Should I Ignore Moriarty Law CCJ for Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with Moriarty Law and debt collectors can be a concern. If you’re feeling stressed about what to do, you’re not alone. Each month, over 12,000 people visit this site for advice on such issues.

In this article, we’ll explore:

- The role and regulation of Moriarty Law as a debt collection company

- How and why Moriarty Law could contact you

- The impact of a County Court Judgement (CCJ) from Moriarty Law on your credit file

- Options for lowering your repayments or agreeing on a payment plan

- Understanding your legal rights when dealing with debt collectors

We know how hard it can be to deal with debts; members of our team have faced similar situations, so we understand and can offer guidance.

Ready to learn more about managing your Moriarty Law CCJ for debt? Let’s dive in!

Why would Moriarty Law contact you?

If you fell behind with any payments to a Moriarty client, chances are they sent your details to the debt recovery company.

It typically happens when a company tries to get hold of you but fails! They then instruct Moriarty to take over chasing you for payment!

When you let it get to this stage, you’d no longer deal with the company you owe any money to. You’d have to deal with the debt recovery company instead which can be a lot more stressful.

Is the debt yours?

You’d be surprised at how many mistakes happen when debt collectors chase people for payments. Maybe you share a similar name as the real debtor.

Or maybe the debt collection agency has sent out lots of letters to different people in the hope of finding the real debtor.

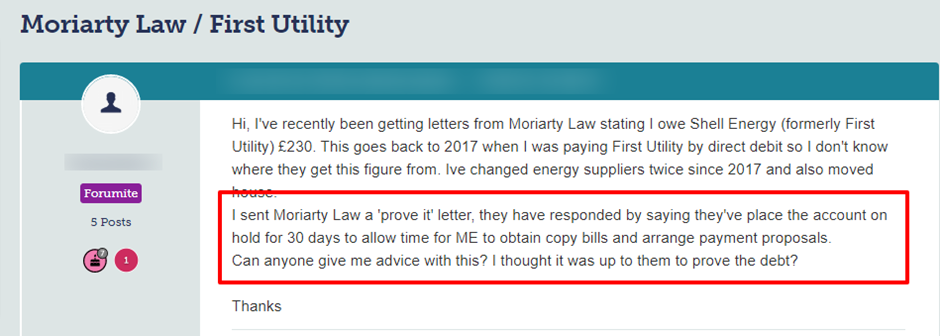

Whatever the reason, mistakes happen and the debt might not be yours. If so, write to Moriarty Law asking them to ‘prove’ you owe the money.

Moriarty Law has an obligation to prove you owe the money, not the other way around! Don’t just accept their word for it. Instead, ask them to send you an authenticated copy of an agreement or contract you had with the creditor!

Don’t sign the letter, instead, just print your name at the bottom of it.

That said, they may have already sent the proof to you in an original letter. But if they didn’t, you have every right to send them a ‘prove the debt’ letter.

Moreover, they must respond in a timely manner and put everything on hold until they’ve produced authenticated proof!

Check out what happened to one person that Moriarty Law contacted about an alleged debt:

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if Moriarty can’t prove the debt?

If a debt collection company like Moriarty can’t prove you owe the money, they can’t enforce payment. If Moriarty’s client takes you to court, a judge needs to see proof the debt is yours.

When there’s no proof, the debt can’t be enforced and therefore, you can’t be made to pay!

What if the debt is proven to be yours?

If Moriarty Law proves you owe money to one of their customers, that’s it. You’ll have to pay.

However, it is always wise to seek independent debt advice before admitting, signing or paying any money first!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is the debt too old to enforce through the courts?

Some debts are too old to enforce through the courts. However, for a debt to be statute barred, it must meet specific criteria.

So, make sure you do the necessary research before you tell them to stop contacting you over a statute-barred debt. You may want to seek advice from one of the debt charities or an independent debt management company first!

What happens when you ignore a debt letter?

Whether the debt is yours or not, you shouldn’t ignore letters from debt collection agencies. It’s very tempting to just bin the letters but it won’t help resolve the problem.

Nor will binning debt letters stop Moriarty from contacting you. In short, the problem doesn’t go away. If anything, it just gets a lot more stressful. You’d get more letters, phone calls, texts and emails.

A Moriarty field agent could pay you a visit at your home!

Ignoring things also means you miss out on establishing important things like:

- Is the debt statute-barred?

