How to Appeal NCO Europe Debt Collection

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a letter from NCO Europe Debt Collection can be scary. Debt collectors can be tough to handle.

But you’re not alone. Every month, over 12,000 people visit this site for advice on money troubles.

In this guide, we’ll help you understand:

- If you must pay NCO Europe

- How to lower your repayments to NCO Europe

- The laws that debt collectors in the UK must follow

- Steps to stop NCO Europe from hounding you

We know it’s hard to deal with debt collectors; it can make you feel stressed. Our team has been in your place.

Don’t worry! This guide will give you the info you need to handle NCO Europe. Let’s get started!

Why Is NCO Europe Trying To Get in Touch?

A key part of NCO Europe’s activities is debt collection. They specialise in multilingual business process outsourcing and work in a number of different sectors.

It’s likely that NCO Europe is trying to reach out to you in order to recover a debt for one of their clients, which might be related to financial services or parking fines.

To initiate the debt collection process, NCO Europe typically sends letters to UK residents, which may seem threatening to some, causing them to panic. NCO Europe offers a copy of the original credit agreement to customers who are unsure whether the debt is valid.

How To Stop NCO Europe From Hounding You

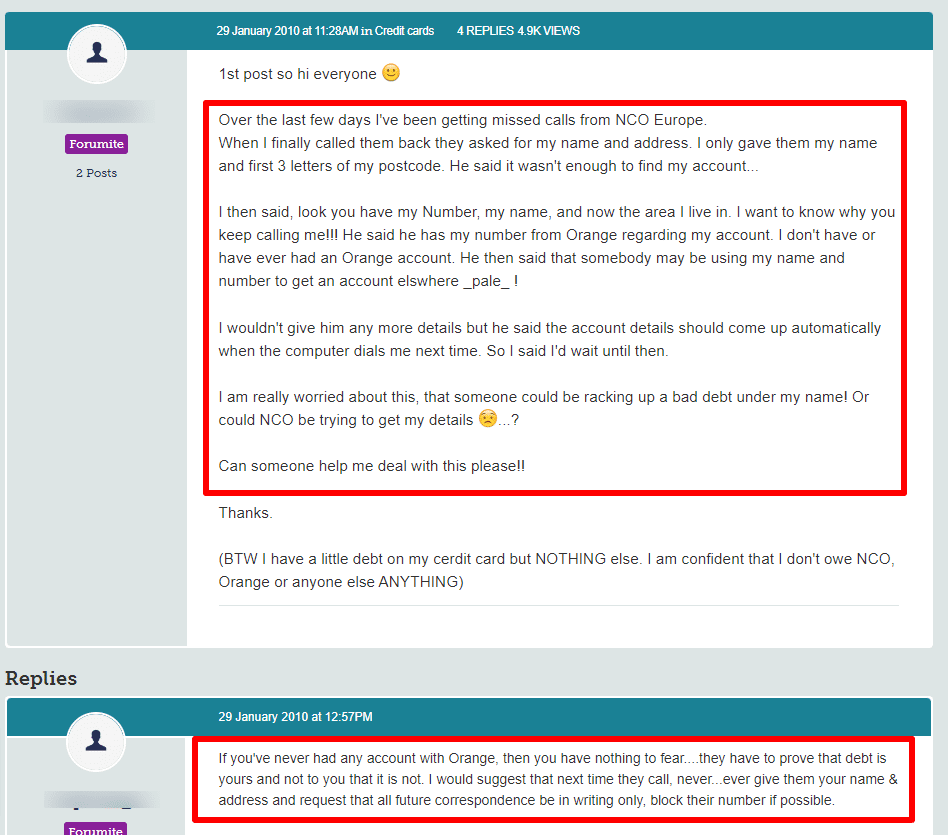

Now you know what can be seen as harassment, I need to cover the steps you can take to stop a debt collection agency such as NCO from contacting you. I’ve explained some steps, below.

- The first step is to confirm that you actually owe the debt. You can do this by asking for a copy of your original credit agreement from the debt collection agency. You may not owe the debt if it belongs to someone else or if it has already been paid in full.

