How to Not Pay Council Tax Legally – Who is Exempt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you looking for ways to avoid paying council tax? Well, this article is here to help you understand how you can do this legally.

We know that council tax can be a big worry, especially if money is tight. You’re not alone. Every month, over 12,000 people visit our site for advice on issues such as this.

In this article, we’ll cover:

- The basics of council tax and why we have to pay it

- How much council tax might cost you

- Who needs to pay council tax and who doesn’t

- How you can check if you should be exempt from paying council tax

- What to do if you think you shouldn’t pay and how to appeal if you’re denied exemption

We understand how tough it can be to deal with financial matters like these; some of our team have faced similar issues. We’re here to help.

So, let’s take a step towards understanding your council tax better and see if you might be exempt from paying it.

Who Has To Pay Council Tax?

A full Council Tax bill is based on at least two adults living in a home in the United Kingdom, with responsibility for paying Council Tax falling primarily on those aged 18 or over. All domestic properties where people live permanently are subject to the tax, which is paid to councils to provide local services. I have made a short list below, explaining who has to pay council tax.

- People over the age of 18.

- People who live together, such as spouses and partners. The bill is their joint responsibility.

- Both homeowners and renters.

- An occupant of each living space within a single building, who occupies the space exclusively for their own family, like a house converted into a flat.

Is Anyone Exempt From Paying Council Tax?

Some people are not counted when calculating the number of residents in a property. This means they might be able to apply for a discount on their Council Tax bill. Once again, I have listed these types of people, below.

- Young people under 18.

- People in certain apprenticeship programs.

- Full-time students 18 or 19 years old.

- Students in college or university full-time.

- People under 25 get funding from the Education and Skills Funding Agency.

- Nursing students.

- British Council registered foreign language assistants.

- Those with severe mental disabilities.

- Caregivers for people who aren’t their partner, spouse, or children.

- Foreign diplomats.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What To Do if You Think You Should Be Exempt From Council Tax

It is important to note that the council won’t automatically grant you an exemption from council tax. You need to apply for the exemption. Below, I have explained the general steps you should take to first, work out if you have already been exempted or given a council tax reduction, and then how to apply for exemption if you have not.

- Get familiar with the council tax exemptions and disregarded groups. Full-time students, people under 18, apprentices, people with severe mental impairments, diplomats, or live-in carers for someone who’s not their partner, spouse, or child under 18, among others.

- Evaluate whether your home falls under the remit of council tax. Exempt properties include unoccupied caravan pitches, boat moorings, and homes left empty for various reasons (like the owner being in prison or moving to receive care).

- Look at your council tax bill to see if any discounts or exemptions have been applied. You can do this by checking the bill you received from your local council or contacting them.

- If you think you’re eligible for a discount or exemption, but it hasn’t been applied to your bill, you’ll need to apply. If you’re disregarded for council tax, you still need to apply for a discount or exemption, it won’t simply be granted automatically.

- Depending on your application, you’ll need to provide evidence. You might have to show proof of full-time student status, evidence of a severe mental impairment, or proof of your age if you’re under 18. If your local council asks for this evidence, be prepared to provide it.

- Follow up with your local council after you’ve submitted your application. You’ll have to keep paying your current council tax bill until you get your exemption or discount.

Can You Appeal if You Are Denied Exemption From Council Tax?

Yes, you can appeal if you are denied exemption from Council Tax in the UK. I’ve explained the basic process of making an appeal below. However, which steps are appropriate will very much depend on your circumstances. If you need more help, I recommend having a chat with the staff at your local Citizens Advice Bureau (CAB).

- You can appeal the decision of your local council if you think your home should be exempt from council tax, disagree with how your bill was calculated, or disagree about the amount of Council Tax Reduction allowed. Before you appeal, you must contact your local council to explain what’s wrong. You should hear back from them in two months.

- If you don’t like the council’s decision or don’t hear back within two months, you can appeal to the Valuation Tribunal, an independent agency. If you want to appeal, you’ll need to fill out an appeal form and provide evidence. As part of this process, you will explain what you object to and why, as well as provide further information if the council asks for it.

- Make sure you gather evidence to back up your claims before your hearing. Including legislation, case law, and past tribunal decisions about similar issues.

- You have to appeal within 2 months of the council’s decision or when it should have responded. Within four months of submitting your original appeal to the council, if the council rejects your appeal or you’re still not satisfied, you can appeal to the Valuation Tribunal.

- The refund of any taxes you have overpaid will then be available to you if your appeal is successful.

