Do I Have to Pay PayPal Debt Collection?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying PayPal debt collection? You might feel nervous about how this will change your day-to-day life, or you could be wondering if you have any rights in this situation. You might even be worried that this is all a big scam.

If these thoughts are running through your head, you’re not alone. Every month, this site is visited by over 12,000 people who are looking for guidance on debt matters.

In this article, you’ll find answers to your questions:

- What is PayPal, and how can you end up in debt with them?

- Can you make your repayments smaller?

- Does PayPal add extra fees to a negative balance?

- Can PayPal Credit get you into debt?

- How does PayPal handle debt?

Our team knows how hard it can be to owe money; some of us have been in your shoes. So, we know how to help you.

Ready to learn more about dealing with PayPal debt collection? Let’s dive in!

How could you end in debt with PayPal?

Going into debt with PayPal is relatively easy. All it takes is to lack funds in both your PP account and your bank account. For example, you pay for something with PayPal but there’s not enough money in the account.

PayPal tries to draw money from your linked bank account but there’s not enough money in it to complete the transfer. The result? Your PayPal account shows a negative balance when you don’t have enough money in your bank account to cover the missing amount!

In short, suddenly you owe money to PayPal which triggers PP fees and a letter telling you to add funds to your PP account.

But there are other ways you could fall into debt with PayPal which I’ve listed here:

- A claim is started against you via the PayPal platform. It happens when you sell something and the buyer pays using PayPal. If they’re dissatisfied with the purchase and you don’t sort it out, the buyer raises a claim against you. When it happens, PayPal puts the amount on hold until the matter is sorted out. It can leave a negative balance on your PayPal account

- A bank transfer payment you receive on your PayPal account is reversed leaving you with a negative balance

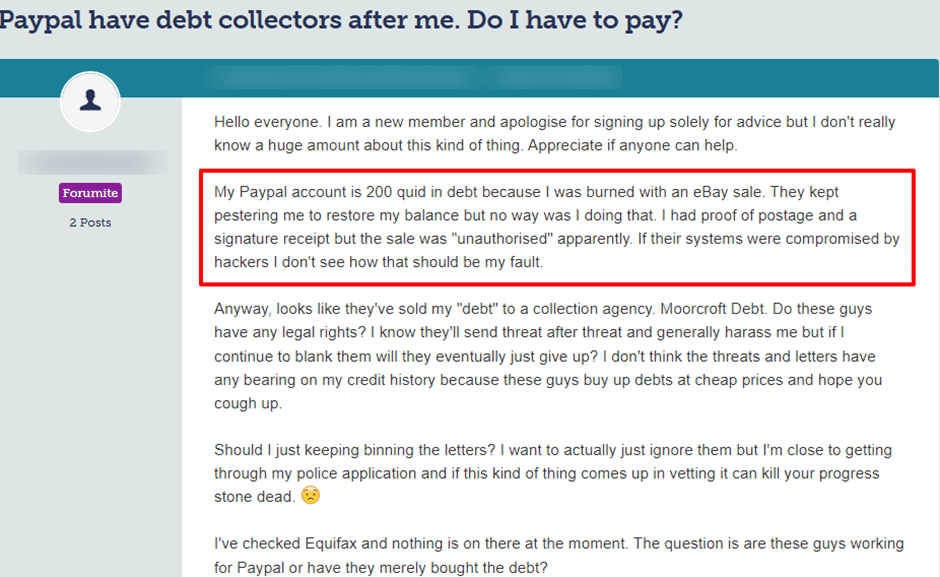

Here’s an example of how one person got a negative PayPal balance:

Source: Moneysavingexpert

Can PayPal Credit get you into debt?

Yes. You could run into debt when you run up a hefty balance on PayPal Credit and can’t meet monthly payments. PayPal Credit is a credit card without the actual physical card! It lets you buy things online just like a traditional credit card.

Late payment fees can soon add up and at £12 for each missed payment, the debt increases!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How does PayPal treat debt?

When you fall into debt with PayPal, you’re given 90 days to contact them and if possible, sort things out. When you don’t get in touch or pay the debt, PayPal could send your details to a debt collection agency!

Don’t ignore PayPal when they get in touch with you over a negative balance. It’s far wiser to stay in touch and sort things out so you achieve a better outcome!

Remember, PayPal gives you 90 days to sort things out and if you’re really struggling to pay, contact a debt adviser sooner rather than later.

Does PayPal add fees to a negative balance?

Yes. PayPal adds fees to your account when there’s a negative balance. These fees can soon add up when you’re unable to add funds to your account. Moreover, if you have any ongoing payments to people from your PP account, these could still be taken!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Which debt collectors does PayPal use?

PayPal could use a debt collection agency to recover a debt. Or they may sell the debt to a debt collector. The two agencies that PayPal typically uses are:

- Wescot Credit Services

- Akinika

Both debt collection agencies are regulated by the Financial Conduct Authority (FCA). So, in short, there are things they can and cannot do when they contact you over a PayPal debt.

What should you do when PayPal Debt Collectors contact you?

Don’t ignore any letters you get from debt collection agencies that are chasing you for a PayPal debt. It’s easy to bin the letters but it doesn’t make the problem or the debt collector from going away!

Debt collectors are notoriously persistent. Plus, you miss out on the following:

- Discovering they got the wrong person and the debt isn’t yours

- Finding out the debt is statute-barred and therefore unenforceable

- Being offered an affordable repayment plan to resolve the debt

- Having part of the debt wiped off

You could also have to deal with the following when you ignore things:

- Being taken to court

- Receiving a CCJ on your credit history

- Being reported to credit bureaus

- Having enforcement agents (bailiffs) come to your door

Ask the debt collector to prove the debt is yours before you admit, sign or pay anything to them! They are obliged to prove you owe the money by providing solid proof.

You shouldn’t just accept their word for it!

Can debt collectors just turn up?

Debt collectors can legally visit you at home. However, they can’t visit you at work. Also, they should give you advance notice before they show up. So, don’t ignore a letter from a debt collector telling you they plan to visit you.

How do you contact PayPal?

I’ve listed PayPal’s contact details here:

| Company website: | https://www.paypal.com/ |

| Phone number: | 08707 307 19100353 1 436 9004 (international users) |

| Email Support: | [email protected]@paypal.com [email protected] |

| Customer Service contact form: | https://www.paypal.com/us/smarthelp/contact-us |

| UK Address: | PayPal Europe Ltd, Hotham House, 1 Heron Square, Richmond upon Thames, Surrey, TW9 1EJ |