- Communication is crucial: You need to stay in touch with your creditors or debt collection agency. It is not advised to avoid or ignore their letters as it could lead to an increase in debt, missed opportunities to resolve issues and more intrusive contact attempts.

- Decide what method of communication you prefer. For example, you might ask the debt collection agency to only contact you through by post instead of calling or visiting you.

- It may be possible to write off some of the debt if you cannot afford to pay it off. Many people in the UK are able to do this legally.

- A complaint can be made to the creditor, the Financial Ombudsman, or the Financial Conduct Authority (FCA) if you feel that you are being harassed by a debt collector.

- Getting advice from a professional may be helpful if you are unsure how to proceed. You can reach out to organisations such as Citizens Advice Bureau and StepChange for assistance.

- You should remember that harassment from a debt collector includes the use of excessive phone calls, home visits, and revealing your debts to others. If you contact NCO and ask them to stop harassing you, they must do so.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The General Debt Collection Process

I want to take a look at the debt collection and enforcement process in this section so that you understand where a collection agency such as NCO fits in, and what their role is. Creditors can take several steps when a debtor fails to pay back a debt when the collection and enforcement process in the UK is carried out.

- A creditor typically invoices for services or goods provided, followed by chasing payment. The creditor will begin chasing up the invoice if the payment is not made within the agreed-upon timeframe, reminding the debtor of their outstanding balance. This would also include sending out bills for credit services, council tax, etc.

- At this stage, the creditor has the option of engaging a collection agency such as NCO to begin chasing the debt on their behalf. Or they may choose to sell the debt for pennies on the pound, to a company that specialises in profiteering from delinquent debts.

- If the payment has still not been made, the creditor may send a letter before the claim. This letter informs the debtor about the outstanding debt and gives a deadline for payment.

- If the debtor fails to respond to the letter before claim or settle their debts, the creditor may initiate legal proceedings through the county court. Once a county court judgement (CCJ) is obtained, the creditor can enforce it in court.

- A court judgment may still need to be enforced if the debtor does not pay. A court may also order the debtor to attend court and provide evidence of their income and expenditure. The court may also send bailiffs to collect the payment. The bailiffs will ask for payment within 7 days of receiving the warrant of control. Debtors who do not pay their debt may have everything in their home or business sold by the bailiff if it cannot be repaid.

What Laws Apply to Debt Collectors in the UK?

There is a whole range of laws and regulations that apply to debt collection in the UK. These protect your rights and aim at making collection agencies act in an ethical manner. I’ve explained some of these laws in this section.

- Debt collectors are regulated in the UK by several laws and guidelines that aim to balance creditors’ rights to recover what they’re owed with debtors’ rights to fair and respectful treatment.

- Firms that collect debt for a third party must obtain permission from the Financial Conduct Authority (FCA). This also applies to those collecting debts arising under credit agreements, consumer hire agreements and regulated peer-to-peer loans. Firms offering outsourced services to lenders are likely to need their own permission as well.

- In order to collect debts, creditors are required to follow certain rules and regulations. If these guidelines are not followed, it could be considered harassment. Harassment includes repeated, inappropriate, or threatening contact, as well as any action that makes the debtor feel distressed, humiliated, or threatened.

- Besides chasing legitimate debts, debt collectors can add interest or additional charges, visit your home, withdraw funds from your connected accounts, and assist creditors in obtaining court orders. In any case, they cannot harass you, contact you at work, threaten you with legal powers they do not possess, breach data protection laws, increase interest if you miss payments, or lie to you. On weekdays, they can only call between 9 am and 5 pm, and calling outside these hours is illegal.

- As part of recent UK government regulations, debt collectors have also been required to simplify the language used in debt letters to make them less intimidating. Lenders must also use bold or underlined text rather than capital letters and limit the amount of information that must be highlighted. In addition to replacing legal terms with more understandable ones, they must clearly indicate where people can get free debt advice.

- Under certain conditions, a debtor might not be liable for a debt. For example, if it has been six years or more since they made a payment or communicated with the creditor, or if there was a problem when the contract was signed.

- It is also possible for debtors to challenge debt collectors if they think they are being treated unfairly or illegally. If they are not satisfied with a debt collector’s response, they can escalate their complaint to the Financial Ombudsman Service, which can investigate complaints regarding the collection of debts for most types of credit.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will NCO Europe Take You to Court?

