Cheapest Convicted Car Insurance After Drug Driving Ban?

Having a drug driving conviction can make finding affordable car insurance tough.

Don’t worry; you’re not alone. Every month, over 1,000 people visit our site seeking advice on car insurance after a driving ban.

This guide will help you:

- Understand what a drug driving conviction is.

- Find out how a drug driving conviction can affect your insurance.

- Learn how long a drug driving conviction can impact your insurance.

- Discover ways not to be overcharged by insurance companies after a conviction.

- Learn how much insurance costs may rise after a drug driving ban.

We know it can seem hard to find affordable car insurance after a drug driving conviction. With this guide, we’ll show you that finding affordable car insurance is not impossible, no matter your circumstances.

Does Drug Driving Affect Insurance?

Yes, all drug driving convictions that are unspent, will have an impact on both your ability to get competitive car insurance quotes and also on whether traditional insurers will want to touch you. Drug driving is a serious motoring offence and can potentially leave you with a criminal record as well.

Does Drug Driving Count as a Criminal Conviction?

A drug-driving conviction doesn’t always have a criminal conviction attached. In the same way, a drunk driving ban doesn’t always lead to a criminal conviction, but can in some cases. This is especially true when the driver has been prescribed drugs by a doctor and was found to be attempting to drive on them. The drugs themselves are not illegal. It is just driving over the specified limit that is safe that was illegal.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Why Insurers Penalise Drink and Drug Driving

The reason it is hard to find affordable car insurance after a drug driving conviction is that you are now seen as a high-risk driver. This means that insurance companies will charge you more, to offset this risk. Not all insurance companies calculate risks the same way, so being a higher risk to one firm, might not work out the same as another.

Is Insurance Void if Drug Driving?

You won’t necessarily have invalid insurance after a drug driving conviction. Not unless you are driving or attempting to drive when you have been disqualified. In this case, your insurance would be invalid.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What Convictions Do You Have To Declare for Car Insurance?

If you are looking for drug driver insurance, you need to understand that convicted drivers have to tell the insurance company about all unspent convictions. You do not have to tell the insurance provider about spent convictions, even if they ask.

How Much Does Insurance Go Up After a Drug Driving Ban?

How much your car insurance goes up will depend on the seriousness of the conviction. For example, a speeding ticket is going to have less impact on the cost than drunk driving would. However, as a rule of thumb, being caught driving while using prescription drugs or illegal drugs, will increase the cost of your car insurance premiums by at least 100%.

How Long Does Drug Driving Affect Insurance?

As you can see from the table that I added in a previous section, drug driving convictions do not become spent for up to 11 years. Your ability to get affordable insurance premiums will be impacted for this entire time.

Can You Get Insurance After Drug Driving?

Yes, you should still be able to get drug driving insurance or drunk driving insurance as long as you were not banned. But you can expect it to be much harder to find affordable drug-driving insurance.

How Long Do You Have To Declare Drug Driving to Insurance?

Convicted drivers need to declare all convictions unless they are spent, and this includes any driving disqualifications. If you fail to do this, you would be obtaining drug driving insurance through fraudulent means. Attempting to drive with insurance that is invalid could lead to another conviction.

What Type of Cover Can I Get Under a Drug Driving Car Insurance Policy?

As long as you can afford it, you can have a fully comprehensive cover. But this will likely be rather expensive. You may find it a lot cheaper to switch to third-party-only insurance.

How Can I Save Money on My Drug Driving Car Insurance?

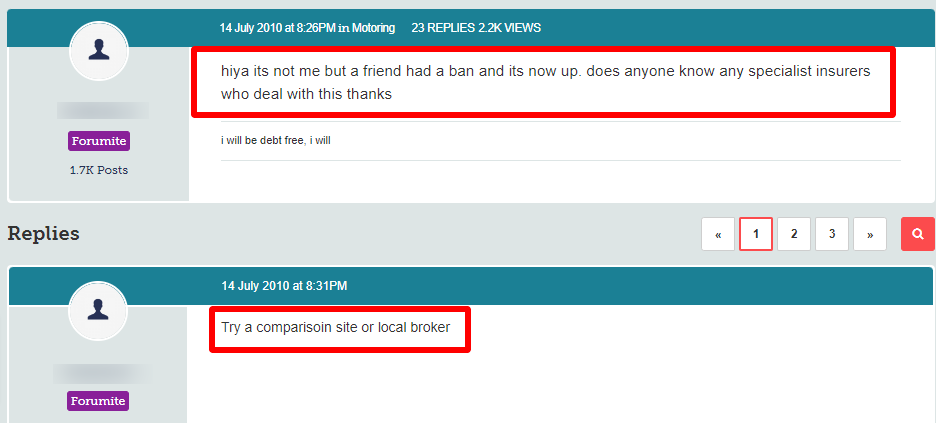

You really need to shop around to find the best deal on insurance if you have convictions. There are two good options here. Either use a comparison website or ask a broker for help. Both can make the effort of finding affordable insurance easier.

Can I Get Insurance With DR10?

A DR10 conviction is generally related to drunk driving, but it can be used for drug driving as well. A DR10 can be a very serious conviction and may result in a ban. If you are not banned but do have an unspent DR10 conviction, you can expect insurance premiums to be costly.