What Happens if I Don’t Pay My Klarna Back on Time?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you have Klarna debt and worry about not being able to pay it on time? You’ve come to the right place. Every month, over 12,000 people visit this website for advice on debt topics, including issues with Klarna.

In this article, we’ll explain:

- Who Klarna is and what types of finance they offer

- What happens if you don’t pay your Klarna debt

- How you can lower your repayments

- Whether Klarna will be understanding and help you meet your debt

- What happens if Klarna takes you to court and a County Court Judgement (CCJ) is issued against you

We understand the stress of being in debt; some of our team members have faced similar problems. With our experience, we’ll help you find out what you can do if you’re unable to pay your debt on time.

Do you have to pay Klarna debt?

There are ways to have Klarna debt written off in the UK.

If you genuinely can’t afford your debt repayments then looking into whether you could have your payments lowered or written off might be just what you need.

If you want to find out whether you qualify for having debt written off or payments lowered then fill out the short form below.

What Happens if You Don’t Pay Klarna?

This is an interesting question because what happens if you don’t pay, will depend on which of the lending products you have taken out with Klarna. For the buy now pay later credit, it is unlikely that Klarna will follow the full legal process for the enforcement of repayment of debt. After all, you were given this buy now pay later credit without a credit check, and it is for a very small amount.

However, if you took on traditional credit with Klarna, and let’s be clear here, the simple buy now pay later credit product is intended to be something of a gateway drug to you borrowing more money from Klarna under a traditional credit agreement, you can expect to face the full legal process of debt recovery. However, you need to understand that there are many myths about this process. For example, unless you give Klarna your address, they have no way to find it if you move house.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will Klarna Take You to Court?

Now, let’s put the buy now pay later credit aside here. We are going to talk about what will happen if you don’t pay back the money you borrow from Klarna under a traditional credit agreement. First of all, the company is going to ask you to pay the debt or set up some form of repayment schedule. If you don’t do this, then your debt could be turned over to a collection agency such as PRA Group, Global Debt, or Lowell Portfolio.

Once this happens, you can expect to be hounded by the collection agency, until such time as you agree that you owe the debt, and set up some schedule for repaying it. You face actions such as the ones listed below.

- Constant phone calls, often at the weekend or in the evening.

- Potential visits to your home, again, can happen at the weekend or in the evening.

- Letter after letter was sent to your home, to try and contact you.

Eventually, if you don’t reply to any of these letters or phone calls, acknowledge the debt, or work out a payment plan, the collection agency will take matters further. And this means potential legal proceedings.

What Happens if I Don’t Pay Klarna After a CCJ Has Been Issued?

I have already explained what you can expect from a debt collection agency, if they had been passed your debt by Klarna. But what happens once matters have become more serious, will you be taken to court?

Your creditor has the option of approaching the County Court to issue a judgement against the debt. This is known as a County Court Judgement (CCJ). if the judgement is granted, you are then deemed legally liable for the debt. If you still don’t pay the debt once this happens, it is within the power of the County Court to sanction bailiffs to enforce the collection of the debt. Ultimately, this means you could have bailiffs knocking on your door, demanding you pay the debt, or wanting to take goods away from your home to be paid to settle the debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Bailiffs Really Take Goods From My Home To Sell To Pay the Debt?

If a bailiff can get into your home, then yes, they are well within their rights to take goods from your home to be auctioned off, and the proceeds paid towards your debt. However, they cannot force their way into your home. They can only come inside if you invite them in.

Additionally, certain items are protected, and exempt from confiscation. For example, your cook or fridge, which are seen as basic needs. Additionally, a bailiff cannot take anything that you need to do your work. Your phone, laptop, or similar.

How Did You Get Into Debt With Klarna?

Putting the traditional credit product aside for a moment, I want to talk about how easy it is to get into debt with Klarna if you use their Pay in 4 services. First of all, you download and install the app on your phone. You then register an account. Once you have done this, Klarna will tell you how much you can spend using their buy now pay later credit scheme.

Note here, that at this stage you are already being offered money by Klarna, even though you haven’t asked for it. The danger here, is that some people will instantly think to themselves, wow, where can I spend this? Effectively borrowing money that they didn’t even need.

Will Klarna Be Understanding, and Help You To Meet Your Debt?

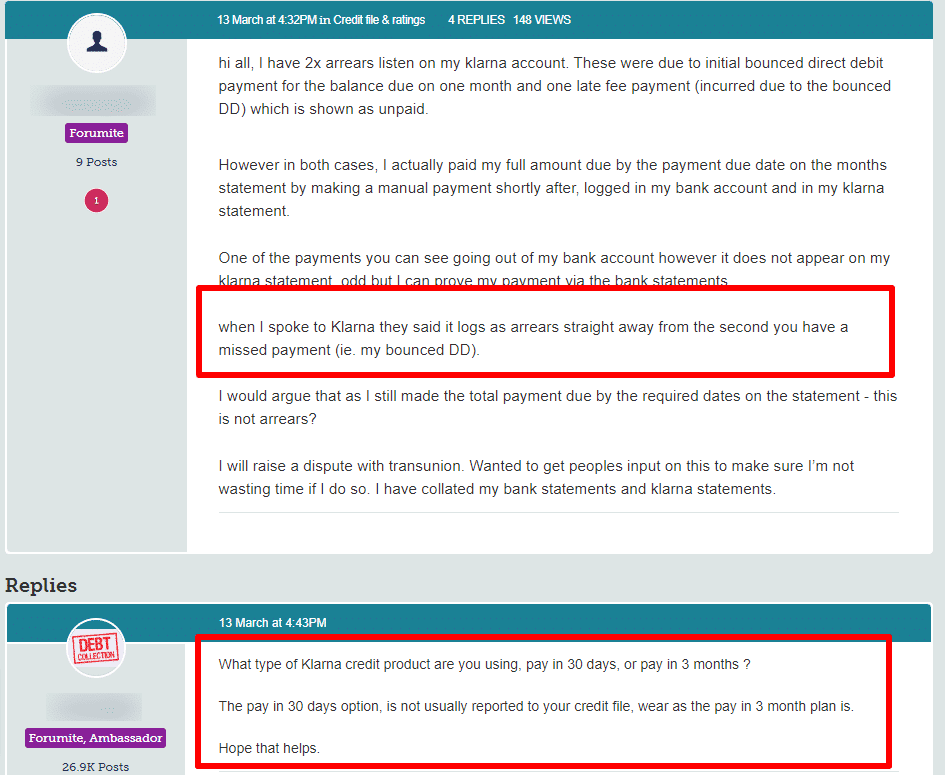

I have to be careful what I say here, let’s just say that if you do a little Googling, you will likely realise that this is a company that has a less than stellar reputation for dealing efficiently and effectively with their customers. I’m not saying that Klarna is unethical. But there does seem to be a general opinion, that this is a company that operates a call centre that is a) extremely busy, and b) staffed by people that do the bare minimum to solve problems.

Therefore, don’t go expecting Klarna to listen to your problems, understand your financial situation, and bend over backwards to help you meet your debts. Instead, you will likely go through a scripted call centre process, with very little flexibility.