Lowell Telecom Contacting Me about Debt – How to Appeal

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Having Lowell Telecom get in touch about a debt can feel very worrying. You’re not alone. Every month, over 12,000 people visit our site looking for guidance on debt issues.

In this article, we’ll explain:

- What Lowell Telecom is, and why they might be contacting you.

- How to know if you really have to pay Lowell Telecom.

- Ways you could lower your repayments.

- How to understand your rights when dealing with debt collectors.

- Steps to take if you don’t think you owe Lowell Telecom any money.

We know how hard it can be to deal with debt collectors; some of our team have been in the same place.

Don’t worry; we’re here to help you learn more about how to handle contact from Lowell Telecom about a debt.

Why is Lowell on my credit report?

If you see Lowell or Lowell Telecom on your credit report, it’s highly likely that they purchased a debt that you owed to a telecommunications company.

Lowell Telecom isn’t allowed to start adding to your credit report until after they tell you they’ve purchased the debt and you now owe them. They should do this by sending you a Notice of Assignment letter.

Lowell then marks your credit report to show the debt is owed and it’s owed to them.

I don’t think I owe Lowell Financial any money

If you understand where Lowell bought the debt from but still don’t agree that you owe the money, you can sometimes ask them to prove the debt by writing them a letter. Lowell would then need to prove to you why you owe the money before continuing to ask for payments.

However, there is a loophole working in Lowell’s favour.

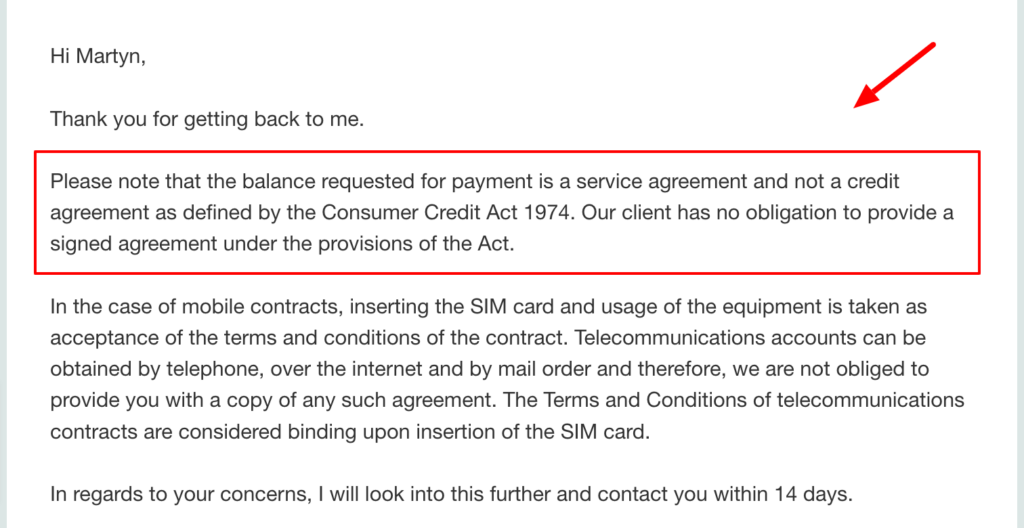

The creditor only has to prove the debt when the debt is covered by the Consumer Credit Act 1974. Service agreements like mobile networks aren’t covered by this Act, and therefore Lowell doesn’t have to prove the debt with a signed agreement.

This is the response one debtor received from Lowell regarding this:

Source: https://forums.moneysavingexpert.com/discussion/5285947/lowell-chasing-old-o2-debt

If Lowell bought a debt that is covered by the Consumer Credit Act then they must provide a copy of the signed agreement when you ask before continuing to request payment. If they’re unable to do this you could use it as a convincing argument if they tried to get a CCJ.

But this may not be the case for telecommunications-related debts.

Use the “Prove the debt” letter

If you can ask Lowell to prove the debt before paying, you may want to make this easier for yourself.

There are many prove-it letter templates online you can download for free and add your own details. This will also make sure you’re requesting proof the right way.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Your Lowell Telecom debt might be too old to be collected!

Lowell is known to chase really old debts. If you have a read of some of the online forum posts about Lowell, you’ll notice that many people are being chased for debts that are many years old. This can work in your favour.

Some debts can become too old to be collected because there is a time limit before the court will not entertain these cases. For most debts, it’s six years in England and Wales but there are a couple of other boxes you’ll need to tick.

When a debt is too old to be collected – i.e. a statute-barred debt – Lowell can’t take you to court and you can therefore never be legally made to pay it. Moreover, they have to stop asking you to pay when you tell them you won’t be paying for this reason.

There are also free letter templates online to inform Lowell the debt is too old and you won’t be paying.

Should I pay Lowell Financial?

You may have to pay Lowell if you owe the money, and you might want to pay to avoid legal action and bailiffs.

But there could be more suitable solutions for your situation, and there might be a case to never have to pay. I’ll be discussing these situations shortly.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How can I pay Lowell Financial?

You can pay Lowell online using your bank card, or you can set up a direct debit to cover the amount taken each month.

If the amount changes at all on the direct debit, Lowell must contact you at least 10 days before to let you know.

What happens if you ignore Lowell Financial?

If you ignore Lowell they will continually contact you to ask you to pay. They may even add charges and interest to the amount owed.

Receiving constant communications and even phone calls about the debt can be draining, which is exactly their plan.

Debt collection companies like this will try to wear you down so you give up and pay. But you might not have to pay yet, and you may not have to pay at all!

What rights does Lowell Financial Ltd have?

