Can You Get a CCJ for Not Paying Council Tax?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about being able to pay council tax? You’re not alone, and this is the right place to find answers. Each month, over 12,000 people visit our site for advice on debt topics.

In this easy-to-understand piece, we’ll cover:

- What council tax is, and why we pay it

- How a County Court Judgement (CCJ) works

- What happens if you don’t pay your council tax

- Ways to lower your repayments

- What to do if your council tax debt is handed to a debt collector

We know that it’s tough dealing with debt; some of us have been in your shoes. Don’t worry; we’re here to help you find out more about council tax, CCJs, and what you can do if you’re struggling with debt.

Let’s get started!

Who Pays Council Tax and Why?

Council tax is usually paid by residential property owners or occupiers in the UK. A home is any dwelling used as a residence, such as a house, flat, or apartment. Council tax must be paid whether you own or rent your home. Council tax is typically the tenant’s responsibility if they rent a property. A tenancy agreement may, however, require the landlord to pay council tax in some cases.

Some people may be exempt from paying council tax in some cases, such as if it is a self-contained unit occupied by a full-time student or if all the occupants are under 18. Discounts are also available for certain groups, such as single occupants and people with disabilities. I have added a list of the types of people who might qualify for council tax exemption, below.

- Full-time students

- Student nurses

- Live-in carers

- People with severe mental impairment

- Diplomats

- Members of the armed forces (in some cases)

- People under the age of 18

» TAKE ACTION NOW: Fill out the short debt form

If You Don’t Pay Your Council Tax, What Happens?

There is a process that is followed if you fail to pay your council tax or have backdated council tax arrears. Everyone is given the option initially, to pay their council tax in 10 monthly instalments across the year. But if you don’t pay, the following could happen.

- The council will send you a reminder notice if you have missed a council tax payment. You will have 7 days to pay the outstanding amount. You can continue with your instalment plan as usual if you pay within this timeframe.

- The council will send you a final notice if you miss two or more payments. You will have 14 days to pay the full amount owed. If you fail to pay by this date, you will lose your right to pay in instalments and the full amount of council tax will become due immediately.

- A summons to court will be issued if you do not pay the full outstanding amount within 14 days of the final notice. You may have to attend the court hearing, where a magistrate will decide whether you owe the money and how to repay it.

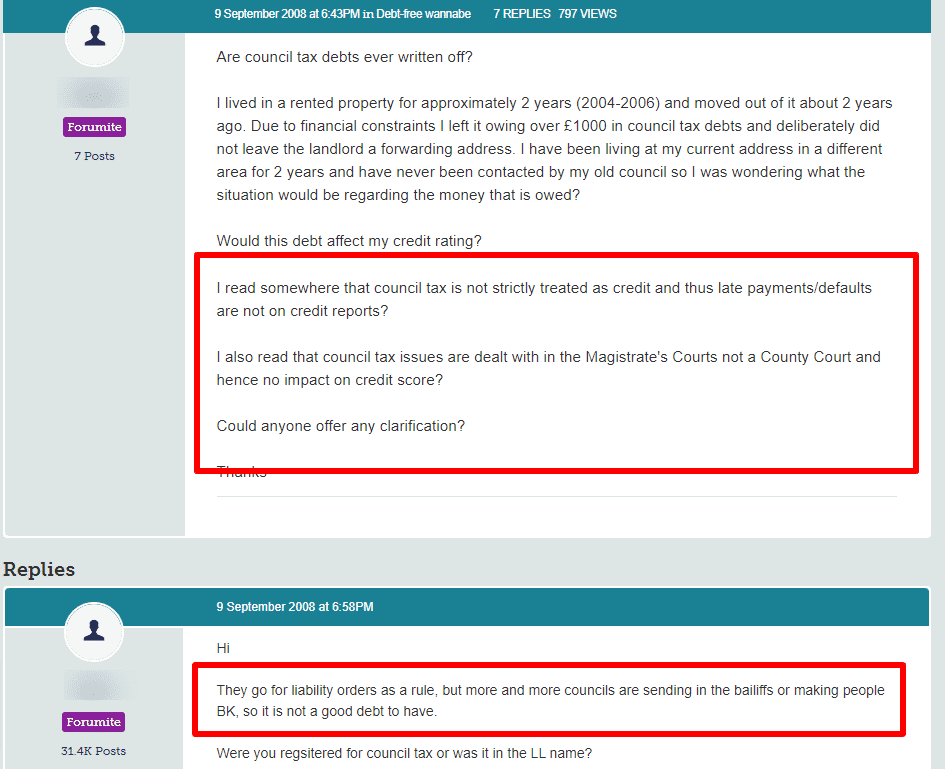

- In the event that you do not attend the court hearing or the magistrate determines that you owe the money, a liability order (CCJ) will be issued. As a result, the council can take further action to recover the debt.

- The County Court may send bailiffs to your home to enforce repayment of the debt.

Will Your Council Tax Arrears Be Handed Over to a Debt Collector?

In some cases, the council might use the services of a debt collection agency to help collect your council tax arrears. Trust me, you don’t want to have debt collectors hounding you to repay a debt. Collection agencies such as PRA Group, Lowel Portfolio and Global Debt Recovery are well-known for their strong-arm tactics when trying to get people to settle a debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if the County Court Sanctions Bailiffs To Enforce Collection?

In the UK, bailiffs may be ordered by the County Court to visit your property to recover goods to the value of the debt owed. The process is referred to as enforcement action. In most cases, bailiffs will give you notice before they visit your property so that you can pay the debt or come to an agreement with them.

If you can’t pay your council tax arrears in full, and the bailiffs won’t accept a repayment schedule, they may want to take goods from your home to be sold off to pay the debt.

However, you need to understand that bailiffs cannot force their way into your home, push past you to get inside or threaten you in any way, and this includes using threatening language. In many ways, they are a paper tiger. They can only come inside if you invite them in. If a bailiff cannot get inside your home, they can only take goods they can find outside. Note though, that this might include your car if it is parked on your drive or in the street.

Furthermore, there are certain types of goods that a bailiff cannot take to be sold. And I have listed some examples of these, below.

-

Items you need for your work:

- A laptop or computer.

- Your work phone.

- Your car.

- A fax machine.

- Your home office furniture.

-

Items that are deemed a basic need:

- Your cooker or microwave.

- Your fridge and freezer.

- A table to eat from.

- Your beds and bedding.

Additionally, a bailiff can only take goods that are yours. For example, your children’s toys cannot be taken.

Getting More Help and Advice About Debt

Probably the best advice I can give, if you are facing council tax arrears you can’t pay, is to get some financial advice from your local Citizens Advice Bureau (CAB). The staff at the CAB help people to get out of debt daily. They can help you to work out how much you can afford to repay monthly and offer advice on how to deal with a collection agency or firm of bailiffs.

If you are in serious debt, the CAB staff can refer you to a debt counsellor, who in turn can tell you about advanced debt management solutions. Including an Individual Voluntary Agreement (IVA) or voluntary bankruptcy.

In closing, let me say that there are many organisations in the UK that can help people with debt, including council tax arrears. There is likely help out there, you just need to ask. Your CAB is the perfect jump-off point for this.