Should You Pay Advantis Credit HMRC Debt Collection?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a letter from Advantis Credit can be a bit scary. You might be wondering what to do next and how to manage this debt.

You’re not alone in this. Every month, over 12,000 people visit our site seeking guidance on debt issues.

In this easy-to-understand guide, we’ll explain:

- What Advantis Credit is, and why they might be asking you to pay money.

- Your rights when dealing with debt collection agencies.

- How you might be able to make your repayments smaller.

- What happens when you don’t answer Advantis.

- How to get in touch with Advantis Credit Ltd.

We know how worrying it can be when you owe money; some of us have been there too. We are here to help you understand how to deal with your Advantis Credit debt.

Let’s get started!

Why have I got a letter from Advantis?

Advantis Credit would contact you on behalf of HMRC if you have an outstanding debt with them. For example, did you receive an overpayment on tax benefits? Or are you in trouble over VAT?

You may have received more money than you should which means HMRC will chase you for repayment. If they can’t get in touch with you, HMRC could pass your details on to Advantis!

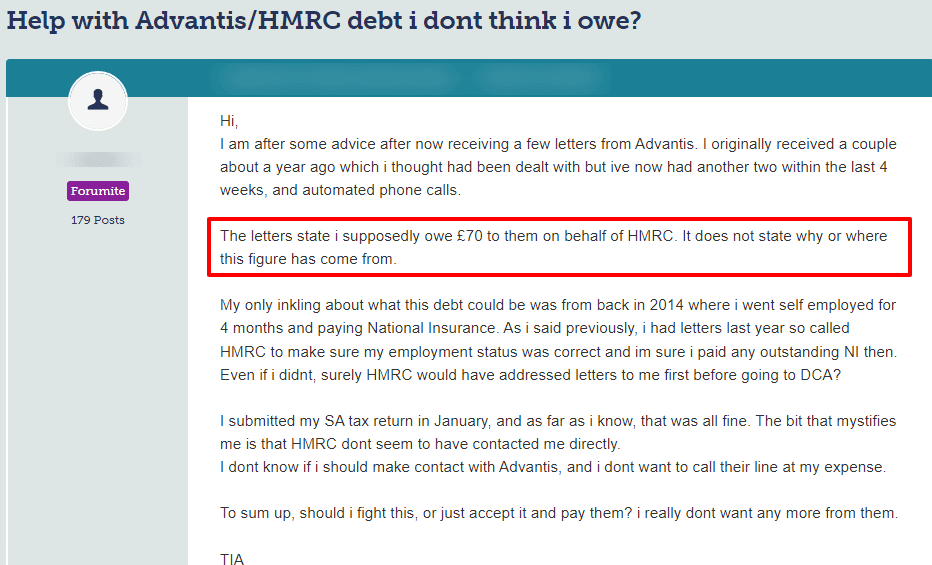

Check out what happened to one person Advantis Credit contacted over an HMRC debt:

Source: Moneysavingexpert

How should you respond to Advantis?

You should stay in touch with Advantis when they contact you. Whether it’s by letter, text or phone call. Staying in touch with debt collectors is a positive move that gets better results!

So, the first thing to do is contact Advantis Credit asking them for proof you owe money to HMRC. Advantis must provide you with solid evidence the debt is yours and that the amount is correct!

Next, seek advice from one of the debt charities or an independent debt adviser. However, there would be a fee to pay if you contact a specialist debt adviser who works in the private sector.

On the other hand, debt advice provided by one of the charities is free!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you pay Advantis Credit?

It’s wiser to deal with Advantis once you establish the debt is yours. Why? Because if you don’t, the debt collector will tell HMRC they failed to get you to pay.

HMRC would then escalate the process and you’d have to deal with enforcement officers knocking on your door. Plus, you risk getting a county court judgement on your credit file.

So, in short, staying in touch with Advantis Credit ltd is definitely the wiser when they’re chasing you for an HMRC debt!

What happens when you ignore Advantis?

It’d be a mistake to ignore Advantis Credit when they contact you over an HMRC debt. Chances are HMRC tried to contact you without success and passed your details on to the debt recovery company.

However, first, make sure the letter you get is genuine because there are lots of scammers out there! First, check your old mail to see if you received any letters from HMRC.

Next, you can check whether the letter is genuine by visiting the government’s website!

If it all proves genuine, contact Advantis sooner rather than later. Otherwise, things will escalate making it harder to settle the debt!

When you just ignore everything, hoping it’ll all go away, things could escalate quite quickly. Moreover, you could be missing out on receiving important information about the HMRC debt.

For instance, you may not realise the following:

- The debt isn’t yours and Advantis is chasing the wrong person. If you ignore things HMRC enforcement agents will still pay you a visit!

- You could have been offered an affordable repayment schedule over several months!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do debt collectors have the same powers as bailiffs?

No. Debt collectors don’t have the same powers as bailiffs (court-appointed enforcement officers). Plus, they can’t pretend they have the same powers which is unlawful!

You don’t have to let debt collectors into your home and you don’t have to let them call you at all hours of the day. It’d be deemed harassment which is also unlawful.

Can a debt collection agent visit you at home?

Yes. If all other ways of contacting you fail, or you refuse to respond to phone calls or letters, an agent could visit your home!

If it happens, you don’t have to open the front door. In fact, you should speak to the agent through an open upstairs window or through the letterbox.

Moreover, you have the right to ask an Advantis debt collection agent to leave and they must respect your request!

Will Advantis take you to court?

No. Advantis won’t take you to court if you don’t pay the amount owed to HMRC. But the debt recovery company will inform HMRC that they failed to get you to pay!

Things take a turn for the worse after this, because HMRC doesn’t need to take you to court. They can use their own enforcement officers to visit you at home!

» TAKE ACTION NOW: Fill out the short debt form

HMRC enforcement officers have the power to seize your possessions and sell them at auction to cover the money owed. Plus you’d get a County Court Judgement (CCJ) on your credit file making it harder to borrow money in the future.

You may have to deal with an attachment placed on your bank account and/or your earnings!

Can you stop debt collection agencies from contacting you?

You can’t stop debt collection agencies from contacting you. But you can tell them when to contact you and how you’d like to be contacted!

So, the first thing to do when you receive lots of calls or correspondence is to write back to Advantis. Tell them when and how to contact you. Maybe you prefer to be contacted in writing so you have records of everything that’s said!

Debt collection companies must respect your request! However, if a debt recovery agent still persists in contacting you in ways you asked them not to – it’d be harassment.

Harassing behaviour is unlawful and you should file a complaint with their head office. After this, you can lodge a complaint with the Financial Ombudsman Services (FOS).

How do you contact Advantis Credit Ltd?

I’ve listed how to contact Advantis debt collection here:

| Website | https://www.advantiscredit.co.uk/ |

| By phone | 01782 401 100 (customer enquiries) 01782 400 400 (choose option 4) (client sales or media enquiries) |

| In writing | Advantis Credit Ltd, Minton Hollins Building, Shelton Old Road, Stoke-on-Trent, Staffordshire, United Kingdom, ST4 7RY |

| Via email | [email protected] |

| Numbers used by Advantis | 01782401123 07891903076 08448241836 |

Thanks for reading my post. I hope I’ve answered the question, should you pay Advantis Credit HMRC debt collection so you achieve a better and more affordable outcome.