How Much is Car Insurance After a Revoked Licence?

Having your licence revoked can be a real worry, especially when thinking about car insurance afterwards.

But don’t worry, we’re here to help. Every month, over 1,000 people visit this site seeking advice on insurance after a driving conviction.

In this article, we’ll guide you through:

- Understanding ‘Revoked Licence’ and why your licence might be revoked.

- The difference between a revoked licence and a driving ban.

- Finding affordable insurance with a conviction.

- What to do when your licence is given back.

- The impact of medical conditions on your ability to drive and insure your car.

We know how tough it can be to find affordable insurance with a conviction. But, we’ll show you that it’s not impossible.

Let’s get started!

Is a Revoked Licence the Same as a Ban?

No, having your licence revoked is not the same thing as a driving ban or being disqualified from driving. When you are banned from driving, it means you are a convicted driver. And you were disqualified either for getting too many penalty points on your driving record, or you committed a serious driving offence that was cause for a ban outright.

When You Get Your Licence Back, Will It Be Harder To Get Insurance?

Depending on the reason your licence was revoked, it may be more difficult to get cheap car insurance once you get it back. Let me explain a few scenarios here.

- Your licence was revoked due to some form of fraudulent or criminal activity. In this case, an insurance company would see you as a higher risk.

- Your licence was revoked because you failed to meet licencing criteria. In this case, you should be able to get your valid license back, once you do meet the criteria. This should have no impact on your ability to get cheap insurance.

- You had your driving license revoked for medical reasons. In this case, once those medical problems are resolved, you will get your full licence back. Insurance companies would not see you as a higher risk, and there should be no increased cost.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What Happens if My Driving Licence Is Revoked?

If the DVLA decides to suspend or revoke your licence, either a full licence or a provisional licence (whether you have passed your driving test or not, the suspension starts straight away. You cannot continue driving once you have been notified that it has been suspended, and driving on a revoked license could lead to a driving conviction.

The DVLA will send you a letter, telling you that your licence has been revoked or is being suspended. Within this letter, will be the reason for your licence being taken away.

Note though, that your licence being suspended is just a temporary measure, and is not intended as punishment. It simply gives the DVLA the time they need to investigate the case further, and decide whether to revoke your licence completely.

Will You Have To Pay More for Insurance After You Get Your Licence Back?

Refer back to the previous section for a moment. The first of the three scenarios would definitely have an impact on your ability to find affordable car insurance. However, the last two scenarios cover events that are very likely out of your control. And in most cases, you would find that an insurance company would not see you as any higher risk, and the cost of your car insurance would not go up.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What Happens if You Get Caught Driving With a Revoked UK Licence?

If your licence has been taken away by the DVLA, continuing to drive could lead to a serious driving conviction. Once you got your licence back, this conviction would still be unspent on your new licence. Convicted drivers generally have to pay more for their car insurance.

How Does a Revoked Licence Affect Insurance in the UK?

If your licence has been either suspended or revoked, then you cannot get vehicle coverage or car insurance at all. No insurance firm is going to even give you a quote.

What Can I Do if the DVLA Revokes Your Licence?

If the DVLA has revoked your driving licence, you can appeal against this decision. You need to start this appeal within 6 months of the date your licence was taken away. You begin the appeal by contacting your local Magistrates Court.

If your licence was taken away due to a medical condition, you will need to provide medical evidence that you no longer suffer from this condition. You can also explain why you believe that the DVLA’s decision to take your licence away was wrong.

What Should I Do if My Licence Is Revoked or Expires?

If your licence is due to expire during the time it is revoked, you don’t need to worry about this. At the end date of the revocation, the DVLA will send you a form to complete and return to them. You will then be sent a new licence.

