contact you by phone, letter or email. At this stage, you’d have to deal with the debt collection agency and not the council

- If the debt recovery company doesn’t get you to pay, you could face court action. A judge would issue a Liability Order which means you’re legally liable to pay. It also means the local authority can enforce what is now a ‘debt’. You’ll incur another £20 on top of what’s owed

- Following this, if you still don’t pay, the council will pass your details to enforcement agents (previously known as bailiffs). They can visit your home and seize your possessions to sell at auction to recover the amount owed

Not only this, but a court would issue an attachment order on your earnings or bank account!

A charging order could be placed on your home and you could be made bankrupt although this is rare.

What can a debt recovery company do?

A debt recovery company will contact you in writing, call you on the phone or send you an email requesting payment.

If you don’t respond, the letters become more threatening. Rather than requesting payment, the debt collector will send ‘payment demands’.

You shouldn’t ignore these letters because you could end up in court and if you don’t attend, a judge would issue a payment order!

The next stage involves court-appointed enforcement officers visiting you at home. They have the right to seize some of your possessions and sell them at auction to recover what’s owed!

You could even face a custodial sentence for non-payment of your council tax!

Can enforcement officers force entry for council tax debt?

No. Enforcement officers can’t force entry into your home to collect a council tax debt.

However, a bailiff (enforcement officer) can enter your home if the door is unlocked!

That said, if you’ve defaulted on a Controlled Goods Agreement, enforcement agents could enter your home if any possessions secured within the agreement are inside the house.

However, they can’t just break the door down, they must use a qualified locksmith to open the door! Also, enforcement officers must let you know when they plan to visit your home, they can’t just turn up.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long can you be chased for a council tax debt?

You can be chased for a council tax debt for six years. However, in Scotland the laws are different and you could be chased for 20 years!

Under the Limitations Act 1980, a debt that’s over six years old is not enforced and this applies to council tax debt too.

In short, a council tax debt expires after 6 years.

The bad news is that rarely would a local authority wait that long to recover what you owe in council tax. They’d issue a Liability Order well before that!

How do you contact a council authority?

You can pay your council tax online or by direct debit. I’ve listed ways to do this in the table below:

| Find your local council | https://www.gov.uk/find-local-council |

| Pay council tax arrears | https://www.gov.uk/council-tax-arrears |

| Pay council tax online | https://www.gov.uk/pay-council-tax |

| Check your council tax band | https://www.gov.uk/council-tax-bands |

| Challenge a council tax band | https://www.gov.uk/challenge-council-tax-band |

| Appeal a council tax bill or fine | https://www.gov.uk/council-tax-appeals |

Lastly, how long can someone stay without paying council tax?

Whether a person has to pay council tax when they move into your home or not depends on several things.

However, if they don’t qualify as ‘disregarded’ by a local authority, you’re legally obliged to let the local authority know straight away!

If you don’t inform the council that someone has moved into your home, you could be taken to court.

You should always check with your local council whether you’d lose the 25% discount you might be claiming if someone else moves in!

Thanks for reading my post. I hope I’ve cleared up any questions about how long someone can live with you without paying council tax!