How to Clear Debt on Your Prepaid Electric Meter

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Having trouble with prepaid electric meter debt? This is a common worry. You may be scared of what comes next if you can’t pay back what you owe. But remember, you are not alone. In fact, I guide over 12,000 visitors each month who are seeking guidance on debt topics.

In this piece, we’ll explore:

- How you can get into debt with a prepaid meter.

- The impact of not clearing your debt and whether your electricity will be cut off.

- Tips on how to clear the debt on your prepaid electric meter.

- What to do if you continue not to pay the debt.

- How to get help with energy debt.

We know it’s tough when you owe money. Our team understands your situation well as we’ve dealt with owing money and feeling lost, so we know how to help you. Let’s dive in and find out more about handling your prepaid electric meter debt.

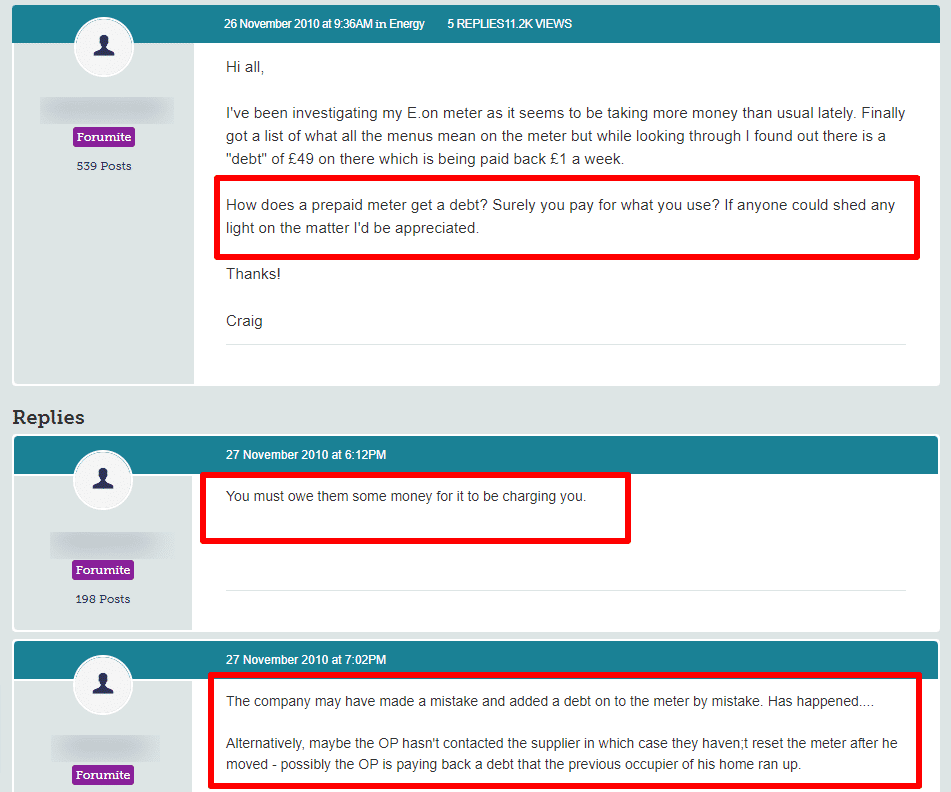

How Can You Get Into Debt With a Prepaid Electric Meter?

Now, this is where I became confused when my friend told me she had managed to rack up debt using a prepaid electricity meter. I just couldn’t work out how this could be. It turns out there are a number of ways to go into debt, even if you are using a prepaid meter, and I explain these, below.

- Not topping up your meter regularly.

- Using a lot of electricity in a short time.

- Using your prepaid meters emergency credit facility.

There are certain rules and regulations that electricity providers have to follow, and many of these are aimed at making sure people don’t get into debt accidentally. But it can still happen.

How To Clear the Debt on Your Prepaid Meter

If you have debt on your prepaid electricity meter, there are two ways to get out of debt. The first way, and simplest way, is just to top up your meter with enough credit to clear the debt. The second way is to pay the debt directly to the supplier. You can either pop in and pay them if they have a local showroom, or phone up and pay them.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if You Continue Not To Pay the Debt?

If you owe your energy provider money, you may be taken to court. Typically, this is a last resort, and your supplier will attempt to resolve the issue with you before taking legal action.

If you have any outstanding debts with your supplier, you may receive a reminder. In the event that you do not pay the reminder, your supplier may attempt to collect the debt through debt collection agencies or take legal action to recover it. These agencies, such as PRA Group, Global Debt Recovery and Lowell Financial, are well-known for aggressively pursuing the repayment of debts. You want to avoid this if you can.

Will Your Electricity Be Cut Off if You Don’t Pay the Debt?

Considering using a prepaid meter is supposed to be a way to manage your electricity bill without going into debt, you can still be cut off if you do.

The electricity supply may be cut off if you don’t have enough credit on your prepaid electric meter to cover your electricity usage. A prepaid meter prevents customers from running up large debts, so if you don’t have enough credit to cover your usage, it will stop supplying electricity.

In most cases, your prepaid meter will provide you with some warning before it cuts off your supply. You may hear beeps or see flashing lights indicating that your credit is low, or you may receive a notification from your supplier reminding you to top up. There are also some prepaid meters with an emergency credit feature, which allows you to continue using electricity even if you don’t have any credit left. It is important to pay back emergency credit, and if your meter is not topped up with enough credit to cover it, your supply may be disconnected.

In the event that your prepaid meter runs out of credit and your supply is disconnected, you will need to top up enough credit to cover your usage before your electricity supply is restored. Your supplier may also charge additional fees for reconnecting your supply.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will You Go to Court if You Don’t Pay the Debt?

In the event of legal action, your supplier may obtain a County Court Judgment (CCJ) against you by taking you to court. A CCJ is a court order that states you are legally obligated to repay the debt. The supplier may take further legal action if you fail to repay the debt as required by the CCJ, which could include bailiffs visiting your home to recover the debt.

Trust me, as somebody who has had first-hand experience of dealing with bailiffs, you want to avoid this if you can. A bailiff knocking on your door demanding either money or to take goods from your home to be sold, is never going to be a pleasant experience.

However, you need to understand that bailiffs are often all bark and no bite. They cannot force their way into your home, and can only come inside if you invite them in. If a bailiff does knock on your door, don’t panic and don’t let them in. Ask them for their ID and details of the debt they are chasing, they must provide these if you ask for them.