How to Find the Cheapest Convicted Driver Insurance Brokers?

Having a driving conviction or points on your licence can make getting affordable car insurance seem tough.

Don’t worry; you’ve come to the right place. Every month, over 1,000 people visit our website seeking advice on this very matter.

In this article, we’ll share with you:

- Ways to find low-cost insurance, even with a conviction

- How different convictions might change your insurance

- Steps to get insurance with a conviction

- Whether insurance companies check driving convictions

- How to avoid paying too much to insurance companies

We understand the worry you might be feeling about affording insurance after a conviction or points. It may seem difficult, but it’s not impossible. Let’s dive in and find out how.

How Do I Get Insurance With a Conviction?

You can try a traditional insurer, but if you are seen as too high-risk, they may not wish to insure you at any price. In such cases, you may have to go to one of the specialist car insurance firms that offer convicted driver insurance in the subprime market. But you should be aware that your driving conviction will mean these specialist insurers will charge you more for your convicted driver’s insurance.

Do Insurance Companies Check Driving Convictions?

In general, no. If you are looking for insurance for convicted drivers and are worried whether insurers can check your convictions, they cannot. They will only know about a driving conviction that you tell them about.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do I Have To Declare Spent Driving Convictions to Insurance Companies?

No. If, for example, your conviction that resulted in a drink driving ban is now spent, you do not have to tell the insurer about it. Even if they ask you for this information, you don’t need to provide it. Put simply, if you were a convicted driver but you now only have spent convictions, you don’t need to tell the insurer about them.

Why Do I Have To Declare My Convictions?

If you are searching for cheaper convicted driver insurance, and are asked about any driving offence you were convicted for that is still unspent, you have to give this information. This is so that the insurer can calculate how much of a risk you pose as a driver. Unlike spent convictions, you are legally obliged to provide this information before they can offer convicted driver insurance.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What Convictions Will Affect My Insurance?

Unfortunately, any driving conviction will have an impact on your ability to find cheap car insurance. However, some motoring convictions are more serious than others. I have listed some of the more impactful driving convictions below.

- Serious speeding, with the speeding ticket being in band C. Or any serious contravention of statutory speed limits.

- Dangerous driving, especially dangerous driving that caused an injury or death.

- Drink driving convictions of all types, and especially a drunk driving ban.

- Driving without car insurance or a driving licence. Especially if the motoring conviction resulted in a driving ban.

- Careless driving. Especially if this resulted in a death or injury.

In short, all of the conviction codes that are given for motoring convictions will mean that you are seen as a higher-risk driver by insurance providers. And will impact your ability to get a cheap car cover.

How Much Will My Conviction Affect My Insurance Premium?

As a general rule of thumb, if you have penalty points on you your licence and any unspent convictions, you can expect the cost of your motor insurance to go up by at least 100%. Furthermore, the cost of your car insurance will be similarly impacted for the next 4 or 5 years.

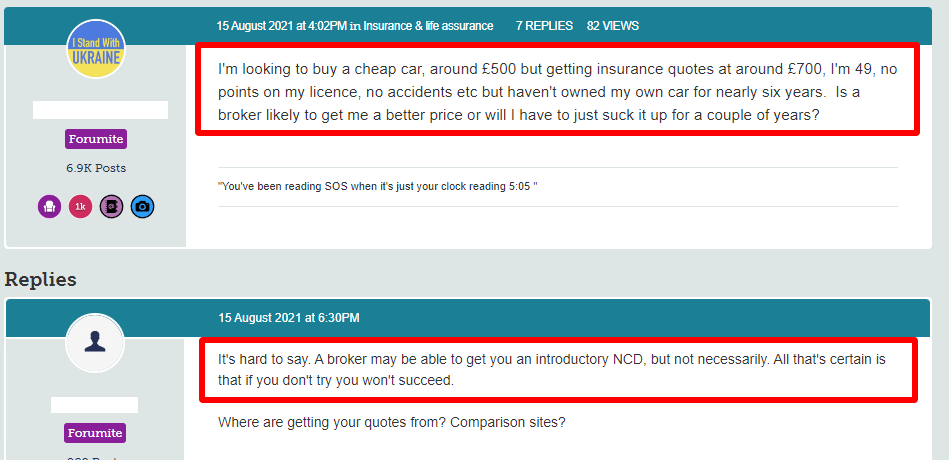

How Can an Insurance Broker Help You To Get Cheap Car Insurance?

Finding cheap convicted driver car insurance takes a lot of legwork, to get and compare convicted driver insurance quotes. However, using the services of a broker can be a shortcut to finding cheaper car insurance if you have a motoring conviction.

The broker is an insurance specialist that can deal directly with a large range of insurance providers to find you an affordable insurance policy. They do all the leg work and get multiple quotes from multiple insurers that are willing to provide insurance for convicted drivers. You can then choose the quote and insurance company that fits you best.

What Are the Advantages of Using an Insurance Broker?

Getting many quotes for car insurance for convicted drivers is going to take a lot of legwork if you do it yourself. Finding the right insurance policy at the right price is going to take effort. A broker removes much of this effort.

The broker will take your driver details, and then use them to contact all of the insurers on their panel. Getting comparative quotes for you.

Furthermore, the broker knows how insurance schemes work. They may be able to negotiate more favourable terms for you, such as a certain level of no-claims bonus to be added to the policy from the get-go.

What Are the Disadvantages of Using an Insurance Broker?

A broker may be able to help you find the cheapest convicted car insurance. But there are limits. A broker will only deal with a specific panel of insurers. This means that if there is a potentially cheaper quote for car insurance for convicted drivers from an insurer that is not on this panel, you won’t know about it.

Who Is the Biggest Insurance Broker in the UK?

There are a number of large car insurance brokers in the UK, that can help you to find cheaper insurance for convicted drivers. I have listed some of these below.

- Admiral

- Axa

- Bell

- First for Insurance

- Flux Direct

- Hastings Direct

- Ladybird Insurance

- Motor Quote Direct

- Swiftcover

What Can I Do To Find Cheap Convicted Driver Insurance?

If you are trying to find affordable cover, and you have unspent convictions, you might not want to use the services of a broker. You may wish to do all the legwork yourself. There are two main options here.

Firstly, you can contact many insurers (the more the better) and get a quote from each of them. You will have to explain your individual circumstances to each of them. Giving your driver details including your name, address, how long you have had a full driving licence, etc.

You will also have to give information about any driving offences you were convicted for, that are still unspent. This is obviously going to take some effort, and a fair bit of time, as you need to repeat the process for each insurer. Once you feel you have enough quotes, you can compare them and choose the cheapest or best of the bunch.

The second option that you have, which is far simpler, is to use a comparison website. You provide all of your driver information and details of convictions that are yet to be spent. The website will then aggregate this information to pull in comparative quotes from a vast range of insurers.

This might take a few minutes, but once the process is complete, you will be given a list of all of the quotes, and the insurer they are from. You can then look through the offers, and find the one that suits you best. Some may be cheaper, but others may be a little more expensive but have better features in the policy wording.