Bristow and Sutor Contacting Me About Debt – How to Appeal

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

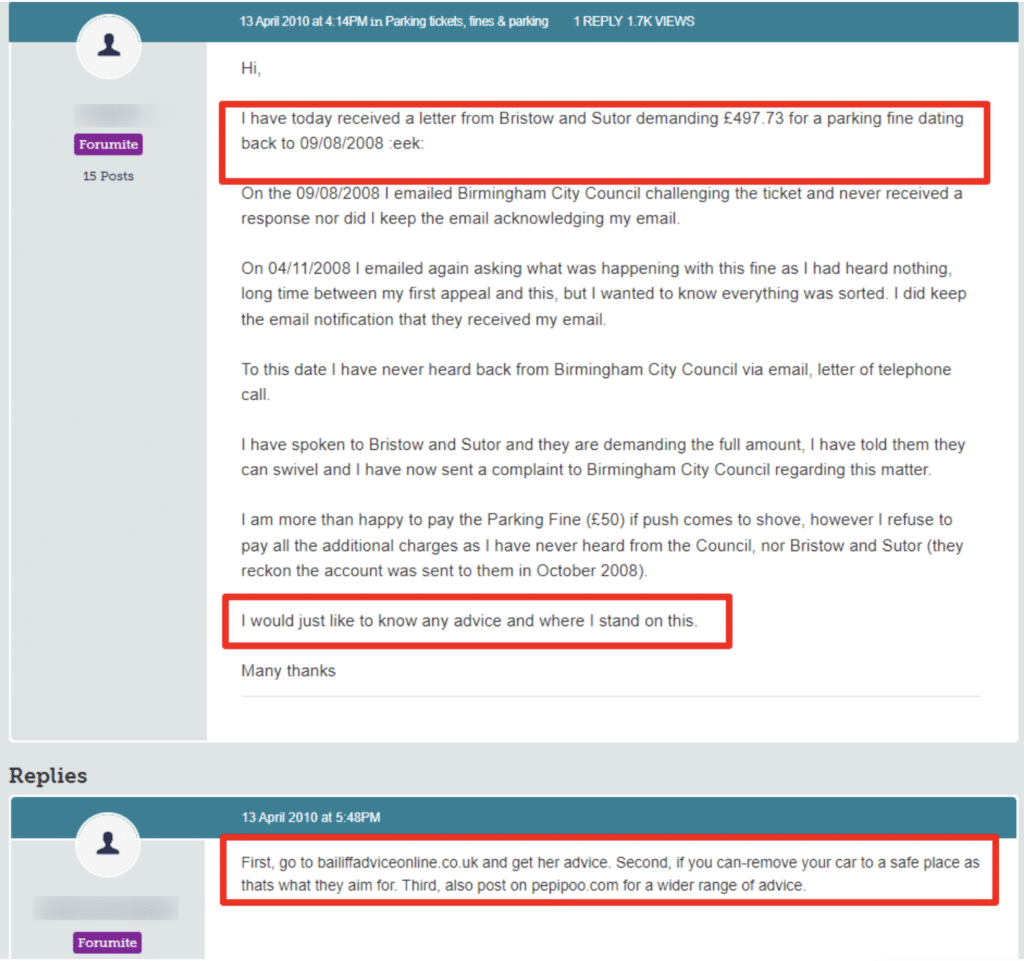

Are you worried about a note from Bristow and Sutor about your debt? You might feel scared or unsure about how to deal with debt collectors. We understand your worry. Every month, over 12,000 people come to this site looking for advice on debt issues.

In this easy-to-understand guide, you’ll learn:

- Who Bristow and Sutor are and why they might be contacting you.

- How you can talk to Bristow and Sutor about your debt.

- Ways to make your repayments smaller.

- What happens if you don’t pay your debt.

- How to stop Bristow and Sutor from contacting you.

We know how hard it can be when you owe money, as many of our team members have been in your shoes, dealing with debt and feeling worried, so we know how to help. Let’s dive in and find out how to deal with Bristow and Sutor and make things easier for yourself.

Why Are Bristow and Sutor Contacting You?

It isn’t always obvious why a collection agency is trying to get hold of you. Sometimes we end up owing a debt we actually didn’t realise we had.

What Happens if You Don’t Pay Your Debt?

Debt collection agencies are paper tigers in reality. They have no special powers over and above those provided to any creditor. But of course, this doesn’t generally mean you can just ignore your debt. But what happens if you do ignore it? I’ve listed some possible outcomes below.

- You’ll be contacted by debt collectors to arrange repayment, but they won’t stop there. Phone calls, letters, emails, or even home visits are all options. It’s all about getting the money back. Contact must be legal, and you can specify the mode of contact you prefer, such as only by post, for example.

- Any additional interest and charges stop if the debt’s been sold to a collection agency, so it shouldn’t keep growing.

- In the worst-case scenario, you may have to go to court if you keep ignoring the debt collectors. There’s a possibility you’ll get a County Court Judgment (CCJ) against you, which could hurt your credit rating.

