Is Non-Payment of Council Tax a Civil or Criminal Offence?

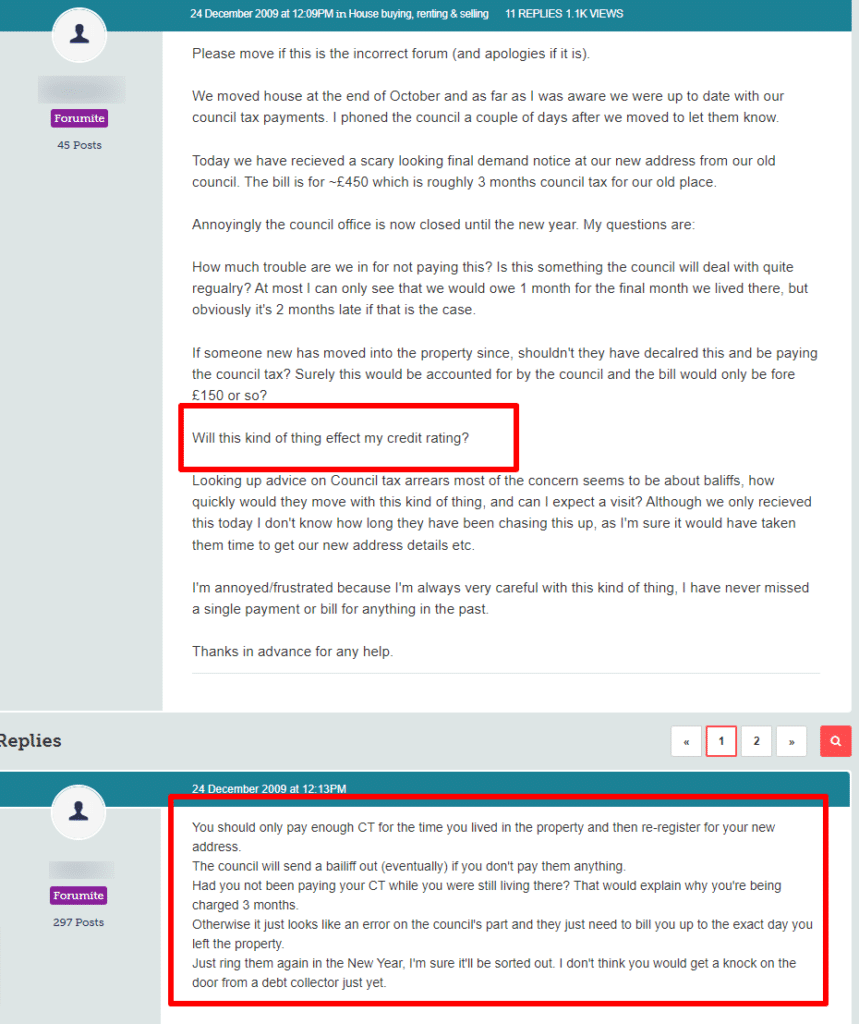

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Unsure about what happens when you don’t pay your council tax? You’re at the right place. Each month, over 12,000 people visit our site for advice on debt matters.

In this article, you’ll find answers to:

- If you must pay council tax and who is exempt.

- How to lower your repayments and what happens if you miss an instalment.

- The consequences when you go into arrears with council tax.

- If nonpayment of council tax is a civil or criminal offence.

- How to deal with visits from bailiffs and where to seek help with council tax arrears.

Our team understands how worrying it can be to have debt problems; some of us have been in your shoes. We’re here to offer you clear, simple advice on what happens when council tax isn’t paid.

Let’s dive in!

Do You Have To Pay Council Tax?

You will usually have to pay council tax if you own or rent a property in the UK. Owners, tenants, lodgers, and boarders all fall into this category, whether they own or rent their homes. There are a few exceptions to this rule, and some people may be exempt from paying council tax, or get a discount.

A number of factors determine the amount of council tax you must pay, including the value of your property, the number of adults living in the property, and the council tax band assigned to your property. Visit the Valuation Office Agency website to find out what council tax band your property falls into.

Who is Exempt From Council Tax?

As I already mentioned, some people are exempt from paying council tax at all, or are charged a reduced rate of council tax. I have listed these kinds of people, below.

