Link Financial Debt Settlement Offer – How Much To Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you are dealing with debt from Link Financial, you’ve come to the right place. Each month, over 12,000 people visit this site seeking advice on debt matters.

Dealing with debt can be tough, as it can make you feel concerned if you are not sure how to pay. Don’t worry! In this article, we’ll learn about:

- Who Link Financial is and why you might need to pay them.

- How to know if Link Financial is a real debt recovery business.

- Ways to make your payments smaller.

- What to do if Link Financial contacts you.

- How to know if your debt is yours.

Debt can cause a lot of worry, but you are not alone. We understand how hard it can be to deal with debt.

We are here to help you answer your questions about Link Financial debt and ease your worries. Let’s dive in.

What should you do when Link Financial contacts you?

There are things you should do before you admit, agree, sign, or pay any money over to Link Financial. For instance, you need to check if the debt collector is chasing the right person!

Next, you should check whether the alleged debt is still enforceable. Why? Because debts that are at least 6 years old become statute-barred. It means courts won’t entertain hearing cases that involve debts that are that old or older!

Moreover, you can’t be forced to pay and you won’t get a CCJ registered on your credit file!

Debt recovery companies are notorious for buying older debts for nothing and then attempting to get people to pay!

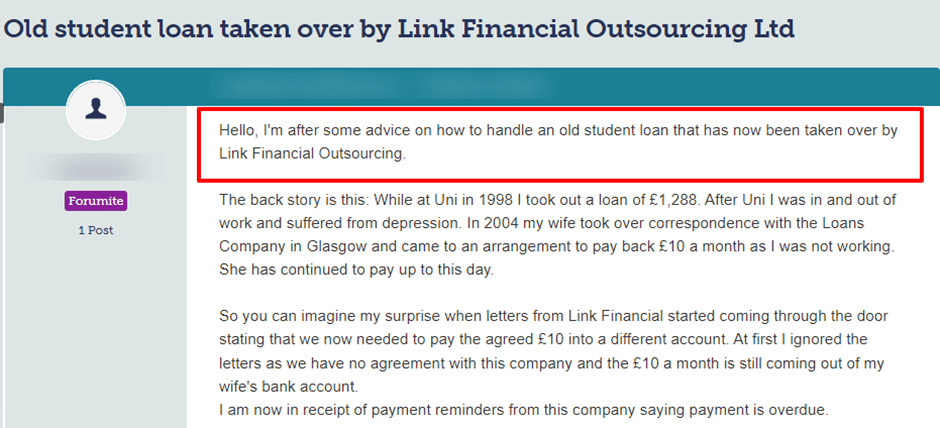

Check out what happened to one person over an older student loan!

Source: Moneysavingexpert

Can you ask Link Financial to prove the debt is yours?

Yes. Once you’ve established the debt is not statute-barred, you should ask Link Financial to prove you owe the money! So before you do anything else, write to the debt collector and ask them to send you evidence that you owe the money!

When a debt collector can’t prove you owe any money on a debt, you’re under no obligation to pay them!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ignore Link Financial?

No. It’s never a good idea to ignore calls or letters from a debt collector. It could lead to the following:

- Link Financial is beginning legal proceedings against you which you’d not be aware of

- Having a County Court Judgement (CCJ) registered on your credit history without you knowing it

- Dealing with court-appointed enforcement officers showing up at your home and seizing some of your possessions

- Missing out on a settlement offer from Link Financial or having some of the debt wiped off

Moreover, when you ignore calls or letters from Link Financial, you may never find out the debt is too old to enforce!

» TAKE ACTION NOW: Fill out the short debt form

What is a fair Link Financial debt settlement offer?

A fair debt settlement offer depends on what you can afford to pay and your circumstances. In general, a fair debt settlement offer means paying 75% of the debt’s value.

For example, if the debt is £2,000, a fair settlement figure would be £1,500.

You should seek advice from a debt charity if Link Financial refuses to take into account your circumstances and the amount you can afford to pay. Moreover, debt collectors must give you the time to assess all your options!

When should you accept and pay a Link Financial debt settlement?

You shouldn’t accept or pay any money over to Link Financial until you get their acceptance of a settlement figure in writing. You may be told over the phone that a settlement is agreed on which is not good enough!

An unscrupulous debt recovery company may take a payment but claim they never agreed to the settlement figure!

Also worth noting is that if a settlement figure is agreed upon and you miss payment dates, the agreement may be null and void!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do you contact Link Financial Limited?

I’ve listed the contact details for Link Financial Ltd here:

| Company Name | Link Financial Outsourcing |

| Other Names | Link Financial |

| Address | Link Financial Outsourcing Limited, PO Box 107, Caerphilly CF83 3GG |

| Tel number | 0800 064 4499 |

| Company website: | https://www.linkfinancial.eu/ |

| Email address | [email protected] |

| Numbers used to call you | 02920853500 02920808685 |