CCJ Sent to Old Address – Here’s Your Defence

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a County Court Judgement (CCJ) sent to your old address and don’t know what to do? You’re not alone. Every month, over 12,000 people visit our site seeking advice on debt matters.

In this easy-to-understand guide, we’ll answer your burning questions:

- How to find out where a CCJ was issued

- If you must pay a CCJ

- How to get a copy of your credit record

- Ways to lower your repayments

- Steps to take if the claimant didn’t know your new address

We know that dealing with debt and CCJs can be scary; some of us have been there too. With our experience, we’ll guide you through this process and help you understand your options.

How do you check if you’ve got a CCJ?

I’ve listed ways to check if you’ve got a CCJ in the table below:

| Where to check | Website address |

| Registry of Judgements | https://rojof.org.uk/ |

| Credit Karma | https://www.creditkarma.co.uk/ |

| Equifax | https://www.equifax.co.uk/Products/credit/credit-score.html |

| Experian | https://www.experian.co.uk/consumer/experian-credit-report.html |

What happens if the claimant wasn’t told your new address?

A court would rule the Claim Form was correctly served if you hadn’t told the claimant about your new address.

In short, the court would deem that the claimant served the Claim Form to your usual or last known address. Therefore, it’s valid.

The CCJ would be valid and a court won’t set it aside!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What should you do if the CCJ is valid?

A court may set aside a judgment even when it is correctly served in specific circumstances.

That said, you need to show either of the following:

- There is “another good reason” for setting aside the judgement, or

- You had a good defence against the original claim

What examples of other good reasons are there?

Some good reasons for setting aside a CCJ include:

- You weren’t aware of it because the form went to an old address

- The judgement has negatively impacted your ability to get credit

- The judgement puts your employment at risk

You must act promptly when you are made aware of the judgement, otherwise, a court may not set aside the judgement.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

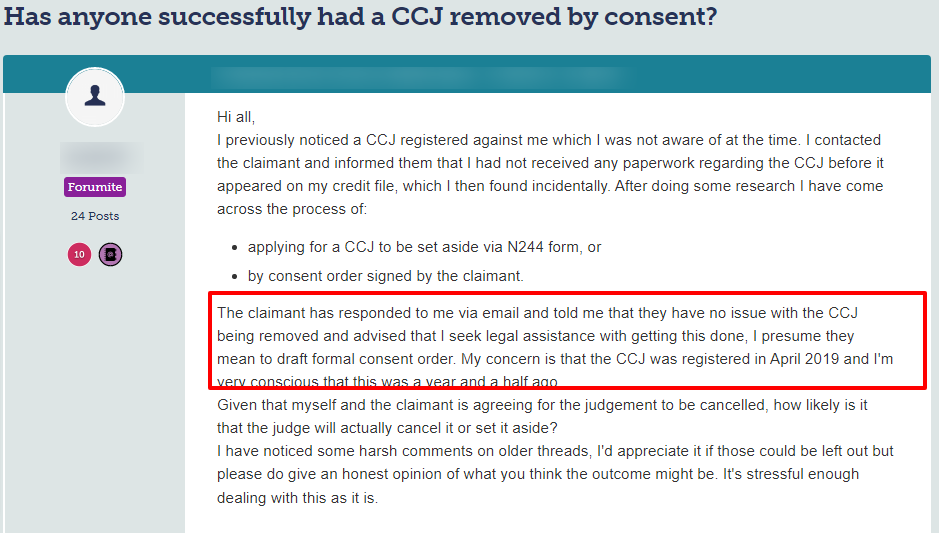

Can the claimant agree to setting aside a CCJ?

Another consideration is whether the claimant would agree to the judgement being removed.

If so, the claimant simply needs to sign a ‘Consent Order’ and then send it to the court.

It’s worth noting that a Consent Order may need endorsement by the court.

Check out the question one person asked on a popular forum about a claimant consenting to setting aside a CCJ.

Source: Moneysavingexpert

What happens when a CCJ is set aside?

The record of the CCJ is removed. Plus, no record of it will appear which means it’s as if the CCJ was not issued at all.

What are the chances of a CCJ being set aside?

The chances of a judgement being set aside (removed) from your credit file depend on several things.

A court would want to consider whether a Claim Form was served correctly for starters. In most instances, a Claim Form should be served on the defendant.

As such, specific steps must be taken which is a court rule requirement when serving Claim Forms.

This is important because the form lays out why you’re being served.

The rule laid out by the courts is that a Claim Form must be posted to your usual or the last known address!

As such, if you prove the claimant was aware or should have known you had moved, a court could rule that the Claim Form was in fact, never served!

In legal terms, it means the judgement is ‘irregular’ and it must be set aside.

Should you contact the Court?

Yes. You should get in touch with the court as soon as you realise that a CCJ is registered against you.

Armed with the right information and having checked your credit file, contacting the relevant court is essential.

The County Court Business Centre issues most CCJs. However, some judgements are not issued by CCBC.

In this case, you can check which court issued it by using the Government Tribunal Finder service.

Can a court find your file?

Yes. The court will find your file once you provide all the information you’ve found out about the CCJ you didn’t know existed.

You can then ask the court to email you the following:

- Which address was used to send the Claim Form

- The claimant’s name

- The date the claim was served

- The claimant’s solicitors if applicable

- The details of the claim

How do you find where a CCJ was issued?

You can find out where a CCJ was issued by checking the registry of judgements. It will tell you when the judgement was recorded against you and where it was sent.

Should you seek legal advice?

Yes. You may want to seek legal advice once you’ve got all the relevant information about the CCJ.

The advice you receive will help determine whether you could have the judgement removed from your credit file.

What would a solicitor need to know?

You’ll have to provide all the details of the claim and any other information you have regarding your change of address.

This should be around the same time as the judgement was issued.

The solicitor should then be in a position to offer you advice on the following:

- The chances of having your judgement successfully set aside (removed)

- If your case is weak in any way whether it can be put right

- The practical and legal steps you should take next

CCJ sent to old address, what should you do? RECAP

You should find out asap when the CCJ was served and which court issued the judgement. You can do this in two ways. First, check your credit file. Second, check the registry of judgements.

Next, you should contact the relevant court to get more information about the claim against you. You can then decide whether you should seek legal advice.

A solicitor will tell you if there are grounds for a court to set aside the CCJ or not!