- Do you owe the money or is the debt collection agency pursuing the wrong person?

What happens when you ignore a Letter Before Action?

You shouldn’t ignore a Letter Before Action you get from Moriarty Law. They may just be threatening legal action to scare you into paying.

That said, it may not just be an idle threat. More especially as Moriarty Law provides its customers with pre-litigation services!

» TAKE ACTION NOW: Fill out the short debt form

Will Moriarty Law take you to court?

Moriarty Law acts on behalf of its customers. But they provide pre-litigation services. In short, it means they are well placed when it comes to advising a client on whether it’s worth taking you to court.

Instructing Moriarty debt collection to recover the outstanding prevents your account from moving to their legal department!

That said, Moriarty Law claims to treat you fairly by fully complying with all “Pre-action Protocols” linked to debt claims. This means you’d get a Letter Before Action (LBA) before the court action begins!

Moriarty also claims to use litigation as the last resort.

Can a debt collection agent come to your home?

Yes. A debt collection agent has the right to pay you a visit at your home. However, they can’t just turn up. They must give you a prior warning before they show up.

That said, field agents only visit you at home when all other methods of contacting you have failed.

Also worth noting, is if you do get a visit from a debt collector, you can ask them to leave your property. What’s more, they must leave when you ask them to!

Could you lose your house over a Moriarty Law debt?

No. Most debts that Moriarty Law takes on for their customers involve unsecured debts. In short, the money owed is not secured against your property!

However, if you’re taken to court and the judge issues a Court Order to pay and you don’t, you’d get a visit from a bailiff. Enforcement officers must let you know when they intend on coming to visit you.

They can’t just turn up which is why it’s never a good idea to ignore any letters from them.

They could seize some of your possessions to recover the amount owed! A court would issue an attachment on your earnings or bank account which could be extremely stressful.

Moreover, you’d have a CCJ recorded on your credit history. You’d have trouble getting a bank loan, credit card or mortgage for six years until the CCJ expires!

Would Moriarty Law agree on a payment plan?

Yes. Moriarty Law could agree on a payment plan with you to settle the debt. However, you should talk to an independent debt adviser before you attempt to negotiate a plan with them.

You need to set a repayment schedule you can afford and which won’t put too much pressure on your daily life.

Also, once a payment plan is accepted and the payment dates are agreed upon, you must be able to meet them. If you default on any payments, the agreement could be null and void.

You’d be right back where you started and could be asked to repay the full amount!

What about a full and final settlement?

Again, you should seek advice from an independent debt adviser if you’re thinking about offering a full and final settlement.

An adviser can work out how much Moriarty Law may accept and whether it’s a worthwhile move. However, debt collection companies that recover debts on behalf of their customers have their hands tied.

In short, it could be up to the original creditor whether or not to accept your full and final settlement offer.

Can you prevent Moriarty Law Limited from contacting you?

No. You can’t prevent Moriarty Law Limited from contacting you over an alleged debt. However, you can dictate when and how you want to be contacted.

Moreover, they must respect this request!

For example, if you say that you only want to receive letters from them, Moriarty Law must comply!

If they continue to send you emails, and texts and you receive lots of phone calls, it could be seen as harassing behaviour. It’s against the law for a debt collector to harass you!

Can you complain about Moriarty Law?

Yes. It’s your right to file a complaint against a debt recovery company if you feel they acted unlawfully in any way.

However, you should complain to Moriarty Law first. Give them the chance to put things right. If you still feel they are not dealing with your complaint appropriately, you can then report the debt collector to the Financial Ombudsman Service (FOS).

How do you contact Moriarty Law?

I’ve listed ways to contact Moriarty Law if you get a debt letter from them in the table below:

| By phone | 0203 126 4544 |

| By letter | Moriarty Law Debt Collection 20 Old Bailey, London EC4M 7AN |

| Via email | [email protected] |

| Website: | https://moriartylaw.co.uk/ |

| Opening times | Monday to Thursday – 9 am – 5:30 pm Friday 9 am – 5 pm Saturday 9 am – 1 pm |

Do debt collectors give up chasing you?

No. Debt collectors are renowned for being persistent. Moreover, today they have tools that help them track debtors down even if they’ve moved several times.

That said, some debt recovery companies resort to using questionable methods to trace people which includes sending lots of emails to different people. It’s a tactic known as phishing!

They use this and other methods in the hope of finding the right person even though it causes lots of stress and anxiety to other people!