How Far Can the Council Backdate Council Tax?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re not sure about your council tax, you’re in the right spot. Many people, almost 12,000 a month, visit this site for advice on money matters.

We’re going to talk about:

- Why we need to pay council tax and how it’s worked out

- What happens if we don’t pay it

- How to lower what we pay back

- Who doesn’t have to pay council tax

- How long the council can ask for unpaid tax

You might be worried about paying back what you owe or scared of what will happen if you don’t pay. We understand how you feel; some of us have been there too.

We’re here to help you understand your council tax. Let’s dive in!

Can a Local Authority backdate your Council Tax?

Yes. A Local Authority can backdate the amount you pay in council tax if they find you haven’t been paying the right amount! Maybe you were receiving a 25% discount although you don’t live alone.

If so, a Local Authority has the right to backdate a future bill so it includes the amount you shouldn’t have claimed!

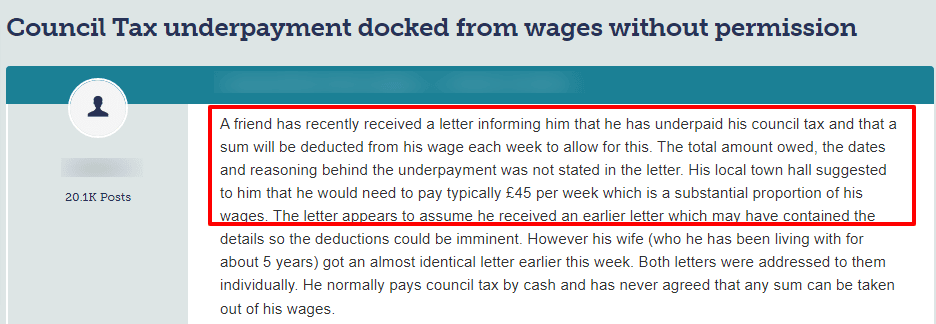

Take a look at one comment posted about a Council Tax underpayment and what happened to the person:

Source: Moneysavingexpert

How far back can the council go?

The council has the right to reclaim all incorrect payments you made on your council tax. In short, if you’ve been underpaying for years and years, the council could make you pay the balance of what you should’ve paid.

But it works the other way too. For example, you could claim a refund on all your overpayments. You could claim overpayments you made since the tax was first introduced in 1993.

Of course, you’d need to provide a good excuse for not having claimed the refund beforehand!

How long can the council chase you for Council Tax arrears?

In England, the Limitations Act means that debts that are six years old can’t be enforced through the courts! Providing it meets specific criteria, that is.

In Scotland, however, you can be chased for 20 years over a council tax debt.

However, rarely would a local council let things go for that long. A local authority is quick off the mark to send you a liability order which means you’re legally liable to pay!

» TAKE ACTION NOW: Fill out the short debt form

Could you go to prison for not paying your council tax?

Yes. Although it rarely happens, you could be sent to prison for up to ninety days if you refuse to pay your Council Tax.

That said, the courts must’ve issued you with a Liability Order that you either ignored or refused to pay!

Can enforcement officers visit you at home?

Yes. If the court orders you to pay a Council Tax debt and you don’t pay, enforcement officers (court-appointed bailiffs) could visit your home.

A judge could instruct the enforcement officers to recover the amount owed to a local authority.

However, you’d receive an official letter warning you of their impending visit. Bailiffs can’t just visit you without first notifying you of their intentions.

The notification gives you time to sort out your finances and hopefully have enough to pay the enforcement officers when they show up.

If you don’t have enough money to pay the full amount, try to negotiate an affordable repayment schedule.

The one thing you shouldn’t do is ignore any official court papers or letters from an enforcement officer!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are council tax arrears ever written off?

You could have some of your council tax arrears written off by entering into a debt solution program. Moreover, a local authority has the power to do this for you.

That said, you could apply for a Debt Relief Order. You may find that it’s accepted as part of an Individual Voluntary Arrangement (IVA).

A council tax debt doesn’t get wiped off straight away but will eventually over time. However, some local authorities don’t favor IVAs as a solution to solving a council tax debt.

Another option is to apply to be made bankrupt which immediately wipes off the debt. But only if the Official Receiver accepts it.

What happens when you don’t pay your Council Tax?

You’re liable for the payment when you’re the named person on your Council Tax bill! So when you don’t pay, your local authority sends you a letter requesting that you pay any arrears within seven days.

