Should I Pay Mortimer Clarke Solicitors Debt Collection?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a letter from Mortimer Clarke Solicitors Debt Collection can be scary. You might be worried about what to do next.

Don’t worry; you’re not alone. Every month, our website is visited by over 12,000 people who are seeking advice on debt topics.

In this article, we’ll explain:

- Who Mortimer Clarke Solicitors are

- If you need to pay them

- How to know if the debt collection agency is allowed to work in the UK

- Ways to make your repayments smaller

- What to do if you think the debt isn’t yours

We know how hard it can be when you owe money; some of our team have been in your shoes before. With our experience, we’ll help you understand what to do when Mortimer Clarke Solicitors Debt Collection contacts you.

Why would Mortimer Clarke Solicitors contact you?

Chances are the original creditor tried to get in touch with you without success. When this happens, some creditors are quick to pass your details to a debt recovery company.

As such, Mortimer Clark Solicitors could contact you. They could write to you, send you an email or they may try to contact you by phone.

As mentioned, they could be acting on behalf of a customer who passed your details to them to recover an outstanding balance. Or, they may have purchased the debt and are pursuing you for payment for themselves.

The one thing to bear in mind, is that every letter and communication will be more threatening than the last one!

Should you respond to Mortimer Clark?

Yes. Absolutely. It’s far better to respond to a debt collection agency rather than ignore things.

First, by contacting Mortimer Clark, you’d establish whether the debt is current or statute barred. Second, you can determine if the debt is actually yours!

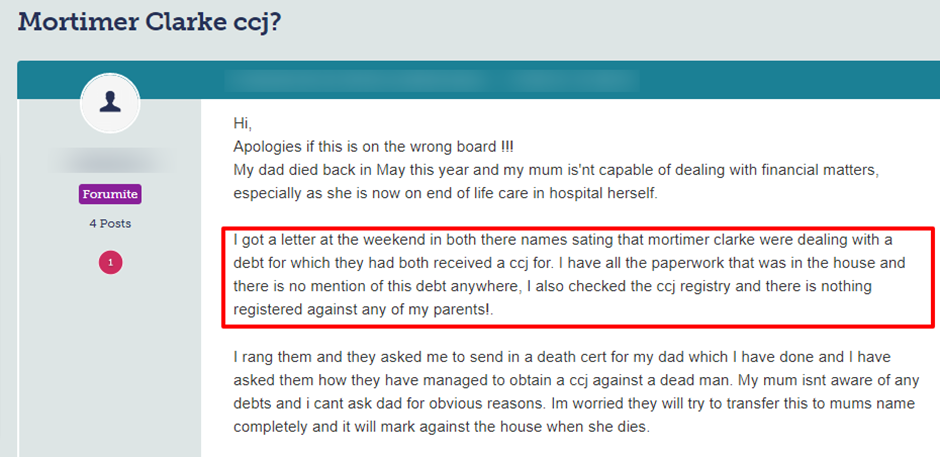

Also, mistakes do happen and the debt recovery company could have the wrong person. Check out what happened to one person who posted this message on a popular forum.

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is the debt collector contacting the wrong person?

Next, find out whether Mortimer Clark is chasing the right person over an alleged debt. You have the right to ask a debt recovery agency to prove you owe the money even when you do.

Mortimer Clark may have already provided the proof, but if they haven’t, you should send them a ‘prove the debt’ letter. It’s up to them to provide hard proof the outstanding owed is yours to settle, not the other way around.

You shouldn’t just accept their word for it. Mortimer Clark must send you authenticated proof which could be a copy of a Credit Agreement or other contract.

What if Mortimer Clark can’t prove you owe the money?

You can’t be made to settle a debt if Mortimer Clark can’t provide proof that you owe the money.

Moreover, courts won’t rule in favour of a debt collection agency or original lender/creditor if there’s no proof the debt is yours.

What happens if Mortimer Clark proves you owe the money?

Unfortunately, you’ll have to settle the amount owed if Mortimer Clark proves the outstanding debt is yours!

However, you should seek independent advice before signing or agreeing to anything. Especially, if like many people, you’re experiencing financial hardship in these difficult times.

There are several debt charities in the UK and there are debt management companies too. Getting advice could help you sort out the right repayment plan before negotiating one with debt collectors!

If you choose the wrong debt solution, it could make your financial situation even worse!

Should you ignore Mortimer Clark Solicitors?

No. It’s never wise to ignore Mortimer Clark Solicitors because it will make things much harder to resolve. Debt recovery companies are renowned for being tenacious.

In short, companies like Mortimer Clark won’t stop pursuing you for payment if you ignore them.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Would Mortimer Clark take you to court?

If Mortimer Clark purchased the debt from another company, the debt collector could start legal proceedings themselves.

However, if they’re acting on behalf of a customer, they could advise the client to take you to court. In this instance, it’s up to the original lender/creditor to start legal proceedings against you if they want to.