- Students enrolled full-time

- A student nurse

- Caregivers who live in the home

- Mentally impaired individuals

- Foreign diplomats

- In some cases, members of the armed forces

- Those under 18 years of age

What Happens if You Miss a Council Tax Instalment?

Everybody who has to pay council tax in the UK, is allowed to do so in 10 instalments across a 12-month period. If you miss a payment, the local authority will send you a reminder. As long as you pay this outstanding amount, you are fine.

What Happens if You Go Into Arrears With Council Tax?

If you have a second slip during the year, and go into council tax arrears, you will lose your right to pay your council tax in instalments. Instead, you will have to pay the whole amount as a lump sum. Even if you get out of debt with your council tax, you still won’t be able to pay in instalments. Even if your council tax arrears only backdate for a couple of months or so.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if You Don’t Pay Your Council Tax Arrears?

Failure to pay council tax will result in action by your local council. There is a process that is followed, to enforce payment of bad debts in the UK, and the local authority will follow this process. I have briefly outlined it, below.

- In case of missed council tax payments, your council will usually send you a reminder letter. You will be able to catch up on your payments without incurring any additional fees.

- The council will likely pass the debt over to a collection agency such as PRA Group, Global Debt Recovery or Lowell Financial. You will then be hounded by the debt collection firm for payment.

- It is possible for a collection agency to seek a County Court Judgement (CCJ). A liability order will be issued if you fail to attend the court hearing or if the court agrees that you owe the council tax.

- Enforcement actions can be taken by the County Court, such as sending bailiffs to your property to seize goods or deducting from your wages or benefits.

Will You Receive a Criminal Prosecution for Not Paying Council Tax?

You cannot be prosecuted for not paying council tax in the UK unless your non-payment was the result of deliberate and willful evasion.

In the case of council tax, nonpayment is considered a breach of a civil contract between you and your local council. As I mentioned in my previous answer, if you don’t pay your council tax, your council will take civil enforcement action to recover the money owed. Taking legal action against you can include sending bailiffs to your property, and requesting a deduction from your wages or benefits.

Providing false information to avoid paying your council tax may be considered deliberate and willful evasion if you refuse to pay despite being able to do so. A criminal prosecution could result in a fine, a criminal record, and, in extreme cases, imprisonment in such cases.

Legal prosecutions for council tax evasion are rare and usually reserved for cases of deliberate and willful evasion. Contact your local council as soon as possible if you’re having trouble paying your council tax to discuss your options and avoid any legal action.

Can You Go to Prison for a Civil Offence?

The UK does not punish civil offences with prison time. These offences involve a breach of civil law, such as contract disputes, property disputes, or personal injury claims. A civil court will typically hear these types of cases, and the remedies available are usually financial compensation, injunctions, or specific actions to resolve the contract dispute.

Civil proceedings can, however, lead to criminal charges in some situations. A person who does not comply with a court order in a civil case could be found in contempt of court, a crime punishable by imprisonment. The non-payment of a civil debt, such as council tax or a parking fine, could also be considered a criminal offence, punishable by prison.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Dealing With Bailiff Visits

The experience of dealing with bailiffs in the UK can be stressful and worrying. If you want to protect yourself and resolve the situation, you can take the following steps. Remember, bailiffs actually have very limited powers in most cases.

- A bailiff should provide you with proof of their identity when they visit your home, such as a warrant or badge. It is a good idea to ask to see this before letting them in. In addition, you can verify their identity by visiting the bailiff register website to see a list of certified bailiffs.

- Bailiffs can take goods from your home to sell to recover the money that you owe, but they cannot take everything. The seizure of certain items is prohibited, including essential household items, tools of the trade, and items that belong to someone else.

- If you cannot pay the full amount owed, you can negotiate a payment plan with the bailiff. Only agree to pay what you can afford. However, this option won’t be available in every case.

- Report the bailiff if you believe they have acted unfairly or broken their code of conduct: You can report the bailiff company or the court issuing the warrant if you believe the bailiff has acted unfairly.

Getting Help with Council Tax Arrears

You have access to an excellent source of help and advice in the UK. You can make an appointment with your local Citizens Advice Bureau (CAB), and ask for some help to deal with your council tax debt. The staff at the CAB are very experienced in helping people face their debts.