Should I Pay Zinc Group Debt Recovery?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried after getting a letter from Zinc Group Debt Recovery? It can be scary to deal with debt collectors, but don’t worry, help is at hand. Every month, over 12,000 people seek advice on this site about dealing with debt.

In this article, we’ll help you understand:

- Who Zinc Group Debt Recovery is and why they might be contacting you.

- If you really need to pay Zinc Group Debt Recovery.

- How you can possibly lower your repayments.

- What to do when you receive a Zinc Group Debt Recovery letter.

- What happens when a debt is too old to be collected.

We understand how hard this can be, as some of our team members have faced the same worry. They’ve had to deal with debts and didn’t know what to do. Let’s dive in and learn more about how you can handle Zinc Group Debt Recovery.

How should you deal with a Zinc Group Debt Recovery letter?

Zinc chases you for a debt or unpaid invoice on behalf of the original creditor. So, when you get a letter from the debt collector, you may not recognise the name. The way to respond to a Zinc Group letter demanding payment is to:

- First, check how old the debt is. If the debt is at least 6 years old, it can’t be enforced. Neither can you be taken to court for not paying because the debt is statute-barred

- Second, if the debt isn’t statute barred, ask Zinc Group to prove you owe the money. You have every right to ask a debt collector to prove the debt is yours. They can’t just tell you that you owe the money

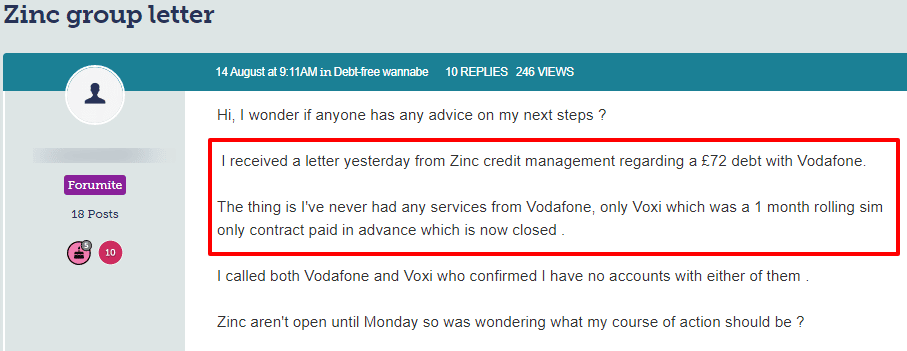

Take a look at what happened to one person Zinc Group contacted:

Source: Moneysavingexpert

Can you ask Zinc Group to prove the debt is yours?

Yes. You have every right to dispute a debt when you know it’s not yours. For instance, Zinc Group or the original creditor may be chasing the wrong person. Maybe it’s due to an admin error, or maybe your name is very similar to someone else’s name.

Whatever the reason, debt collectors must provide you with authenticated evidence that you owe the money. If they can’t, you won’t have to pay them.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens when Zinc proves the debt?

You may have to pay if Zinc proves the debt is yours. However, you should seek advice from one of the debt charities if you’re at all concerned about anything. This includes if you feel you’re being harassed or bullied in any way by the debt collector.

Moreover, getting advice from one of the major debt charities could be of great help when negotiating an affordable repayment plan.

Debt collection agencies have a legal obligation to allow you the time to seek advice and to find out about your best option!

Do not admit, sign, agree to or pay anything to the debt collector before you’ve sought advice!

» TAKE ACTION NOW: Fill out the short debt form

Should you ignore Zinc Group Debt Recovery?

No. Even when the debt is too old to be enforced or it’s not your debt, don’t ignore Zinc Group letters. Why? Because the original creditor could still take you to court.

You could be held responsible for a debt that belongs to someone else and not even knows it!

Furthermore, you could also be missing out on the following:

- Finding out the debt is yours but it’s statute barred

- Discovering you owe the money but the debt collector can’t prove It

- Having some of the debt wiped off

- Being offered an affordable repayment schedule to pay off the debt

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can Zinc Group Debt Recovery do?

There are actions a debt collection agency can legally do and things they can’t legally do.

A debt collector can legally do the following:

- Contact you over an alleged debt whether in person, by phone, or by letter

- Talk to you civilly with understanding about an outstanding debt

- Ask you to pay them directly

The things a debt collector can’t legally do are listed here:

- They can’t threaten or harass you

- Pretend they are court-appointed enforcement agents (bailiffs) which is a criminal offence

- Use documents that seem to be court issued when they aren’t

- Talk to your family members, friends, neighbours or employer about your alleged debt which breaches privacy laws

- Visit you where you work

- Force their way into your home

- Clamp your vehicle or seize your possessions

- Use confusing legal terms

- Urge you to take out another loan to pay the debt you owe

Can you stop Zinc Group Debt Recovery from contacting you?

No. But you can dictate when and how you want to be contacted. For example, you could write to the debt collector informing them you only want to be contacted by letter.

Debt collectors must respect these wishes or it could be seen as them harassing you which is illegal!

How do you contact the Zinc Group Debt Recovery?

I’ve listed the Zinc Groups’ contact details here:

| Telephone | +44 (1789) 273149 |

| Fax | +44 (1789) 405 065 |

| Address | Kings House 4 Elm Court, Stratford Upon Avon, CV37 6PA, United Kingdom |

| [email protected] | |

| Website | https://www.wewanttosayyes.co.uk/ |