Should I Pay Rundles Bailiffs Debt Collection or Appeal?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a letter from Rundles Bailiffs Debt Collection can feel scary. You may be asking yourself, should I pay or should I appeal? We’re here to help answer these questions.

In this article, we’ll cover:

- Who Rundles & Co Bailiffs are and why they might contact you.

- How to know if the debt they claim you owe is actually yours.

- What you can do to lower your repayments.

- What powers Rundles & Co have and what they can legally do.

- How to effectively deal with a visit from Rundles Bailiffs.

We understand that dealing with debt collectors can feel overwhelming, but you’re not alone – every month, over 12,000 people come to us for guidance on dealing with debt issues.

Our team is experienced and empathetic, as some of us have been in your situation before. We know the worries and fears you may be facing. But with the right information, you can handle this situation effectively. So, let’s take a closer look at how to deal with Rundles Bailiffs Debt Collection.

Why would Rundles Bailiffs contact you?

As mentioned, Rundles Bailiffs will contact you over an unpaid debt. For example, you may have ignored previous letters from a creditor who then sold the debt to Rundles & Co.

If you ignore a court summons to attend a hearing, a judgement is levied against you by default. The result? A County Court Judgement (CCJ) on your credit file and an impending visit from enforcement agents!

Namely, a Rundles enforcement officer!

Once the bailiff contacts you over an unpaid debt, it’s much wiser to respond within 7 days of receiving a notification from Rundles & Co!

That way you find out why they are contacting you and who you owe the money to if you actually do owe anything.

In short, you should ask them what debt they are chasing you for. For example, maybe you owe money to:

- A business, organisation or some other person

- HMRC over a tax overpayment or unpaid tax

- A payday loan company or credit card provider

- The court for defaulting on a court fine

In most instances involving enforcement officers (bailiffs), any action they take can only happen following court action. This could be a hearing held in any of the following courts:

- A magistrate’s court

- A High Court

- A County Court

However, this depends on the sort of debt that Rundles Bailiffs is chasing you for. Also, as Rundles purchases debts and therefore owns them, they are more likely to start court proceedings against you!

Who do Rundles Bailiffs collect debts for?

Rundles & Co Bailiffs has a long list of clients which includes the following businesses, organisations and local authorities:

- Utility providers like United and Npower

- Mobile phone companies which include EE, Virgin Media and O2 for example

- Local councils over unpaid parking fines and outstanding council tax

Should you pay the debt?

When Rundles & Co Bailiffs confirms the debt is yours and they’ve shown you all the right documentation, you’ll have no choice but to pay.

This provides several advantages which include:

- You’ll no longer be contacted by Rundles & Co

- No further action will be taken against you

Make sure you get an official receipt for the payment or payments you make to the bailiffs.

