Cabot Financial Debt Settlement Offer – How Much To Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a notice from Cabot Financial about a debt settlement, you might feel worried. What does this mean? How much do you have to pay? You’re not alone in this. Each month, more than 12,000 people come here for guidance on such matters.

In this article, we’ll explain:

- Who Cabot Financial is.

- If you have to pay them.

- How to lower your repayments.

- What makes a fair Cabot Financial settlement offer.

- How to deal with a Cabot Financial debt settlement.

We know that dealing with debt collectors can be scary, as many people in our team have been in the same boat. We’ve felt the worry of debt and not knowing how to handle it, so we’re here to guide you through this. Let’s learn more about handling your Cabot Financial debt settlement offer.

Should you ignore letters from Cabot Financial?

No. Ignoring letters from Cabot Financial won’t make the problem go away. If anything, it just makes matters worse. Moreover, you could find you miss out on important information.

For example, you could lose out on:

- Discovering the debt isn’t even yours but belongs to someone else. In short, Cabot is chasing the wrong person for payment!

- Establishing the debt is yours, but it’s too old to enforce. A debt that’s six years old is deemed statute barred and therefore you can’t be forced to pay!

- Cabot offering you a fair debt settlement offer, one you can afford to pay!

- Having some of the debt wiped off makes it easier to resolve

Also, ignoring letters from Cabot Financial could lead to:

- Having a CCJ recorded on your credit file because you were unaware of the court action taken out against you

- Dealing with enforcement officers (bailiffs) who could visit you at home and seize your possessions to cover what’s owed

- Having an attachment order placed on your earnings!

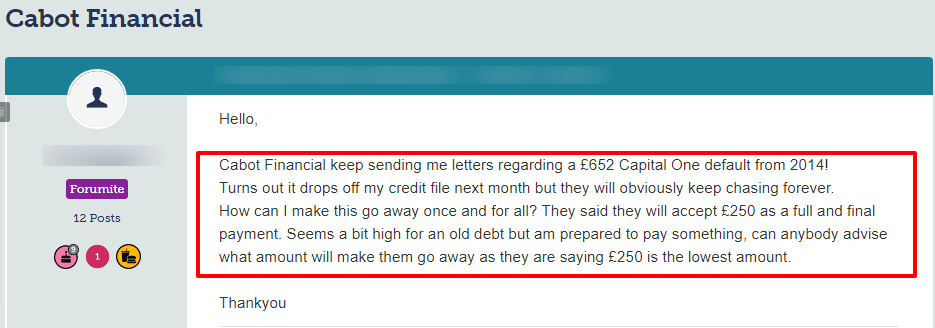

Take a look at what happened to one person who ignore letters from Cabot Financial:

Source: Moneysavingexpert

What is a fair Cabot Financial settlement offer?

Cabot Financial may propose a financial settlement offer provided you stayed in touch with them when they contacted you. It may have left you wondering if the amount proposed is fair or not.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Would the Cabot Financial debt settlement offer be accepted?

Cabot Financial must prove the debt is yours by sending you an authenticated copy of an agreement/contract you signed. Once you receive the confirmation in writing from Cabot, you should seek advice from a debt adviser.

Debt collectors must allow you the time to seek advice and to find out about your options!

Get in touch with Cabot Financial once you’ve consulted a debt adviser to propose an affordable debt settlement offer. Debt collectors are under no obligation to accept your proposal but they must consider it!

Debt collectors can’t just reject a debt settlement offer out of hand!

What is a fair Cabot Financial debt settlement offer?

It depends on how much you can afford to pay Cabot. Moreover, your circumstances must be taken into consideration when calculating a fair debt settlement offer.

Generally, a debt collection business may accept 75% of the total amount owed as a fair debt settlement offer. But it’s not set in stone!

If you owe £3,000, you could offer to pay £2,250 as a full and final settlement.

You should contact a debt adviser if you’re at all concerned about things or feel that Cabot Financial is being unreasonable.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How should you deal with a Cabot Financial debt settlement?

Make sure you get everything in writing if Cabot Financial agrees to a debt settlement offer. Don’t just accept a verbal agreement. The debt collector appears to have a decent reputation but it’s always better to have an agreement in writing so they’re set in stone!

Moreover, the agreement means you must meet any payments on the agreed due dates. If you don’t, the agreement may become null and void.

You may have to pay the full amount when you miss agreed payments after setting up a debt settlement offer.

» TAKE ACTION NOW: Fill out the short debt form

How do you contact Cabot Financial?

I’ve listed ways to contact Cabot here:

| By phone | 0344 556 0263 |

| Via the website | https://www.cabotfinancial.co.uk/ |

| In writing | 1 Kings Hill Avenue, Kings Hill, West Malling, Kent ME19 4UA |

| Opening hours | Monday to Friday 8:00am – 8:00pm Saturdays 9.00am – 1.30pm |