How Do Penalty Points Affect Your Car Insurance?

Are you wondering how penalty points on your licence might change your car insurance? This is a common worry for many drivers. We’re here to help you understand this topic. Each month, over 1,000 people visit this blog for advice on how penalty points affect car insurance.

In this guide, we’ll explore:

- What penalty points are and how they’re given out.

- How many points it takes for your licence to be taken away.

- If points on your licence can change the cost of your car insurance.

- How to find cheap car insurance if you have penalty points.

- What happens if you don’t tell your insurer about your points.

We know that having points on your licence can be a big worry. It can be hard to know if you can still get affordable car insurance. Our team has lots of experience guiding drivers in your situation – we’re here to offer you clear, useful advice. This guide will help you understand the link between penalty points and car insurance.

Let’s dive in.

How do penalty points affect insurance?

Having points on your licence when looking for insurance can cause three problems, namely:

- Some companies might refuse you for vehicle insurance because you’re considered too much of a risk.

- Most, if not all, companies will charge you more in insurance premiums compared to someone with a clean driving record trying to insure the same type of vehicle

- Some insurers may include higher excess charges within their policy

So, why is this the case?

People with penalty points are considered somewhat riskier to insure. The insurer believes the points indicate that they take more risks on the road and are therefore more likely to be in a future road incident.

After all, this is all the information the insurer has to go on to calculate the risk. To offset some of the increased risks, they ask you to pay more. Otherwise, they simply reject you for insurance.

Do all penalty points affect insurance?

Yes, all penalty points can negatively impact the availability and cost of insurance.

Some insurers may look past the points at the exact offences to determine how much more of a risk it is to ensure you behind the wheel. But all in all, all points will negatively impact an insurance search to some degree.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How much do penalty points increase the cost of insurance?

The cost of insurance will typically increase based on the number of unspent penalty points you have on your record.

The more points you have, the greater the increase you should expect in your car insurance premiums.

Does 3 points on a licence affect insurance?

Yes, three points on your licence could increase premiums by around 5% to 10%. The exact increase will depend on the insurer.

How much does 6 penalty points affect insurance?

On average, it’s believed that having six points on your licence will increase premiums by around 25%. Again, this depends on individual circumstances and the insurer.

How much does 9+ penalty points affect insurance?

Having nine points on your licence will increase premiums by an estimated 45% or thereabouts. Any more and your insurance could double!

What happens if I don’t tell my insurer about points on my licence?

Failing to disclose unspent convictions and penalty points is serious. Your vehicle insurance policy will be void and you won’t be covered if you or any named drivers need to make a claim. This could have significant financial consequences.

Insurance offences can also make it even more difficult to get insured elsewhere.

On top of this, there have been instances when the insurer asks you to pay a lump sum to cover what your insurance premiums would have been if you had correctly disclosed your (or a named driver’s) unspent motoring convictions.

Find better convicted driver insurance deals

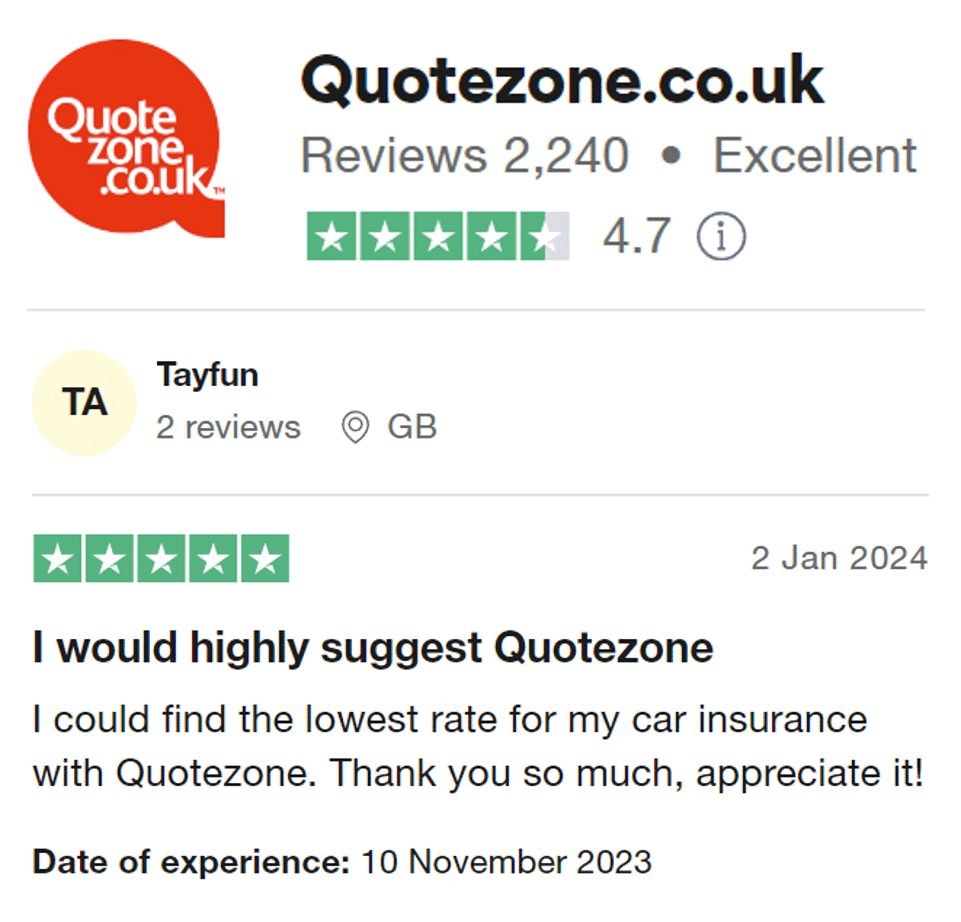

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Do points on your driving licence expire or get written off?