You’ll receive another letter if you fail to pay the amount owed to the council within seven days. This time, a local authority demands the full payment of your yearly bill from you.

Moreover, the payment must be made straight away!

So, if you owe six plus months on a Council Tax bill, you’d have to pay the full amount by return of post.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Would a local authority take you to court?

Yes. You risk court action if you don’t pay or respond to the council when they contact you!

First, the council could pass your details to a debt recovery company. But if the debt collector doesn’t succeed in getting you to pay, the council will start legal proceedings to recover the amount owed.

Moreover, the council may submit an ‘information request’ from the courts. Like this, they can find out how much you’re being paid and how much you can afford to pay them!

Plus, if you’re taken to court and you don’t respond, a judge will issue an “order to pay” against you. You’d also get a County Court Judgement (CCJ) recorded on your credit file!

You’d have trouble getting a credit card, bank loan, or mortgage until the CCJ expires!

Can you dispute a court ruling to pay your Council Tax?

You have the right to dispute a court decision when a judge rules you have to pay your Council Tax. However, it could land you in more legal trouble if you can’t provide a valid reason for not paying it.

In short, disputing a court order to pay your Council Tax could end up costing you a lot more money. Not to mention the stress it would involve!

What happens when you ignore a court order to pay?

When a court orders you to pay your Council Tax, you’ll receive what’s known as a Liability Order. You are then legally liable to pay what you owe to the Local Authority.

If you ignore the order, the court could instruct enforcement officers (bailiffs) to visit your home. They could seize some of your possessions if they can’t get you to pay, or you don’t agree to a repayment plan.

However, enforcement officers can’t just show up at your home. They must let you know when they are going to visit you! Like this, you have time to sort out your affairs, and hopefully pay what’s owed to the council.

You’d incur fees just for getting a letter informing you that bailiffs are about to visit you.

It’s worth noting that if you’re classed as a vulnerable person, you can stop enforcement officers from visiting you. Even when you’re liable for the debt!

Can you ask for a Council Tax refund?

You can request a Council Tax refund if you were entitled to receive the 25% single occupancy rate but did not claim it. The same is true if you were receiving a state benefit or you are disabled.

The council could owe you hundreds of pounds if you never claimed the discount.

You should contact your local authority and ask them to look into your case. However, make sure you can prove you’re entitled to the reduction!

Are you struggling to pay a council tax debt?

You should stay in touch with your local authority to let them know you’re experiencing financial hardship. The council should be sympathetic to your personal circumstances and agree to set you up a payment schedule you can afford.

Keeping in contact with the council prevents things from escalating out of control.

Is anyone exempt from paying Council Tax?

Some people are exempt from paying Council Tax and local authority will consider the people as disregarded.

This includes the following:

- People under 18 years old

- Anyone on an approved apprentice scheme

- People aged 18 or 19 who are in full-time education

- Students who attend college or university on a full-time basis

- People under 25 who get funding from the Education & Skills Funding Agency

- Student nurses

- People who work as foreign language aids

- Seriously mentally impaired people

- Live-in carers who aren’t related to the person they’re caring for or are under 18 years old

- Diplomats

How do you find and contact your local council?

I’ve listed ways to find and contact your local authority when you need to get in touch with them in the table below:

| Find your local council | https://www.gov.uk/find-local-council |

| Pay council tax arrears | https://www.gov.uk/council-tax-arrears |

| Pay council tax online | https://www.gov.uk/pay-council-tax |

| Check your council tax band (England) | https://www.gov.uk/council-tax-bands |

| Challenge a council tax band | https://www.gov.uk/challenge-council-tax-band |

| Appeal a council tax bill or fine | https://www.gov.uk/council-tax-appeals |

Lastly, how far can the Council backdate Council Tax?

The bad news is that councils can backdate Council Tax as far back as when the tax was first introduced in the UK.

The good news is that if a local authority owes you a refund, it can be backdated that far back too.

However, you’d need to explain why you never claimed a refund from the council beforehand!

When you are the named person on a council tax bill, you have a legal obligation to pay the Council Tax. You are also legally obliged to inform a local authority of any changes in your circumstances!

You could receive a 90-day prison sentence if you refuse to pay your council tax when you’re ordered to pay by the courts! Luckily, this rarely happens.

Thanks for taking the time to read my post. I hope the information contained in the article helps answer the question ‘how far can the Council backdate Council tax’?