Can Debt Collectors Take My Car If It’s On Finance?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Feeling worried about debt collectors and your car? You’re not alone. Each month, over 12,000 people seek guidance on debt-related matters from this site. In this article, we aim to clarify:

- The legal debt enforcement process in the UK.

- The authority and limitations of debt collectors.

- How to manage your repayments effectively.

- The role of County Court in debt recovery.

- Ways to handle a bailiff at your door.

We understand your concerns. Perhaps you’re fretting over losing your car or other valuable belongings to debt collectors. Our team, some of whom have personal experience with debt, is here to support you. We’ll explain when and why a car on finance can be taken and what you can do to prevent it. So, rest easy and read on. With our guidance, you can gain control over your situation and navigate through your debt worries.

Is There a Standard Process for Enforcing Repayment of a Debt?

Creditors in the UK have several options for enforcing repayment of their debts. Depending on the type of debt and the amount owed, the specific process may differ, but there are some common steps: These can’t generally be avoided, although it may be hard for collection agencies to find your new address if you move.

- Prior to taking legal action, a creditor usually sends a demand letter requesting payment of the debt to you. If payment is not made by the deadline, the letter may warn of further action.

- If you do not respond to the demand letter, the creditor may file a County Court Claim. A fee must be paid to the court and a form must be filled out. A copy of the claim will then be sent to you (as well as a claim form pack), and you have a limited time to respond.

- In the event that you do not respond to the County Court Claim, the court will issue a default judgment in favour of the creditor. A hearing may be held if you do respond. The court will issue a CCJ ordering you to pay the creditor if they find it in the creditor’s favour.

- A judgment can be enforced if you fail to pay the debt after the judgment has been issued. Generally by sending bailiffs to enforce collection.

Can they Take Your Car if it is Still Under Finance?

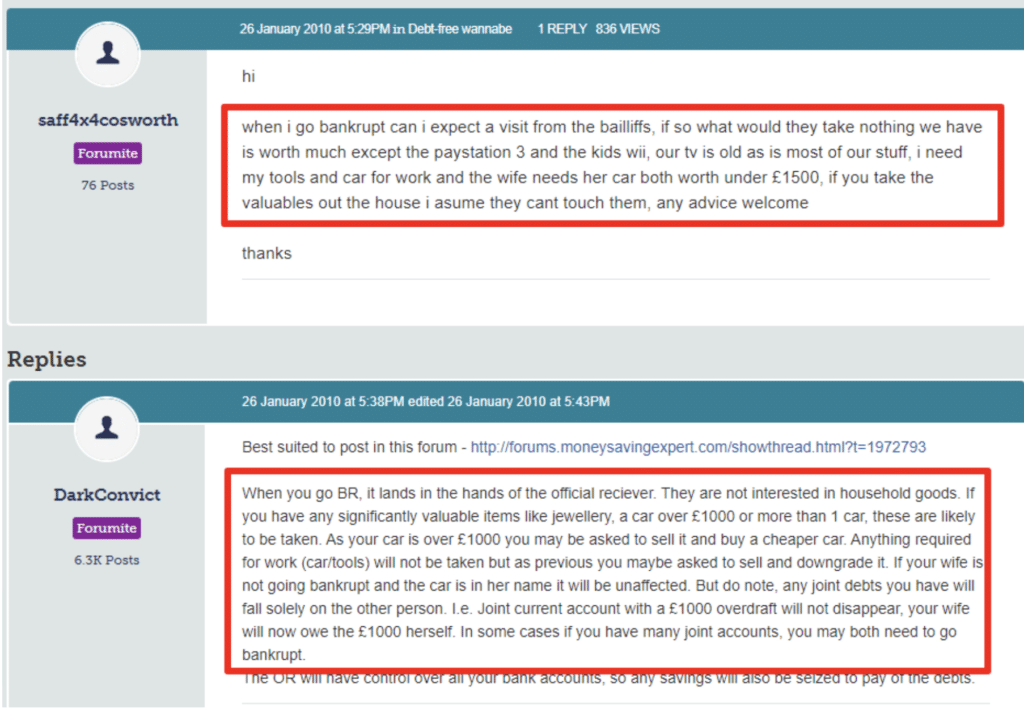

Your car can be taken by bailiffs if it belongs to you and is not exempt from being confiscated. In some cases, however, they are restricted from doing so. If your car is parked on private property or essential for your work or caring for someone else, they cannot take it.

When a car is financed, the finance company holds a legal interest in the vehicle until the loan is repaid. Therefore, technically, the car does not belong to you, but to the finance company.

The bailiff may be able to take the car if it belongs to you, rather than the finance company if a bailiff is instructed to recover a debt. It will not be possible for them to take the car if it belongs to the finance company. But you need to be prepared to provide proof that the finance company still owns the vehicle due to outstanding car finance.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Can a Bailiff Take?

A bailiff is only permitted to take goods that are owned by you, and are not exempt from being confiscated. Items such as furniture, electronics, and jewellery may fall into this category. Bailiffs cannot take some goods, such as items that are essential for your employment or fill a day-to-day need.

Does the County Court Always Sanction Bailiffs To Enforce Collection?

The County Court won’t always send in bailiffs to enforce a debt. Although this is the most common result. There are other options the court can choose, and I have listed these below.

- An attachment of an earnings order allows the creditor to take money directly from your wages.

- A charging order might be placed on your property if you own your home, which means the debt must be paid upon sale.

- If you owe a large amount of money and are unable to repay it, insolvency proceedings may be an option. This could include involuntary bankruptcy.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Dealing With a Bailiff at Your Door

You should know your rights and take steps to protect yourself if a bailiff arrives at your door in the UK. I have listed some of these steps, below.

- Make sure the bailiff has identification showing their name and the name of the company they work for. It is your right to ask for this identification before letting someone into your home.

- Bailiffs are not allowed to force entry into your home in most cases. It is not required that you let them in unless they have a warrant from the court.

- You should stay calm and polite when a bailiff arrives at your door. Aggressive or confrontational behaviour is unlikely to help and may make matters worse.

- When the bailiff says you owe money, ask for proof of the debt. Court orders and creditor letters are examples of such documentation.

- Work out a payment plan with the bailiff if you owe money. If they accept instalments, you can avoid further enforcement action.