How To Move House With Council Tax Arrears?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Council tax arrears can be a big worry. You might be feeling stressed about what will happen if you can’t pay what you owe.

Don’t worry, you’re not alone. Every month, over 12,000 people visit our site for advice on issues just like this one.

In this article, we’ll go through:

- What council tax is, and why we need to pay it

- Who must pay council tax, and who doesn’t have to

- What happens if you fall behind with your council tax payments

- How to make your repayments smaller

- What you can do if you want to move or sell your house, but you owe council tax

We understand how tough it can be to owe money; some of our team have been in your shoes. With our experience, we’ll help you understand what you can do if you owe council tax and want to move house.

What Happens if You Get Into Council Tax Arrears?

Everyone is initially given the option to pay their yearly council tax in 10 monthly instalments. If you miss one of these instalments, the council will contact you and send you a reminder. If you miss one more instalment within the 12-month period, the council will withdraw your ability to pay in instalments, and then ask you to pay your yearly council tax in one lump sum.

If you let your council tax get into arrears, it will be treated as a debt just as a credit card or a personal loan would. And in this case, you can expect a debt to be handed over to a collection agency such as Global Debt Recovery, Lowell Financial or PRA Group.

Eventually, if you don’t settle your council tax arrears with the collection agency, you face a County Court Judgement (CCJ), and visits from a bailiff.

Can You Move House if You Have Council Tax Arrears?

Yes, you can move house if you are council tax arrears. Council tax is a personal debt, that you carry with you. It is not attached to the address where you live. If you move house, you still owe the council tax arrears. You might think that you have evaded paying, but the council or their agent will track you down.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can You Sell a House if You Have Council Tax Arrears?

Yes, you can sell your house even if you owe council tax arrears for the address. As I have already mentioned, council tax arrears are a personal debt, and have nothing to do with where you live apart from the fact that the tax was levied originally because you were living at the previous address.

Is Anyone Exempt From Paying Council Tax?

If you are the person (or part of a couple) that is the occupier of the premises. And this can be rented premises or privately owned premises, then you (or you as part of a couple) will be liable for council tax in most cases. However, there are a few types of people who are exempt from paying council tax, and I’ve covered these below.

- Foreign diplomats don’t pay council tax stop

- Anybody who suffers from severe mental illness does not pay council tax.

- If you are a live-in carer, you are not liable for council tax.

- Student nurses, and any student who is attending university or college full-time, does not have to pay council tax.

- Anyone who is still in full-time education, and is between the age of 18 and 19, doesn’t pay council tax.

- Certain people who are on apprenticeship schemes don’t have to pay council tax.

- Anybody who is under the age of 18 doesn’t pay council tax at all

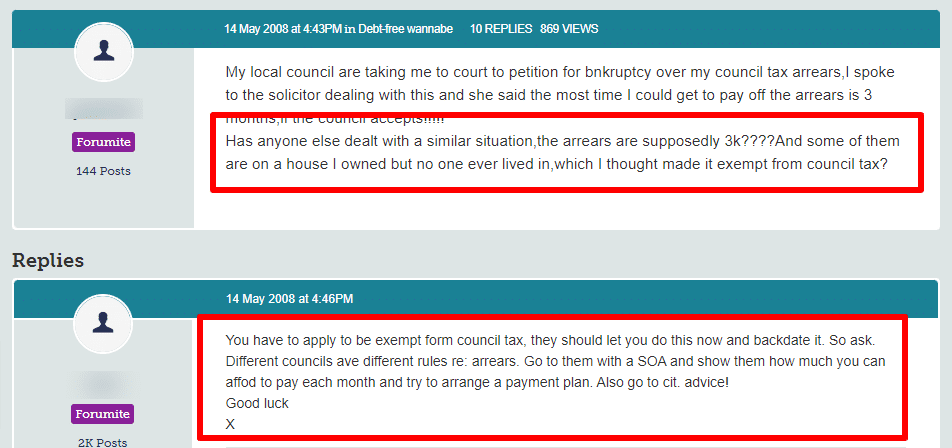

Note though, that if you believe you are exempt from paying council tax, you have to apply for this exemption, as it won’t simply be granted. So if you are given a council tax bill even though you believe you are exempt, you will have to appeal against the council tax demand. In most cases, this should be a simple matter. However, it is much safer to apply for an exemption proactively, rather than wait until you are sent a council tax bill.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Options for Dealing With Council Tax Arrears

If you owe council tax arrears, there are some options that could help you get out of debt. Below, I have listed a few of these.

- If you only owe a small amount of debt, you can contact the council and try and arrange affordable repayments.

- If your council tax arrears are just a small part of an overall larger debt package, you might need to consider an advanced debt management solution such as an Individual Voluntary Agreement (IVA).

- If there is simply no way you can meet all of your debts, including your council tax arrears, you may need to consider voluntary bankruptcy.

A good place to start advice about dealing with debt, including council tax arrears, is your local Citizens Advice Bureau (CAB).