Penalty points on your driving record will only remain on your record for a fixed period of time. The type and nature of the offence determine how long the points stay on your licence before being automatically removed.

How long do penalty points last on your driving licence?

For lesser offences, the penalty points stay on your record for four years from the date of the offence. However, the most serious driving offences and penalty points stay on your record for eleven years, usually from the date of conviction rather than the date of offence.

Every driving conviction is identifiable through an endorsement code made up of two letters and two numbers. You can look up individual endorsement codes to find out the consequences of the conviction.

However, the driving conviction doesn’t become spent when the penalty points disappear from your record. I’ll explain this in more detail shortly…

Can you get car insurance with points on your licence?

Yes, with over 2.6 million UK residents estimated to have at least three points on their licence, you can still get vehicle insurance with penalty points.

But it’s likely that the more penalty points you have, the fewer companies there’ll be willing to offer you a policy.

Do I need to tell car insurance about points?

Depending on how long ago the driving conviction occurred, you may need to tell your vehicle insurance company about the conviction and penalty points when you apply for a policy or try to renew a policy.

You may also need to tell as soon as you receive penalty points part-way through an existing policy term, but this depends on the terms and conditions of the policy. Always ask and don’t assume when it comes to this.

How long do you have to tell insurance about points?

You must disclose penalty points to your (prospective) insurer if the driving conviction and penalty points are unspent.

These types of convictions don’t usually become spent for five years, so you will need to declare the conviction and points to the insurer for five years.

Once the conviction has become spent, you don’t need to tell the insurer about it. Some insurance providers still ask about older convictions, but it’s illegal for them to use this information to influence the policy you’re offered.

How do I check how many penalty points I have?

You can check how many points are on your driving licence by calling the DVLA or by using the online gateway to view your driving record.

You usually need your driving licence number, the postcode on your licence and your National Insurance number to access this information online.

How can I get cheaper car insurance with penalty points on my licence?

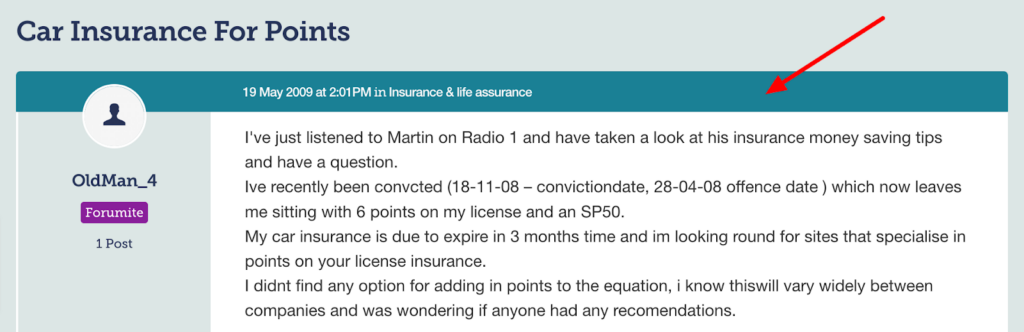

Asking how to get cheaper insurance with points on a licence is very common. It’s a frequent search on Google and it gets a lot of attention on forums.

Here is just one example of someone asking this question in their own way:

Source: https://forums.moneysavingexpert.com/discussion/1698807/car-insurance-for-points

As the forum poster suggests, there are some insurance companies that are supposedly more understanding and won’t increase premiums as much as the others.

These companies usually advertise their policies to the convicted driver market. They might do this by referring to the conviction endorsement code in their policy title, or they might simply call it high-risk car insurance.

Another top tip is to engage the services of a car insurance broker. But instead of using a standard broker, try to find one that has a proven record of helping convicted drivers get insured at a cheaper price.

Not enough motorists know about these brokers who may have industry connections and access to unseen deals.

Is there any way I can reduce my insurance premium if I have points on my licence?

Another way to potentially lower your premiums is to choose a vehicle that is considered cheaper to insure because it’s less powerful. Some of the vehicles that are often cheaper to insure are:

- Ford Fiesta

- Ford Ka

- Hyundai i10

- Renault Clio

- Volkswagon Polo

Do men have more penalty points than women?

Data released by the Department of Transport (DfT) suggests that UK male drivers have around double the number of penalty points than UK female drivers.

Ask me your question today!

Have I missed something? Let me know by getting in touch today. You’re welcome to ask your own personal question, which I may then answer in an anonymous blog to help other readers as well!