What to do with a County Court Business Centre Claim Form

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a County Court Business Centre Claim Form, there’s no need to worry. This guide will help you understand what to do next.

Every month, over 12,000 people visit our website for advice on debt topics just like this one. You’re not alone.

In this article, we’ll explain:

- What happens at the County Court Business Centre

- If you have to pay

- Why your claim might have been passed to the County Court Business Centre

- How to respond to a County Court Business Centre Claim Form

- What to do if you owe the money

Dealing with the County Court Business Centre can feel scary — you might be worried about paying a debt, or what might happen if you can’t pay.

We understand your concerns, and we’re here to help. So, let’s take this journey together and figure out the best way to handle your County Court Business Centre Claim Form.

What should you do with a CCBC claim form?

You should respond to a CCBC claim form as soon as you can. In short, you should respond within the deadline otherwise things will escalate.

However, before signing or doing anything, it’s best to seek independent advice. You could contact a solicitor or seek free advice from one of the leading debt charities.

What should you check when you get a CCBC claim form?

There are things you should check once you receive a County Court Business Centre claim form.

For instance:

- Check whether the claim form was correctly served. It must include a ‘Response Pack’. If you find it’s missing, the claim form was not served correctly which gives you grounds to have it cancelled. Check if the claim form explains clearly what the ‘claim’ is about. If details of the claim are not included in the claim form, you have the right to apply to the courts to stop the case from going forward

- Check if the claim form was served on time. If the claim is too old to enforce, it’s deemed statute-barred because it’s 6 years old. You have the right to apply to the court to ‘strike out’ the claim

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you respond to a CCBC claim form?

As mentioned, all claim forms should contain a Response Pack. In it, you’ll find an N9 (CC) form known as an ‘Acknowledgement of Service’.

The time limit to respond to the claim form is set at 14 days which starts from the day you receive the form. If you wait later than 14 days to return the form to the court, you’d have run out of time!

A debt collection agency could get involved to recover what you owe!

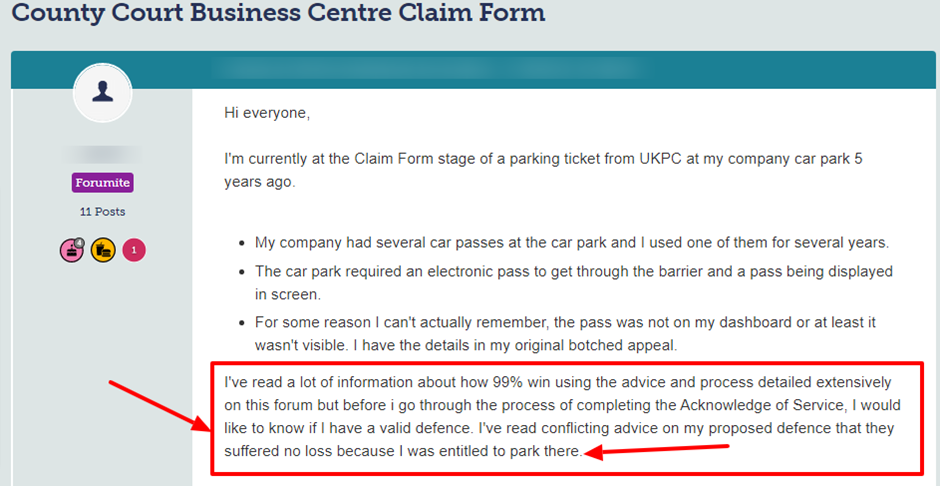

Check out what one person asked on a popular forum about filling out the claim form:

Source: Moneysavingexpert

Why has my claim been passed to the County Court Business Centre?

Chances are your claim has been sent to the County Court Business Centre because you owe money to someone.

In short, a creditor has passed the claim to CCBC who then acts as their collection agency to recover the amount owed.

You’d get a Court form N1 which is a letter of claim.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What should you do if you owe the money?

You have several options when you receive a CCBC claim form. The first is to admit you owe the money. You do this by filling out the Acknowledgement of Service form.

Ways to pay what you owe are also included in the Response Pack.

How do you challenge the debt?

Another option is to challenge the claim. If you don’t accept that you owe the debt, you must tick the right box in the Acknowledgment of Service form. By doing this, you declare that you are defending all or part of the claim.

As soon as you ‘tick the box’ and file your defence, the clock stops ticking and the CCBC can’t escalate things until a ruling is made.

It’s worth noting that you have 14 days to present your defence.

What happens if you ignore a CCBC claim form?

It’s not a good idea to ignore a claim form from the CCBC. The matter escalates quickly and you could end up with a County Court Judgement (CCJ) on your credit file.

Moreover, a court could issue a warrant of recovery which allows enforcement agents (bailiffs) to contact you.

It could result in:

- Having an attachment placed on your earnings

- Coping with a charging order

- Being made bankrupt

What was once one amount of money could quickly increase to a lot more thanks to the extra fees and costs you’d incur.

Could you get a County Court Judgement?

Yes. When you don’t respond in time to a CCBC claim form, you could get a County Court Judgement registered on your credit history.

It will remain there for 6 years making it hard or impossible to get credit for that amount of time.

However, you could ask the court to remove the CCH if you pay the total amount within 30 days of getting it!

Do you need more advice about debts?

Check out my other post on how to get out of debt which could help you get your finances back in order!

Thanks for reading this post. I hope the information helps you deal with a County Court Business Centre claim form so the experience is less stressful.