How Many Times Can a Bailiff Visit Your Home?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried about a bailiff coming to your home? Are you unsure about how many times they can visit?

It’s okay, you’re not alone. Each month, over 12,000 visit this site to find answers to questions on debt topics.

In this article, we’ll explain:

- What do bailiffs do?

- What happens when they visit your home?

- Can they take your things if you don’t let them in?

- How can you lower your repayments?

- How many times can a bailiff visit your home?

I understand your worries – not being able to pay a debt can feel scary; I’ve been there too. But I want you to know that there are rules that bailiffs must follow, and you have rights.

Let’s take this journey together and find the best way to manage your situation.

What happens during a bailiff visit?

As mentioned, once you get a Notice of Enforcement from a bailiff, you should expect a visit 7 days later! After that, they have the right to visit you 2 more times making a total of 3 visits to collect a debt.

So, they will:

- Visit you on the first occasion to note down assets/possessions you own. This is an inventory known as ‘taking control’ of your possessions

- On their second visit, bailiffs will want to recover the debt you owe with their fees and other charges added to the original amount

- On the third occasion, bailiffs attempt to recover the money you owe if they failed to collect it on the second occasion

» TAKE ACTION NOW: Fill out the short debt form

Can bailiffs just turn up at your home?

No. You must be given 7 days’ notice before a Bailiff can visit your home for the first time. They must send you a Notice of Enforcement before their visit. This allows you a little time to sort things out beforehand which includes getting some debt advice!

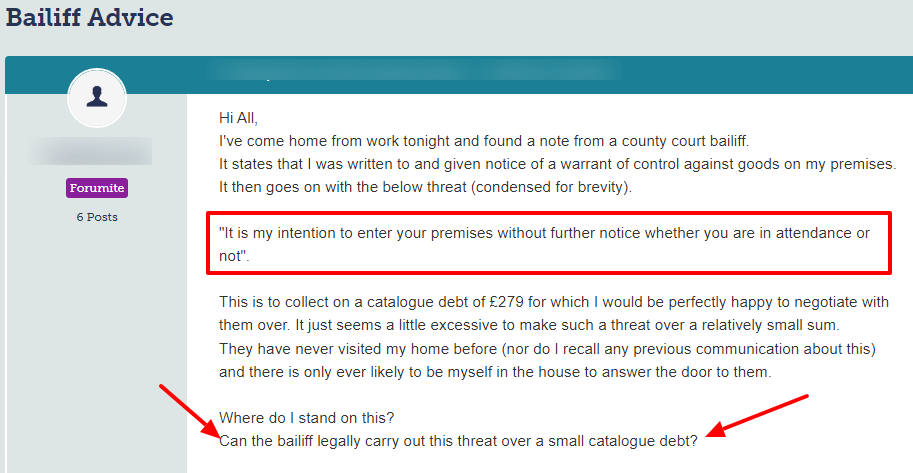

Check out what happened to one unfortunate person who got a note from a bailiff:

Bailiffs cannot threaten or harass you. Nor can they force entry into your home for this type of debt!

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How long is there between bailiff visits?

There is no limit on how often bailiffs can visit you. However, repeated or even daily visits could be seen as harassment. If your bailiff is visiting you very frequently, you might have grounds for a complaint.

What should you do when bailiffs visit you?

As mentioned, if you’re anxious about letting bailiffs into your home, you can speak to them through the letterbox. Or from an upstairs window if you don’t have a letterbox!

Ask to see their ID and any court-issued documents which they can pass under a door. A bailiff must respect the request and produce their ID and relevant paperwork.

» TAKE ACTION NOW: Fill out the short debt form

If they can’t produce proof of who they are and why they are contacting you, ask them to leave. They must respect this request and once they have, contact their head office straight away!

There are specific ways to deal with bailiffs and when you know about them, it could help make the whole ordeal less stressful.

How do you confirm a bailiff’s ID?

All bailiffs should carry an official ID showing who they work for. Moreover, they must also produce their enforcement agent certification.

Once you have the information to hand, you can check whether it’s genuine by:

- Contacting the court that instructed the bailiffs to visit you

- Checking a High Court bailiff’s ID on the High Court Enforcement Officers Association website

- Confirming a Certified Enforcement Agent’s ID on the Certificated Bailiff Register

When an enforcement agent can’t confirm their ID, you must ask them to leave and if they refuse, you have the right to call the Police!

There have been reports of people posing as bailiffs which is a worry.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can bailiffs force their way into your home?

It depends on the sort of debt a bailiff is trying to recover as to whether they can force entry into your home. That said, they can’t just break down your door, they must use a qualified locksmith to gain entry.

To avoid this happening, it’s best to pay the debt or arrange a repayment plan with the bailiffs!

Enforcement agents can only legally force their way into your home if the following applies:

- The debt is an unpaid court fine or criminal fine

- They are recovering a debt for HMRC

Also, bailiffs can’t force their way into your home without first producing a warrant or writ along with proof of the debt.

You should ask them to post the relevant paperwork through your letterbox or push it under the door. You should then check whether all the details are correct which include:

- Your details

- The date the document was signed

When any information is incorrect or missing, you have the right to ask a bailiff to leave.

Moreover, a bailiff cannot force entry into your home to collect the following:

- Credit card debts

- Council tax arrears

- Debts owed to utility companies

- Telephone companies

- Unpaid parking tickets

What’s the best way to stop bailiffs from visiting you?

Provided you respond to a Notice of Enforcement as soon as you can, it’ll stop the bailiffs from visiting your home. Once you get in touch with them, try to pay the full amount or if you can’t, try to arrange a repayment plan.

However, if they agree to a repayment plan to clear the debt, make sure you keep up with the repayments. If you miss a payment, your repayment plan could be cancelled leaving no choice but to pay the full amount!

Can bailiffs seize your possessions if you don’t let them in?

Bailiffs can only enter your home when you let them in or if they find a door is unlocked. So, if you don’t let them into your home, they can’t seize any items found inside.

However, they can take possession of any items found outside your home. This includes your vehicle!

How should you prepare for a bailiff’s visit?

If you’ve received a Notice of Enforcement from a bailiff, you have 7 days to get ready for their visit. As such, you should make sure everyone in the home is made aware of the impending visit.

Make sure everyone knows not to let the bailiffs into your home and to keep all doors and windows locked. It’s also a good idea to park vehicles well away from the property and not on your drive or parked on the road.

What happens when you ignore bailiffs?

You shouldn’t ignore a Notice of Enforcement from a bailiff because the problem won’t go away. If they show up once, they’ll show up again!

The best way to stop bailiffs from visiting you is to pay the amount you owe or if that’s not possible, try to set up a repayment plan.

It’s worth noting you don’t have to let the bailiff enter your home so keep your doors locked if you’re expecting a visit from them.

How many times can a bailiff visit your home? (Recap)

Bailiffs can only visit your home 3 times and they must leave a 7-day gap between each of the visits. Like this, you have time to prepare yourself for the encounter!

If you want to stop a bailiff from visiting your home, you should try to pay the full amount within 7 days of receiving the Notice of Enforcement!

However, if you’re struggling with your finances don’t ignore the bailiffs. Instead, try to arrange a repayment plan with them. If you need advice, contact one of the leading debt charities before contacting the bailiffs!