- Creditors can take enforcement action if you don’t respond to a CCJ or follow the repayment terms. A bailiff could seize property, an attachment of earnings order could be applied for, or in severe cases, bankruptcy could be filed.

- In some cases, you can get your debt written off if you haven’t been contacted by your creditors for six years. The debt becomes statute-barred. The six-year rule doesn’t apply if you’ve acknowledged the debt in writing or paid towards it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will Bristow and Sutor Take You to Court?

As you probably worked out by now, debt collectors will not stop chasing you for the debt once they have the bit between their teeth, and if you don’t pay the debt, you face potential legal action.

In the event that you don’t settle the debt, Bristow and Sutor may initiate County Court proceedings if you live in England or Wales. As a result of receiving a County Court Judgement (CCJ) against you, you will incur court fees, have to pay interest on your debt, have to pay solicitors’ costs awarded by the court, your credit rating will suffer, and the court may declare you bankrupt for debts of more than £5,000 or more.

Therefore, Bristow & Sutor can take you to court if you don’t settle a debt. In general, it’s best to talk to them or get independent financial advice to explore possible options and avoid escalation of the debt recovery process. Know your rights and obligations, and what steps Bristow and Sutor can legally take to get their money back.

Can Debt Collectors Send Bailiffs to Your Home?

In a nutshell, no. Only the court can send bailiffs to your home to collect a debt. In the debt recovery process, both debt collectors and bailiffs are involved, but their roles, powers, and methods are different.

Creditors or separate debt collection agencies may employ debt collectors. They can contact you in different ways, like visiting your house. Debt collectors don’t have the right to take your things away, so you’re not obligated to let them in. The law doesn’t give debt collectors any special powers.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Debt Collectors Contact You in the Evening and at Weekends?

A collection agency such as Brostow and Sutor, PRA Group, Global Debt Recovery or Lowel Financial will generally go to great lengths to try and get hold of you. This includes trying to catch you at home at the weekend, or in the evening. But they can’t justice reach out at any time, there are some rules they need to follow.

There are several laws and regulations governing debt collectors in the United Kingdom. They set the rules for how often and when they can contact a debtor.

» TAKE ACTION NOW: Fill out the short debt form

The Financial Conduct Authority (FCA) regulates debt collectors in the UK. Getting in touch with a debtor too often, at unreasonable times, or inappropriately is harassment, according to the FCA. There are no specific definitions in the laws or regulations of what’s considered too often or unreasonable though, unfortunately.

Debt collectors should not contact debtors at inconvenient times, and they should respect requests not to contact them during certain times. Whenever a debtor requests not to be contacted after hours or on weekends, the debt collector should respect that request.

How To Stop Bristow and Sutor From Contacting You

There are quite a few methods for stopping a collection agency from contacting you non-stop. And until you take these steps, they will likely hound you consistently. Even if you move, they will likely find your new address and start chasing the debt again. I’ve listed a few examples of things you can try, below.

- Reach out to them directly: Bristow & Sutor has several contact methods, including telephone, WhatsApp, and a physical address. You can use these avenues to tell them if you don’t want them contacting you. You should put your request in writing and keep a copy.

- There are a number of organizations that can give you advice and possibly intervene on your behalf. Citizens Advice Bureau, StepChange, and National Debtline are some of them. They can negotiate with Bristow & Sutor and come up with a repayment plan or a suitable solution. Using an advice agency would require you to provide the necessary info to Bristow & Sutor using their Advice Agency Contact form.

- If your debts are over £5000, you might want to consider an Individual Voluntary Agreement (IVA). You agree to pay off your debts over time with your creditors. You need an insolvency practitioner to set it up. Bristow and Sutor, like other creditors, should stop contacting you once the IVA provider manages your payments.

» TAKE ACTION NOW: Fill out the short debt form

How to Contact Bristow and Sutor

Unlike many debt collectors I have looked at in the past, who seem to make it as hard as possible to contact them, Brostow and Sutor offers a wide range of ways for you to reach out to them. I have listed them all below.

- For general questions or if you’re a debtor, you can use their ‘Debtor Contact Us’ page. You can also book a phone appointment to talk with their team. They’re open from 8am to 8pm Monday through Friday, and 8am to 1pm on Saturdays and Sundays.

- They also offer WhatsApp messaging if you want something more modern. 07860 078 251 is the number for this service. Responses will be provided through the same method, as it’s not an instant method.

- A textphone/minicom service is available for people with hearing or speech problems. You can reach them at 0330 390 201018001 + 0330 390 2010.

- If you want to write to them, you can write to: Bristow & Sutor, Bartleet Road, Washford, Redditch, Worcestershire, B980FL

- You can contact them online through their ‘Contact Us’ form. In most cases, they’ll get back to you within 5-7 days.

- You can contact Bristow & Sutor through their ‘Client Contact’ page if you’re a client. It usually takes them five days to respond.

- On their website, fill out the ‘Email Form’ and attach any documents you need

- You can contact them online if you’re a debtor by filling out the ‘Debtor Contact’ form.