It is important to understand how NCO Europe collects debts in order to determine if they would take someone to court.

By contacting the debtor, sending letters, making phone calls, and offering repayment plans, debt collectors like NCO Europe attempt to collect the debt. In order to achieve this, they will use a variety of methods. It is possible that NCO Europe will take further legal action, including taking the debtor to court, if these initial attempts to collect the debt fail.

It’s important to note that the actual decision to take someone to court will likely depend on various factors, such as the size of the debt, the debtor’s financial situation, the costs involved in taking legal action, and whether or not the debtor has the ability to repay the debt. However, typically, you can expect to receive at least a letter before a claim from NCO if you don’t pay the debt, even if they have no intention of seeking a CCJ.

You should seek advice if you have received a debt collection letter from NCO Europe and are concerned about potential legal action, don’t ignore the debt, it won’t disappear by itself.

Can NCO Europe Send a Bailiff to Your Home?

Despite NCO Europe’s claims, it won’t send in bailiffs. NCO Europe is a debt collection agency that operates throughout the UK. They buy debts from various clients and then take on the responsibility of collecting them.

As a debt collection agency, NCO Europe does not have the same legal powers as bailiffs (also known as enforcement agents in the UK). If you owe unpaid debts, such as council tax, parking fines, court fines, or judgments from the county court, high court or family court, bailiffs may visit your home to collect them. But the bailiffs will not have been sent by NCO.

NCO Europe is not legally permitted to send bailiffs to your home as a debt collection agency. In some cases, they may be able to take legal action to recover debts, but they cannot send bailiffs directly. If a court action is successful, a County Court Judgement (CCJ) could be issued, and failure to comply with the terms of a CCJ could result in bailiffs being used, but this would be a decision of the court, not NCO Europe.

Is NCO Europe Harassing You?

Debt collectors are notorious for being over the top when trying to collect a debt. But too much contact could be seen as harassment, which is illegal. I have listed some typical forms of debt collector harassment, below.

- Excessive contact by debt collectors is forbidden. For example, they cannot repeatedly phone you, visit you at home, or bother you in public. If you request to be contacted by email or post, they must follow this request and should not contact you via any other method.

- Unlike creditors, debt collectors do not have permission to call or visit you at any time of day or night. They must keep their attempts to contact you within reasonable hours.

- If you don’t give your permission, a debt collector cannot reveal your financial situation to anyone else. Your employer is also prohibited from discussing your borrowing without your permission. This includes discussing your debt with a family member, friend, or neighbour.

- As debt collectors do not have extra-legal powers like bailiffs, they cannot force entry or take possession, so pretending to be a bailiff would be considered harassment.

Debt collector harassment involves any action that makes you feel distressed, humiliated, or threatened. Debt collector harassment is illegal. You can complain to the creditor, the Financial Ombudsman, and the Financial Conduct Authority (FCA) if you feel harassed by a debt collector.

If you decide to complain, it is important to gather as much evidence as possible (e.g., call logs, dates, times) and first send your complaint to the debt collection agency. The Financial Ombudsman can investigate your complaint if you are not satisfied with the response. You need to provide your personal details, your version of events, and any evidence you have. Most types of credit can be handled by the Financial Ombudsman Service if you have concerns about debt collection.

How To Contact NCO Europe

Unlike some other debt collectors, there are quite a few contact methods available on NCO Europe’s website, all of which can be used to reach out to them:

- They can be contacted by phone at 0330 060 1500. The call is free on most mobile networks within the UK.

- They can be contacted via email at [email protected]

- They can be reached by post at New City House, 57-63 Ringway, Preston, Lancashire, PR1 1AF.

- Their website allows you to manage your account or make payments. You can register for an online account if you don’t already have one.

The following are their opening hours for customer service:

- Monday to Thursday: 8am to 8pm

- Friday: 8am to 7pm

- Saturday: 8:30 am to 1pm

- Sunday: Closed

When you have a complaint, you can use the Resolver tool to contact NCO Europe customer service. This independent issue-resolution tool simplifies the complaint process by enabling you to raise and resolve consumer issues.