- While you’re appealing, you need to keep paying what’s on your original bill until you get the new one. In addition, you can’t appeal because you think your Council Tax bill is too high.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

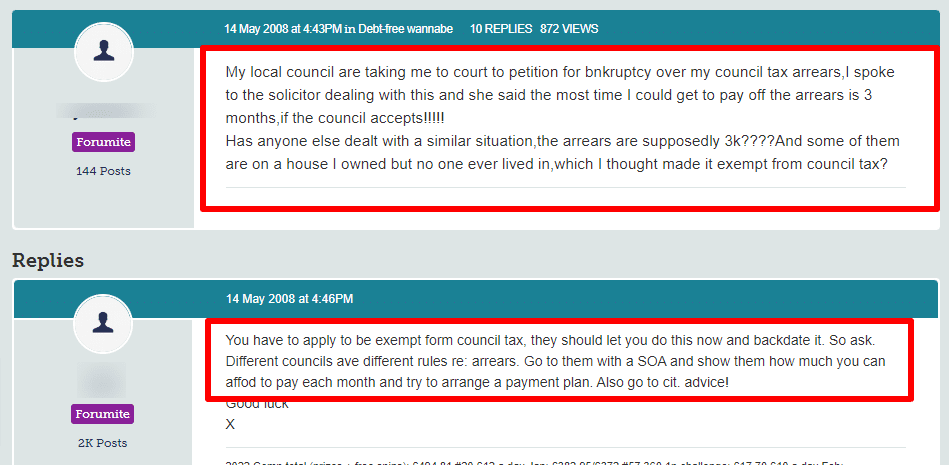

What Happens if You Don’t Pay Your Council Tax?

I can’t stress enough how important it is to keep paying your current council tax rate, even if you believe you should be exempt, or receive a Council Tax Reduction. You will go into council tax arrears if you don’t keep paying your council tax, and this can have consequences, as I have listed below.

- Your council will send you a reminder if you miss a council tax payment, giving you 7 days to pay the arrears. As long as you pay within this period, you can keep paying your council tax in instalments.

- You’ll get a final notice if you don’t pay within 7 days or miss another payment. You’ll have to pay the whole year’s council tax at this point.

- The local authority may engage a debt collection agency such as PRA Group, Lowell Portfolio, or Global Debt Recovery to try and get you to pay. Expect to be hounded non-stop if this happens.

- It is possible for the council to issue a court summons if the council tax goes unpaid. You’ll get a letter with the date and time of the court hearing. When your council tax is paid in full before the hearing, you can let the magistrate know. You’ll get an extra charge at this point.

- A magistrate can issue a liability order, allowing the local authority to collect unpaid council tax. In some cases, bailiffs will be appointed to recover the debt, or your wages or benefits could be deducted.

How Much is Council Tax?

This is where things start getting complicated. I will do my best to give an understandable explanation and a couple of examples, below.

- Local authorities in England set the average Band D council tax for 2023-24 at £2,065, an increase of £99 or 5.1% over 2022-23’s figure of £1,966. The average includes adult social care and parish precepts.

- Band D council tax in London is $1,789. Compared to 2022-23, this is an increase of £105 or 6.2%.

- Compared to last year, the average Band D council tax in metropolitan areas will be £2,059, up £99 or 5.1%.

So, as you can see, how much you pay annually for council tax very much depends on where you live, even down to whether you live in an urban area or not.

Council Tax Bans Explained

This is an overview of Council Tax bands in the UK. The actual amounts may vary depending on the local authority. Depending on its estimated value in April 1991, each property is categorized into one of eight bands (A-H). I included this table for completion’s sake, so you can work out roughly which band your own property fits within.

| Council Tax Band | Property Value in April 1991 (England) | Property Value in April 1991 (Scotland) | Property Value in April 2003 (Wales) |

| A | Up to £40,000 | Up to £27,000 | Up to £44,000 |

| B | £40,001 to £52,000 | £27,001 to £35,000 | £44,001 to £65,000 |

| C | £52,001 to £68,000 | £35,001 to £45,000 | £65,001 to £91,000 |

| D | £68,001 to £88,000 | £45,001 to £58,000 | £91,001 to £123,000 |

| E | £88,001 to £120,000 | £58,001 to £80,000 | £123,001 to £162,000 |

| F | £120,001 to £160,000 | £80,001 to £106,000 | £162,001 to £223,000 |

| G | £160,001 to £320,000 | £106,001 to £212,000 | £223,001 to £324,000 |

| H | More than £320,000 | More than £212,000 | More than £324,000 |

However, regardless of the band your property sits within, the exact amount of council tax you pay will be calculated by the local authority. And as I have already explained, some local authorities are more expensive than others.