Do I Pay or Ignore Oriel Collections HMRC Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you had a letter from Oriel Collections about HMRC debt? Are you worried and unsure what to do?

You’re not on your own. Each month, over 12,000 people visit this site looking for guidance on matters just like this.

In this article, we’ll help you understand:

- Who Oriel Collections are, and if they are a real debt collection agency

- The type of HMRC debts Oriel chases

- How you can make your repayments smaller

- The actions Oriel Collections can and can’t legally do

- What happens if you ignore or don’t pay debt collectors

Owing money can be hard to deal with; some of our team have been there too. With our experience, we’ll help you learn more about how you can handle Oriel Collections HMRC debt.

What happens when you ignore debt collectors?

As mentioned, ignoring and not paying an HMRC debt could land you in serious trouble. First, Oriel Collections will attempt to contact you several times.

They could write to you, phone you, send you emails or visit you in person if all else fails!

If you don’t respond, the debt collector informs HMRC that they couldn’t contact you or get you to pay!

Things then escalate and HMRC will use their legal powers to collect the outstanding money owed.

What happens when you don’t pay debt collectors?

Things get messy when you don’t pay debt collection agencies that are chasing you for an HMRC debt. It’s not the same as other debts you could be chased for!

HMRC probably tried and failed to contact you over an outstanding payment. Your details are sent to a debt collector when this happens. In this instance, it’s Oriel Collections that take over the task of collecting what’s owed.

So when you get a debt letter from Oriel Collections, you should take it seriously and respond sooner rather than later.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What powers do debt collection agencies have?

A debt collection agency’s powers are limited. For example, Oriel Collections won’t take you to court themselves if you don’t pay an HMRC debt.

They just tell HMRC they failed in their task and Customs & Revenue take it from there!

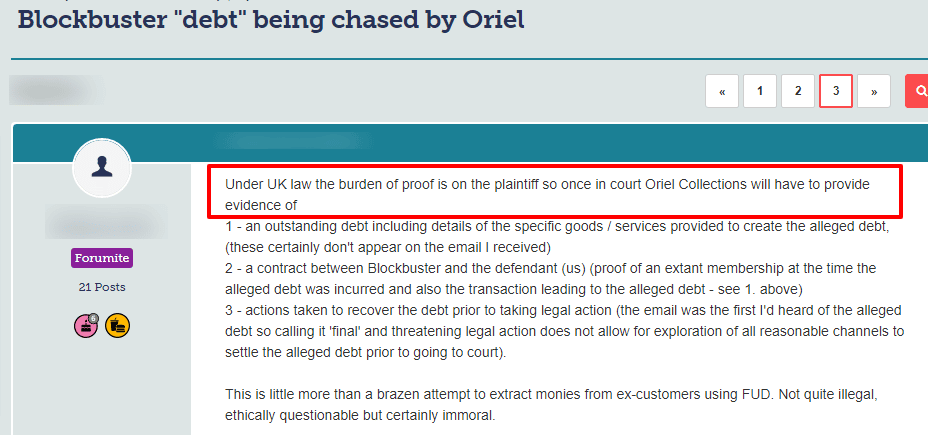

Oriel Collections are persistent when chasing people for debts. Take a look at what one person wrote on a popular forum and the replies they received:

Source: Moneysavingexpert

What can Oriel Collections legally do?

Once HMRC instructs Oriel Collections to recover money that’s owed them, the debt collector must follow the law and the CSA Code of Practice.

They can legally:

- Contact you about an alleged HMRC debt whether, by letter, phone, text, or email and they can visit you at home. However, they can’t just turn up, they should let you know about their intentions

- Talk to you about the debt in a polite and understanding way

- Ask you to pay the outstanding amount to them directly

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What will HMRC do to recover a debt?

If Oriel Collections fails to recover the amount owed to HMRC, things escalate and the situation will involve more serious enforcement action.

For example, HMRC could:

- Instruct an HMRC enforcement officer to visit your home, repossess assets and sell them at auction to clear what’s owed. The cost you’d incur would be an additional £75 on top of the original debt. The fee covers the cost of telling you about a planned visit to your home

- Take money from your bank account if you owe them more than £1,000 providing it won’t cause you any financial hardship

- Place an attachment on your earnings. They have the power to instruct your employer to pay a percentage of your wages directly to Revenue & Customs

- Place a charging order on your home and take some of the proceeds following the sale to clear the debt

- Take money from a current or eventual pension

- Place a bankruptcy order on you

So as you can see when you don’t pay an Oriel Collections, things get complicated, expensive and really stressful!

Can you stop Oriel Collections from contacting you?

No. Debt collectors are within their rights to contact you. However, they must remain within the law when they do!

That said, you’ve got the right to tell them how you’d like to be contacted. Moreover, Oriel Collections must respect your wishes and if they don’t, it would be seen as harassing behaviour.

Harassment is against the law!

So, in your shoes, I would write a letter to the debt collection agency asking them to only contact you in writing.

Preferably by mail so you have a record of their demands should the case go to court.

Also, make sure you send your letter by registered post so you know Oriel Collections received it!

Not all debt collectors act with integrity and could deny receiving the letter from you.

» TAKE ACTION NOW: Fill out the short debt form

Can you complain about Oriel Collections?

Yes. You’d be within your rights to file a complaint with Oriel Collections if you feel the HMRC debt collectors acted inappropriately.

First, file a complaint with Oriel Collections to see if they’ll make things right.

Second, if they don’t deal with your complaint, you have the right to report the debt collection agency to the Financial Ombudsman Service (FOS).

You can’t file a report with FOS if you haven’t filed a complaint with the debt recovery company first!

How can you contact Oriel Collections?

The best way to deal with an HMRC debt when Oriel Collections contacts you is to stay in touch with the debt collector. Let them know your situation.

HMRC debt collectors should take into account your personal circumstances when recovering a debt.

I’ve listed ways to contact Oriel Collections in the table below:

| Address: | Oriel Collections3 Manchester Park, Tewkesbury Rd., Cheltenham GL51 9EJ, United Kingdom |

| Phone Number: | +44 1242 508639 |

| Email: | [email protected] |

| Website: | https://orielcollections.co.uk/ |