Could you get a County Court Judgement on your credit file?

You could get a County Court Judgment (CCJ) for ignoring and refusing to pay Mortimer Clarke Solicitors if they’ve proven the debt.

A court will issue an order to pay which makes you liable for the outstanding balance owed.

A CCJ stays on your credit file for six years and you’d have trouble getting a bank loan, credit card, or mortgage for this amount of time!

It’s far better to prevent this from happening by negotiating an affordable monthly payment plan to settle the outstanding you owe. However, you should seek independent advice before agreeing to a payment plan!

What can debt collection companies do?

Debt companies like Mortimer Clarke must follow the law and the code of conduct when pursuing debts. They must respect privacy laws and your rights as a consumer!

That said, a Mortimer Clarke can:

- Call you on the phone, text you, send you emails and letters. They can also visit you in person if all other methods of contacting you are unsuccessful

- Discuss the problem with you but they must remain polite while at the same time showing empathy for your personal circumstances

- Ask you to pay them directly rather than the original lender/creditor

Is there anything debt collectors can’t do?

Yes. Debt collectors would be acting unlawfully and against the CSA code of conduct if they do or say any of the following things:

- Tell you they have more powers than they really have. For example, make out they are enforcement agents (bailiffs)

- Show you documents which look like a court has issued them when they have not

- Talk to you in a complicated way using lots of legal jargon to confuse you

- Urge you to borrow more money to repay what they say you owe

- Seize your possessions or clamp any vehicles

- Force their way into your property

- Visit you at your place of work

- Discuss an alleged debt with your neighbours, friends, employer or even a family member

- Harass you with phone calls, texts, and emails

- Threaten you

You have the right to lodge a complaint with Mortimer Clarke if one of their agents acts unlawfully. Moreover, the company must deal with the complaint promptly.

Can you report Mortimer Clarke Solicitors to the FOS?

If you still feel that Mortimer Clarke is not following the code of conduct or the law, you can report them to the Financial Ombudsman Service (FOS).

The ombudsman will investigate your complaint. You could be entitled to compensation if Mortimer Clarke is found to have acted unlawfully!

Moreover, the company could lose their licence to operate in the UK!

Will Mortimer Clark give up chasing you?

No. Rarely would Mortimer Clarke Solicitors give up chasing debtors for outstanding debts. In fact, these days, they have many tools to trace people who owe money.

It is their job to make sure outstanding debts get paid. In short, these companies do whatever is possible to collect debts!

Plus, some of the tactics companies use are suspect, to say the least!

» TAKE ACTION NOW: Fill out the short debt form

How would you know if a debt has been sold?

You should have received two notifications. One from the original lender/creditor and the other one from the debt collection agency that purchased the debt.

For instance, if Mortimer Clarke Solicitors purchased the debt, they’d send you a letter in the post informing you they own an outstanding balance.

It means you have to deal with the debt collectors from that point on and not the original lender/creditor.

Moreover, The debt could be sold even if you already signed a payment arrangement with the original lender/creditor. Why? Because the original agreement you signed would typically have contained a clause that allows this to happen!

You shouldn’t ignore these notifications because debt collectors will soon escalate the matter to the courts.

Can you stop debt collection agencies from contacting you?

No. You can’t prevent them from contacting you whether they’re acting on behalf of a customer or pursuing a debt themselves.

However, you can send Mortimer Clarke Solicitors a letter telling them how you’d like to be contacted!

It’s always a good idea to ask debt collectors to contact you in writing by letter. Like this you have a record of their requests and demands should you face legal action.

Don’t sign the letter and send it by recorded delivery to make sure it arrives safely!

Can you complain about Mortimer Clarke?

Yes. You should file a complaint with Mortimer Clarke Solicitors if you feel they acted unlawfully or you felt harassed/threatened in any way.

Your complaint should be dealt with in a timely manner but you can escalate things to the Financial Ombudsman Service if you’re still not happy!

That said, you must complain to debt collectors before you contact the ombudsman!

How do you contact Mortimer Clarke Solicitors?

It’s always better to stay in touch with Mortimer Clarke Solicitors when they contact you. First, it prevents them from escalating the matter. Second, you can establish whether the debt is statute-barred. Third, you can check if the debt is yours!

I’ve listed ways you can contact Mortimer Clarke Solicitors in the table below:

| Address | 16-22 Grafton Road, Worthing, West Sussex, BN11 1QP |

| By post | Mortimer Clarke Solicitors, PO Box 130, BLYTH, NE24 9FA |

| By phone | 0330 045 0779 |

| Complaints | [email protected] |

| Opening times | Monday – Friday 8.00 am – 8.00 pm Saturday – 9.00 am – 1.00 pm Sunday – Closed |

| Via email | [email protected] |

| Website | https://www.mortimerclarke.co.uk |

You could use any of the above contact details to get in touch with Mortimer Clarke Solicitors.