The Cheapest Car Insurance With Penalty Points on Licence?

When you have penalty points on your licence, finding cheap car insurance can seem really hard. But don’t worry, you’ve come to the right place. Every month, lots of people visit our site seeking advice on car insurance after they have been convicted.

Here’s what you will learn from this article:

- What penalty points are and how they work.

- How to find the cheapest insurance even if you have a conviction.

- How long penalty points last on your licence.

- The truth about car insurance prices when you have points.

- What to do if you are refused car insurance because of a conviction.

We understand your worries – finding affordable car insurance after a conviction is tough. But remember, it’s not impossible. We’ll guide you and show you the best ways to find cheaper car insurance. So, let’s get started!

Can You Get Insurance With Points?

Finding the cheapest car insurance with points on your licence is never going to be easy. But as long as you are not seen as a too high-risk driver by insurers, you should be able to get convicted driver insurance.

However, you need to be aware that in some cases, a traditional insurance company may not want to insure you at all. And in this case, you would need to go to specialist insurers that cover the subprime market and are willing to provide insurance to convicted drivers. Keep in mind though, that these specialist insurers will generally charge much more.

Does Your Car Insurance Go Up if You Get Points?

Unfortunately, if you are searching for the cheapest car insurance with points on your licence, the cost of your vehicle cover, if you have unspent motoring convictions, is going to be around 100% more.

Furthermore, drivers with penalty points on their licence can expect the cost of their vehicle insurance to remain inflated for up to 5 years.

Is Car Insurance More Expensive With Points?

As I already mentioned in a previous section, the cost of convicted driver insurance is more, because of the risk they pose. The more points you have on your licence, the higher the risk you present to an insurer. Therefore, points on your licence will, in general, always make it more difficult to find cheaper insurance.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do I Need To Declare Convictions to My Car Insurance Provider?

You have to tell your insurer about any unspent driving convictions if they ask. This is a legal requirement and you must be accurate with the information you give your insurer about the driving offences you have been convicted of.

What if I Don’t Disclose My Conviction to a Car Insurance Provider?

If you fail to tell your insurer about an unspent driving conviction that is on your driving history, or if you are not entirely truthful with the facts, your insurance would be invalid. Driving without valid insurance could lead to a further driving conviction.

» TAKE ACTION NOW: Find the best insurance for drivers with points

What Convictions Do I Need To Disclose?

You need to disclose all convictions that resulted in penalty points added to your licence, but only if they are unspent. You don’t need to tell the insurer about spent convictions.

Can I Do Anything To Lower My Insurance Premium if I Have Points?

There are a few things you can do to lower the cost of your car insurance. Such as switching to a car in a lower insurance bracket, dropping the level of cover you require, parking your car off road at night, stopping using your car for work, etc.

What Is the Best Car Insurance for Points on a Licence?

If you really are struggling to find vehicle cover you can afford as a driver with penalty points, you might want to drop the cover you require to a third-party only. This is the cheapest of all options.

What Is the Cheapest Car To Insure After a Ban?

I have listed a few cars that would be cheaper to insure as convicted or disqualified driver.

- Ford Fiesta

- Renault Clio

- Citroen C1

- Skoda Yeti

- Ford KA+

Can You Pay To Remove Points From Driving Licence UK?

If you are a convicted driver, the only way to have points removed from your licence is to wait for the conviction to become spent. In some cases, such as drunk driving, this could be up to 11 years.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What Happens if My Conviction Is Spent?

Drivers with points on their licence will have these points removed when the conviction becomes spent. This will either be four years for minor offences, or eleven years for serious offences such as drink driving.

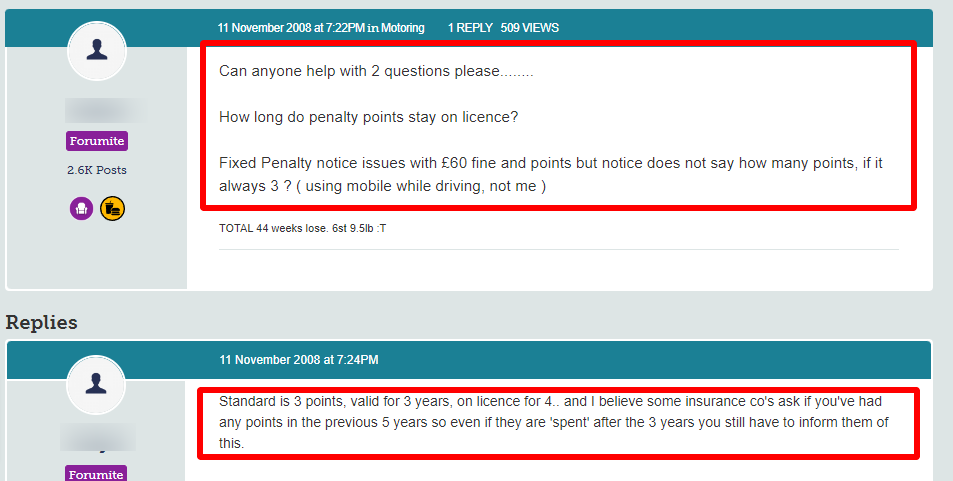

How Long Do Penalty Points Last?

Minor motoring convictions give penalty points that will stay on your licence for 4 years. More serious motoring convictions will add points to your licence for 11 years.

What Are My Options if I’m Refused Car Insurance Because of a Conviction?

If you are refused vehicle cover by every insurer you approach, your only option is to wait however many years it will be until your convictions are spent.

Can I Get Temporary Car Insurance for Convicted Drivers?

Yes, you can, but the same caveats will apply in relation to the risk you present to insurers. Even though it is only short-term insurance, you still pose a much higher risk than drivers without convictions.