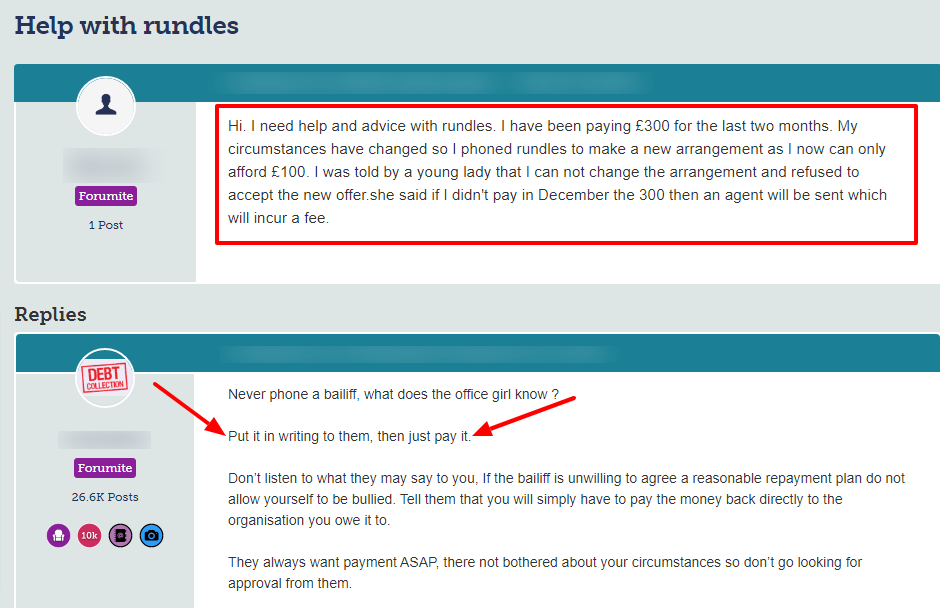

If you can’t pay the full amount owed, try to set up a repayment schedule with Rundles & Co who should be willing to do this. But if you can meet a payment at any time, you must let Rundles know as soon as possible.

Otherwise, a repayment plan could be cancelled and you’d have to pay the full amount in one go.

Check out what happened to one unfortunate person who had dealings with Rundles:

Source: Moneysavingexpert

What help is there when dealing with Rundles & Co Bailiffs?

There is plenty of debt help available in the UK, more especially from charities that provide free debt advice. It’s a great place to start when you want to find out how to get out of debt.

There are also independent debt management companies but you’ll have to pay for their services.

That said, you could consider any of the following:

- An Individual Voluntary Arrangement (IVA) which applies in England, Wales and Northern Ireland. All your debts are combined and you pay one affordable monthly payment with a chunk of the debt eventually being written off

- Debt management is also another option but would depend on your circumstances. If your situation permits you could enter into a debt management plan, consolidate your loans and if necessary arrange bankruptcy. However, you should seek professional advice first

I’ve listed some of the debt charities that offer free advice in the table below:

| Charity | Links |

| Citizens Advice | https://www.citizensadvice.org.uk/debt-and-money/ |

| StepChange | https://www.stepchange.org/contact-us.aspx |

| National Debtline | https://nationaldebtline.org/ |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is the debt too old to enforce?

Some purchased debts are too old to enforce. So it’s always worth checking the age of the debt before responding to Rundles & Co.

When a debt is 6 years old and specific criteria are met, it’s no longer enforceable because it’s statute barred.

For example, if the following apply you may not have to settle the debt:

- You didn’t admit owing the money in the past 6 years

- You weren’t in contact with the original creditor in the past 6 years

- There’s no existing county court claim relating to the debt

What if the debt isn’t yours?

One very good reason for responding to Rundles Bailiffs sooner rather than later is to establish the debt is actually yours. Mistakes happen whether because of a clerical error or because the debt belongs to a person who no longer lives at your property. Or maybe the real debtor’s name is very similar to yours.

You should call Rundles Bailiffs as soon as possible to let them know they’re contacting the wrong person. Tell them that you’ll send proof the debt isn’t yours and that it belongs to someone else.

Rundles Bailiffs should stop any further action until they receive the proof. They must respect this request and look into your case in a timely manner.

What if Rundles Bailiffs pressure you into paying a debt that’s not yours?

If Rundles Bailiffs pressures you into paying a debt that’s not yours, it could be deemed harassment.

In short, you can’t be made to pay if:

- The debt is someone else’s but their name is similar to yours

- You already settled the debt in full

Enforcement agents cannot pressure you into paying a debt you don’t owe. If they do, it could be seen as harassment which is against the law. You could claim compensation for the distress this may have caused you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if you ignore Rundles & Co Bailiffs?

It’s never a wise move to ignore Rundles & Co Bailiffs because as mentioned, they are incredibly persistent. Just because you don’t respond to them, it doesn’t mean they’ll simply go away. And neither will the problem vanish!

Moreover, you’d miss out on establishing important things. This includes whether the debt is already settled or that it belongs to another person if you don’t respond!

Eventually, you’ll have to deal with things and could find that the original debt has increased making it harder to settle.

Enforcement officers will add their fees and other costs to the debt which include:

- The cost of sending you an enforcement notice (compliance) is £75

- The cost of visiting your home (enforcement) is £235

- The cost of selling your possessions (sale of goods) is £110 – or 7.5% for anything over £1,500

In short, it’s wiser to respond to Rundles & Co Bailiffs rather than ignore them. Even if the debt isn’t yours or you’ve already settled it!

What powers do Rundles & Co have?

