The Cheapest Convicted Learner Driver Insurance with Points?

If you are a highrisk driver with convictions or points, finding affordable car insurance can seem daunting.

But don’t worry; you’ve come to the right place. Over 1,000 people visit our site each month seeking advice on how to navigate the insurance market after a driving conviction.

In this article, we’ll cover:

- What makes someone a high-risk driver.

- How to find the cheapest insurance even with a conviction.

- Understanding different high-risk driver classes.

- Tips to avoid paying too much for car insurance.

- Ways to reduce your car insurance costs as a high-risk driver.

Being a high-risk driver can make getting car insurance a challenge. We know it can feel like you’re stuck paying high premiums forever. But with the right knowledge, it’s not impossible to find affordable coverage.

We’re here to provide you with the information you need to make informed decisions about your car insurance. Let’s get started!

Do You Have To Tell Your Insurer About a Driving Conviction?

When you apply for a car insurance quote as a learner driver, you will be asked whether you have any unspent driving convictions. You have to answer this question truthfully. If you lie, you are committing insurance fraud, which can be a criminal offence and your car insurance would be invalid. In general, you don’t have to tell them about spent convictions.

How Does Learner Driver Insurance Work?

Learner driver insurance can be used to get short-term motor insurance to cover a driver with a provisional driving licence, so that they can use their own car for practice, or for lessons before they are ready to take their driving test. But they must be supervised by a qualified driver at all times.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Can Learner Drivers Get Penalty Points?

It is actually quite common for learner drivers, especially young drivers who are learners, to get penalty points before they have a full licence. Some of the common ways this can happen are:

- Ignoring a school crossing patrol sign and not stopping.

- Driving without a qualified and experienced driver supervising.

- Failing to stop at red traffic light signals.

- Be caught using a mobile phone while driving.

- Not obeying the statutory speed limit.

- Driving while under the influence of alcohol or drugs.

What Happens if a Learner Driver Is Caught Speeding?

Speeding is one of the most common of all driving offences that learn drivers, especially young drivers are convicted of. Speeding can be a very serious driving offence, depending on how fast you were travelling above the speed limit.

If you are given a speeding ticket and a subsequent conviction, you can expect insurance providers to see you as a much higher risk.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Can You Get Learner Insurance if You Have Points?

Finding affordable car insurance as a learner driver with points on your licence, especially if you are a young driver, is going to be something of a challenge.

However, if you are willing to pay the money, you can get provisional insurance but expect insurance premiums to be high. You may have to go to one of the specialist insurers that offer coverage to high-risk drivers, or drivers with convictions. But expect the cost of this convicted driver insurance to be very high, especially as you need a learner insurance policy as well.

Can I Get Learner Driver Insurance if I Need To Retake My Test Because of a Conviction?

Yes, with the same caveats as in the previous section. If you just need to be insured to take your test, it would probably be cheaper to find an instructor with comprehensive car insurance, who is willing to take you for your test. This is the way learner driver insurance works if you use an instructor, and this can be a lot cheaper than taking out your own convicted driver insurance.

How Do You Get Insurance With Convictions?

As I have already mentioned, you might not be eligible for an affordable insurance policy from a traditional insurer. You may need an insurance policy from one of the subprime insurers. There are many of these, and a quick Google will be able to find you plenty.

Will Your Insurance Premium Go Up Because of a Driving Conviction?

You are going to be seen as a high risk to insurers if you have unspent convictions. This will inflate the cost of your insurance by at least 100%. Having a provisional licence and unspent convictions is just not favourable to insurance firms, and the increased cost of cover reflects this.

How Much Is Learner Driver Insurance?

Monthly insurance for people with a provisional licence, ranges from around £75 a month upwards. Depending on the level of coverage required, fully comprehensive or only covering third-party risks. Furthermore, once you switch from learner driver insurance after you pass your test, you can expect your insurance costs to stay inflated for the next 5 years.

Which Convictions Affect the Cost of My Insurance?

All convictions related to passenger vehicles are going to have an impact on the cost of your learner driver insurance. However, drivers with convictions such as drunk driving, dangerous driving, serious speeding, drug driving and driving without a valid licence, and driving a vehicle uninsured for use are amongst the more serious offences that will have the most effect on the cost of coverage.

How Long Do Driving Convictions Last?

Penalty points scale based on how badly you broke the law. For example, if you went over the speed limit by a couple of miles an hour in a 30mph zone, you would generally get a minimum of 3 penalty points. But if you caused death through careless driving, you would likely get the maximum number of 11 penalty points because careless driving leading to harm is more serious than a minor speeding fine.

But the duration that these penalty points remain unspent will always be either 4 years or 11 years. This makes dealing with convicted drivers under the law very flexible. You could be given just 3 penalty points for drug driving, but they will remain on your licence for 11 years. Similarly, you could be given 11 penalty points for causing death by dangerous driving, but they would be spent in just 4 years.

What’s the Cheapest Way To Insure a Learner Driver?

The cheapest way to insure a driver who is a learner is usually to include them on a policy for the same car that another family member drives. This is a good way for disqualified drivers to lower the cost of insurance, although it will put the policy cost up for everyone else included in the policy.

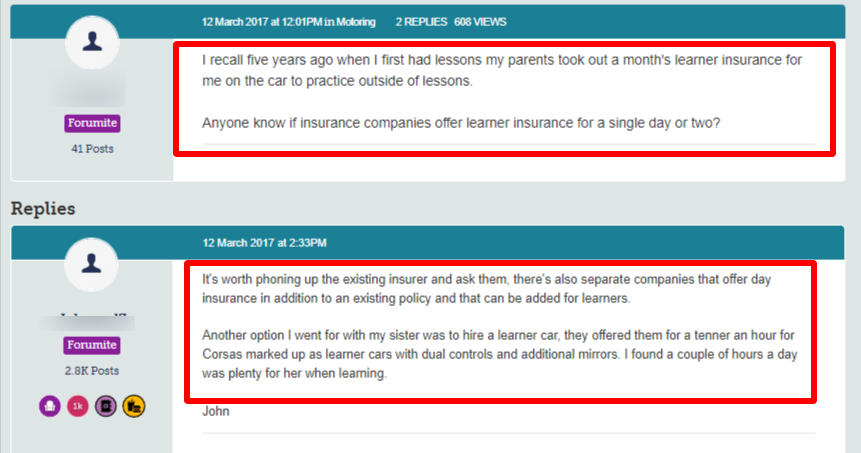

Can I Get Learner Insurance for a Day?

Many companies offer single-day motor insurance for drivers who are learners, either for driving their own car, or somebody else’s car, such as their parents. You can also get weekly or monthly new driver insurance.

Can a Disqualified Driver Supervise a Learner?

No, a person who is currently disqualified from driving cannot be the supervisor of a driver with a provisional licence who is in control of the vehicle, even if the accompanying driver is a family member. The driver would be committing an offence in this case.