Where to Find the Cheapest Car Insurance for Cancelled Policies?

Having trouble finding cheap car insurance because of past cancelled policies or points on your licence? You’re not alone. Over 1,000 people visit this blog every month for advice on insurance after a driving conviction.

In this easy-to-understand guide, we’ll:

- Explain why insurance could be cancelled and the difference between non-renewed, cancelled, and voided insurance.

- Help you avoid paying too much for your car insurance.

- Show what happens if your car insurance is cancelled due to nonpayment.

- Discuss what to do if you think you might miss a payment.

- Answer common questions like “Can I drive with cancelled insurance?” and “Can insurance companies find out about cancelled policies?”

We know how hard it can be to find affordable insurance after a cancellation or conviction. We’re here to help you learn and make things easier.

What’s the difference between non-renewed, cancelled and voided car insurance?

Your car insurance policy could end in one of three ways. It could either be non-renewed, cancelled or voided.

Most people’s policies will end in a non-renewal whereby they don’t continue with the policy at its term end date, either because they stop needing car insurance or have chosen a different insurer.

Cancelled car insurance is when the policy is cancelled before it’s due to expire or renew, which might be due to payment issues. You might be within your rights to cancel the policy yourself.

On the other hand, voided car insurance is when the insurer declares the policy null and void since its beginning, possibly due to inaccurate information at the time of application.

However, lots of people refer to cancelled car insurance when the policy has been declared null and void by the insurer, so it can be difficult to differentiate between these.

In this guide, we will use “cancelled insurance” to refer to when the insurer null and voids the policy as well.

Why has my insurance provider cancelled my policy?

There are lots of reasons why an insurer might cancel your insurance policy. The most common reasons include:

- You didn’t disclose information, such as failing to tell the insurer about an unspent driving conviction. Deliberate non-disclosure is very serious.

- Instances of fraud during the application process, including the practice of “fronting”, which is where the policy is put in someone else’s name with the real main driver only named as a secondary driver.

- You haven’t kept up with your insurance premium payments

- The insurer noticed you have been driving dangerously due to the installation of a “black box” in your vehicle.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Can I drive with car insurance cancelled?

You can only drive with cancelled insurance if you have managed to secure a new insurance policy since the cancellation.

As I’ll explain below, this could be more challenging than you first realise.

What happens if your car insurance policy gets cancelled?

If your vehicle insurance is cancelled by your insurance provider, you may be asked to pay more for future insurance policies. Moreover, you might be asked to pay for your insurance via an annual lump sum payment, rather than in monthly instalments.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Can I get car insurance if I’ve had a policy cancelled?

Finding affordable insurance is more challenging when you’ve had a policy cancelled in the past, but it’s certainly not impossible.

Can insurance companies find out about cancelled policies?

There are ways for insurance companies to see if you’ve had any cancelled car insurance policies in the past, such as using the MID to check your insurance history. But regardless, you have to disclose this information yourself when you apply.

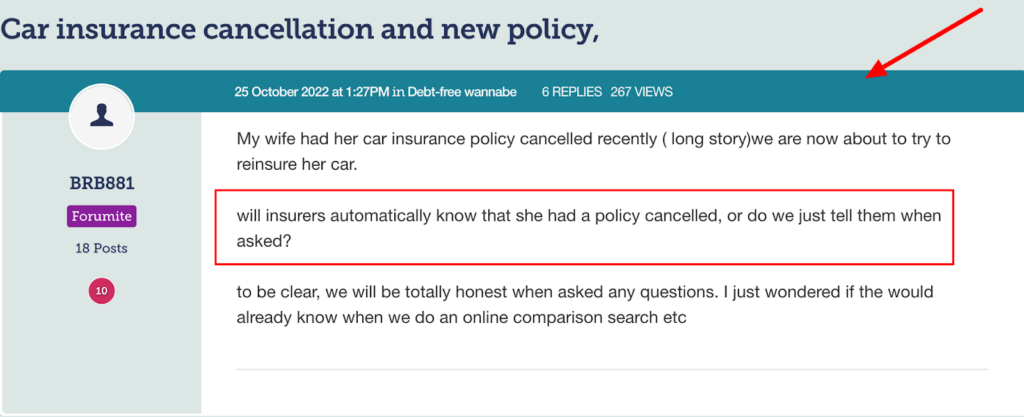

This is a hot topic online, as this forum post goes to show:

Source: https://forums.moneysavingexpert.com/discussion/6397340/car-insurance-cancellation-and-new-policy

As the poster states, it’s essential that you’re totally honest when asked. If not, you are likely to get the next policy null and void by the next insurer as well, which would make it even more difficult to get a policy in the near future – and very expensive!

What would happen if I didn’t disclose a cancelled policy to my new car insurance company?

Not disclosing a previously cancelled insurance policy when applying for a new policy is a big mistake. Not only will your insurance eventually become null and void, but you will also make it very difficult to get affordable insurance again in the future.

Instead of lying on the application, you’re better off trying to find more understandable insurance providers who won’t charge you an arm and a leg for a policy. I’ll be coming back to this topic shortly.

How long does a cancelled policy stay on your insurance?

A cancelled vehicle insurance policy doesn’t stay on your driving record, but it must always be disclosed to the insurance provider when they ask.

Some insurance providers ask this question within a set timeframe, such as the last five or ten years. If they ask if you’ve had a cancelled policy within a timeframe and you haven’t, then you don’t have to declare an older policy cancellation.

Pay special attention to the wording of these questions, or you could be committing insurance fraud by not disclosing the cancellation.

What can I do if an insurance provider refuses to insure me?

There’s nothing you can do when an insurance company refuses you an insurance policy due to driving convictions, driving bans or a previously cancelled policy.

But you shouldn’t give up hope. There are still ways to find suitable and affordable car insurance after a cancelled car insurance policy.

Cheap car insurance for cancelled policies

Away from the mainstream insurance companies, there are several insurance providers willing to insure people who have had a previous policy cancelled. Don’t expect their policies to be as cheap as you paid before your previous cancellation, but they will be more competitive than others.

To find these lenders, you may have to search for cancelled policy insurance companies – or words to that effect. These companies might not appear on insurance comparison websites, so you’ll have to independently search for them.

Read on if you need help finding the cheapest car insurance with a cancelled car insurance policy!

What happens if my car insurance is cancelled due to non-payment in the UK?

The policy won’t be active and you’ll need a new insurance provider with an active policy to start driving again.

If you missed a payment by mistake rather than due to financial problems, you might be able to call the insurer and get your original policy back. But this will depend on personal circumstances and the insurance provider.

What can I do if I’m going to miss a payment?

If you know you’re going to miss your next car insurance premium payment, you should contact your insurer immediately and let them know before it happens.

By keeping them in the loop, they may offer you a different payment plan that prevents your policy from being cancelled. Many insurers can be understanding and help you overcome the immediate problem.