As accredited enforcement agents, Rundles & Co Bailiffs have certain legal powers when it comes to debt recovery. That said, as a debtor, you also have specific rights which bailiffs must respect!

As mentioned above, Rundles Bailiffs have the right to visit you at home if all other methods to contact you fail. They can also force entry into your home to collect the following:

- Unpaid criminal fines

- Unpaid Income Tax

- Unpaid Stamp Duty

However, bailiffs can only force their way into your home for the above debts as a last resort!

Enforcement officers from Rundles can visit you at reasonable times of the day but not after 9 pm or before 6 in the morning! They can’t enter your home through windows either.

Also, when you refuse entry to a bailiff, they have the right to seize any of your possessions found outside your home. For example, they could take possession of your vehicle!

That said, bailiffs cannot attempt to enter a property if only vulnerable people are home, or when the only people present are under 16 years old.

Bailiffs do have the right to ‘take control of goods and sell them to recover the money owed, their costs and fees!

New laws also allow bailiffs to look through a window and note down anything they see which could include televisions and other equipment typically found in a living room.

It’s always a good idea to keep the curtains shut if you’re expecting a visit from bailiffs for this reason!

Can Rundles Bailiffs just turn up at your door?

No. Enforcement agents can’t just show up at your home. They must send you a notice of an intended visit at least 7 days before they do. This gives you enough time to prepare for their visit!

That said, you might want to settle the debt to stop this from happening! But not before you seek debt advice from one of the charities on independent debt advisers!

What can you do if Rundles & Co seize your possessions?

If you let Rundles enforcement officers into your home and they seize possessions, you may still be able to have the items returned to you.

The quickest way to achieve this is by settling the debt straight away before the items are sold. You might not be in a position to pay the full amount, but Rundles may agree to setting up a repayment plan.

Another option is to buy the items back yourself!

Moreover, if Rundles & Co Bailiffs failed to follow the correct procedure in entering your property when seizing your goods, you could get your possessions back.

If you’re unsure how to do this, Citizens Advice provides essential support which is free of charge!

How do you deal with a Rundles Bailiffs visit?

When enforcement officers from Rundles visit you at home, you’re not obliged to let them into your property. Even if they say that you do!

Moreover, you should ask them to produce all the paperwork relating to the alleged debt and the court order to recover it. When a bailiff can’t produce the right documentation, you should ask them to return with the right paperwork at a later date.

Also, you should ask the enforcement agents to show you their identification to prove they have the authorisation to enter your home. The sort of ID they may produce could include:

- Their ID cards or badges showing that they work for Rundles Bailiffs

- A breakdown of the debt you allegedly owe including the total cost involved

- A Warrant of Recovery or documentation showing they are authorised to enter your home

In very extreme cases, enforcement agents may use the services of a qualified locksmith to gain entry into your home. They cannot break the door down! Plus, if they cause any damage, they must put things right.

Unfortunately, the cost is added to the money you owe!

If you’re anxious about opening a door to an enforcement officer, you have the right to ask them to push the paperwork under the door or through your letterbox.

This allows you to check all the details and whether or not the debt is too old to enforce!

You have the right to ask the enforcement agents to leave your property if they cannot produce adequate proof. That said, you should then contact Rundles & Co head office as soon as possible to reschedule a visit or pay the debt!

Can you complain about Rundles?

Yes. If you feel a Rundles enforcement officer acted improperly or unlawfully, you have the right to file a complaint.

First, file a complaint with Rundles & Co’s head office. Allow them the time to respond which they must do in a timely manner.

If you feel they are not treating your complaint to your satisfaction, you can escalate your complaint to the Financial Ombudsman Service (FOS). The FOS will investigate your complaint.

How do you contact Rundles & Co Bailiffs?

I’ve listed Rundles and Co’s contact details in the table below:

| Website | rundles.org.uk |

| By telephone | 0800 0816000 |

| Via email | [email protected] |

| In writing by post | Rundle & Co. Ltd. 53 Northampton Road, Market Harborough Leicestershire, LE16 9HB |

| Payment options | Online, in person, by telephone, by bank transfer and more |

| Opening times | 8 am to 6 pm on weekdays8 am to 12 pm on Saturdays |