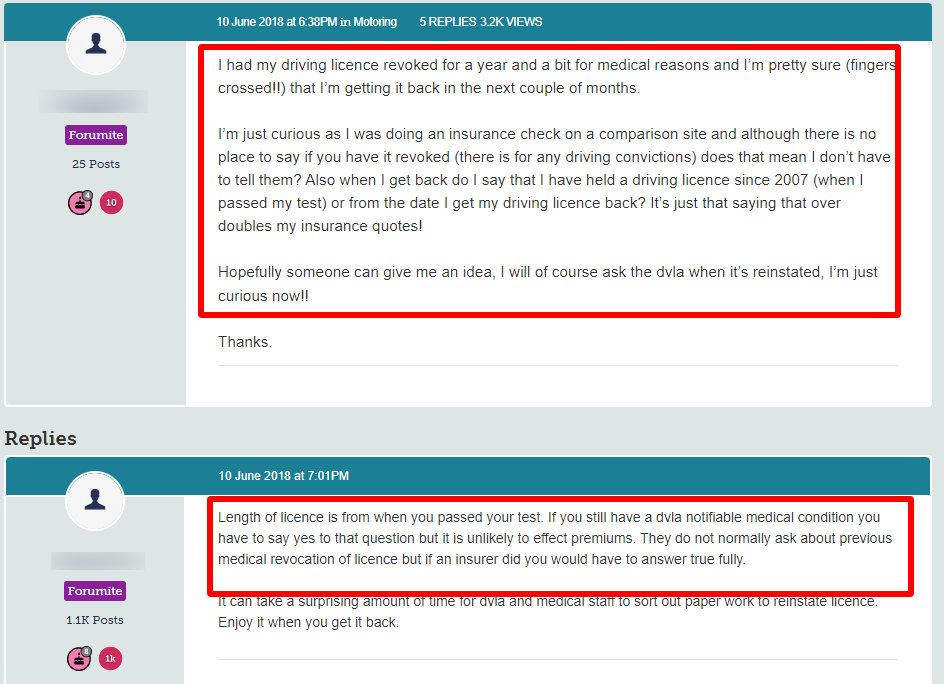

Do Insurers Check Your Licence?

No, an insurance firm will not check with the DVLA to find out if you have a valid licence. The onus is on your to deal with the insurer truthfully. If you don’t, and you obtain insurance through fraudulent means, you could face a criminal conviction.

When Could Your Driving Licence Be Revoked?

Your licence can be taken away at any time. If the DVLA believes you are not fit to drive a vehicle, they can revoke your licence for all of the reasons I have covered so far in this post. The DVLA does not need to give you any warning that your licence is going to be suspended/revoked.

What Happens if You Drive With a Revoked Licence?

Driving without a licence is deemed a serious motoring offence. If you were to be pulled over and given a speeding ticket, the police will check your licence. They will learn from the DVLA that it is revoked, and would then issue a further conviction.

What Medical Conditions Can Stop You From Driving?

There are certain medical problems and illnesses that you have to tell the DVLA about if you suffer from them. These could be reasons to take your licence away. Some of these conditions are listed, below.

- You are diabetic and take insulin.

- You suffer from fainting (syncope).

- You have a heart condition (including having a pacemaker fitted).

- You suffer from sleep apnoea.

- You have epilepsy.

- You have had a stroke.

- Your vision is impaired (glaucoma for example).

What Conditions Do I Need To Disclose?

All of the medical problems I listed in the previous section need to be disclosed to the DVLA once you have been diagnosed with them. However, you should consider contacting the DVLA if you are diagnosed with any illness with symptoms such as::

- Reduced eyesight.

- Impaired memory.

- Ability to move your limbs.

- Any form of paralysis.

- Diseases with severe symptoms.

What Happens After I Notify the DVLA of My Condition?

Once you tell the DVLA about your illness or health issue, it will make a decision based on how badly your ability to drive has been impaired. You may need to provide medical evidence at this stage.

Driving With a Medical Condition: Licences & Insurance

In the previous two sections, I covered health issues that may be a cause to have your licence taken away. If it is, and you continue to drive before you get your licence back, you are committing an offence.

However, once you get your licence back, insurers will not need to be told that your licence was revoked due to medical grounds. And you can count the time your licence was taken away as years since you passed your test.

Driving a Car Adapted for Disabled Drivers

In some cases, you may be able to retain your licence if you can prove to the DVLA that you are fully capable of driving a car that has been modified for use for people suffering from your medical condition. You would likely have to go to a specialist insurer for your vehicle insurance in this case.

You may find that you have to go for a driving assessment to prove that you can indeed control a modified vehicle.

What To Do if Your Licence Is Revoked Due to Medical Grounds

If your licence was taken away due to medical reasons, you can contact the DVLA to have your licence returned, once you can prove that you no longer suffer from the medical problem that caused it to be revoked in the first place. Be prepared to present medical proof that you are now fit to drive, before the DVLA will return your licence to you.