Lowell Financial has the right to contact you about the debt and ask you to pay it. The debt letters you receive will probably come from Lowell Solicitors, which makes them appear even scarier.

They don’t have a right to harass you, intimidate you, confuse you with jargon or pretend that they’re bailiffs – they’re not!

Will Lowell Financial Ltd come to my house to collect debts?

Lowell Telecom can come to your home and ask if they can discuss the debt, but this is unlikely because it might be a big waste of their time.

It could be a waste of their time because you can request they leave you alone and they must do so. Lowell field agents are not bailiffs and have no legal powers to enter your property or take any of your goods to sell them.

If a Lowell worker does come to your home and even indicates that they have these powers, you should report them. I’ll be explaining how to do this towards the end of this post. Stay tuned!

Can Lowell Financial take me to court?

If Lowell takes the necessary steps to try and recover the debt but you refuse to cooperate or pay, they can start formal legal proceedings against you in the County Court.

The aim of this is to get a judge to agree you owe the debt and make you pay by issuing a County Court Judgment (CCJ), which is a type of court order in England and Wales. Scotland has a comparable process.

Once a CCJ is issued, you must pay as the judge instructs, which could be a lump sum payment or to pay by instalments. Failing to follow this order can result in debt enforcement action.

Will Lowell Group use bailiffs?

Lowell can use bailiffs to collect the debt if they have already taken you to court and a CCJ was issued but wasn’t paid as instructed.

To do this Lowell would have to go back to the court and apply for a warrant so the bailiffs could come to recover the money. The bailiffs would then contact you in writing by sending a Notice of Enforcement letter to ask you to pay or expect their visit.

The bailiffs could then come to your home no earlier than seven days after the letter is received.

Bailiff fees and a great deal to the amount owed. The initial letter adds £75 and there are much bigger fees if they need to come to your home, seize goods, store goods and sell goods.

Lowell has other options as well. Instead of using bailiffs, they might try to have money deducted from your wages via the court, or even add a charge to your property so you have to pay before you can ever sell.

Does Lowell Group Debt Collection offer payment plans?

Yes, Lowell offers payment plans.

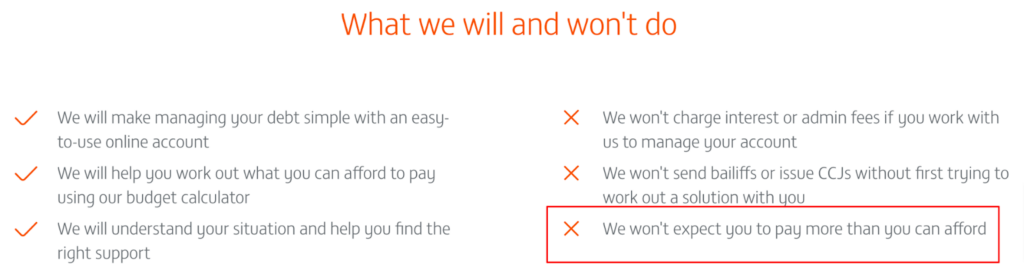

Lowell Financial Limited states it will never ask debtors to pay more than what they can afford to repay within a payment plan.

Here is a snapshot from their website discussing this:

Source: https://www.lowell.co.uk/about-us/

I feel embarrassed to talk to Lowell Financial debt collectors

You shouldn’t feel embarrassed to discuss your debts with Lowell. And the person you speak with should be compassionate and understanding.

If you’re really worried, you can ask a debt charity or Citizens Advice to communicate with them on your behalf. This is sometimes possible.

Is It possible to write off my Lowell Group debt?

There are ways to write off your Lowell debt in other ways than using the statute-barred loophole. You could use one of the many debt solutions which write off some or all of the debt, including:

- Individual Voluntary Arrangement

- Debt Relief Order

- Bankruptcy

You should always get personalised advice, but you can get a headstart by learning some options on my How to Escape Debt page.

» TAKE ACTION NOW: Fill out the short debt form

Can I stop Lowell Financial Ltd from contacting me?

You can stop Lowell Telecom from contacting you in certain ways, but you cannot permanently block all forms of communication.

The Financial Conduct Authority states that debtors have the right to provide debt collectors with their communication preferences in writing. The debt collector must then adhere to these preferences or they could be judged to be harassing the debtor.

You will have to be reasonable in your request, but you could ask Lowell to only contact you in writing, preferably by letter.

How can I stop debt letters from Lowell Financial?

You may want to ensure all forms of communication are done in writing because this ensures you keep evidence of all communications. However, you may also want to stop Lowell’s debt letters for a period to give you a break. This is possible!

Speak to a debt charity to assess your Lowell debt solutions, and in the process, you can ask the charity to apply for the breathing space scheme to stop letters.

This will give you a number of weeks where Lowell and any other creditor aren’t allowed to contact you. But you must be using this time to genuinely assess your debt solution options.

The restriction can be lifted if you’re not.

How do I make a complaint about Lowell Debt Collection Company?

There could be many reasons to complain about Lowell Debt Collection, such as harassment, pretending to be bailiffs or something else.

Your initial complaint must be sent to Lowell. But if they don’t respond as you expect or don’t change their behaviour, you can submit a second complaint to the Financial Ombudsman Service.

Thai independent group will look at the facts and come up with a resolution, which could include severe punishment for Lowell.

How do I contact Lowell Financial?

Contact Lowell Financial Ltd using the details in the table below.

| Phone numbers | 0333 556 58350161 968 70650333 344 63790333 556 55700333 556 58470333 556 59020333 556 5562 |

| Email address | [email protected] |

| Postal address | PO Box 1411, Northampton, NN2 1BQ |