Do I have to pay Jacobs Enforcement Agents Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a note from Jacobs Enforcement Agents about a debt can be scary. You may feel worried and unsure about what to do.

You’ve come to the right place. Each month, more than 12,000 people visit this site seeking advice on debts.

In this article, we’ll explain:

- Who Jacobs Enforcement Agents are

- Why they might contact you

- What to do if they get in touch

- How to check if the debt is really yours

- What help is available for dealing with debts

We know that dealing with debt can be hard; people who work on this site have been in the same spot. Don’t worry; we’re here to help.

Ready to find out more about what you can do if you have a debt with Jacobs Enforcement Agents? Let’s dive in!

Why would Jacobs Enforcement Agents contact you?

Jacobs Enforcement Agents may contact you over council tax or rent arrears. Or maybe you’re in corporate debt which is another arm of their recovery business. If so, Jacobs will contact you, sometimes relentlessly, to get you to pay!

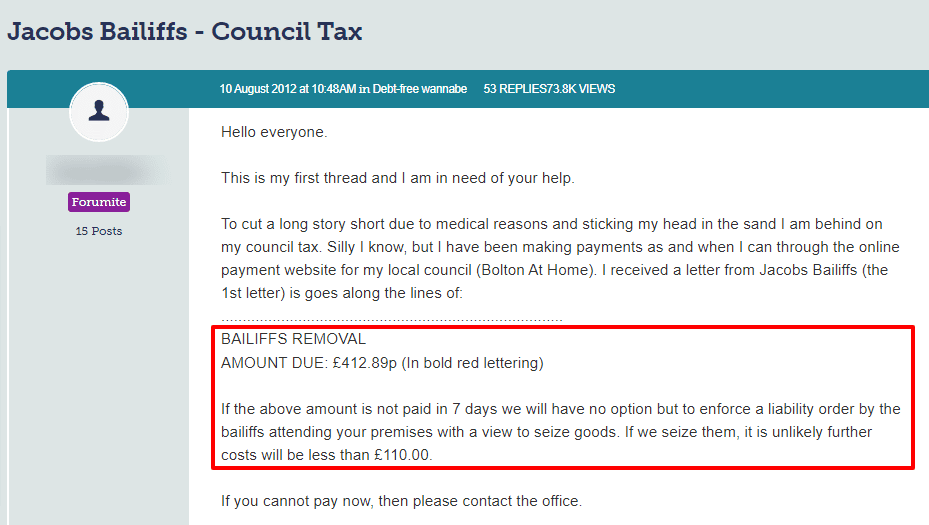

Take a look at what one person had to deal with when Jacobs contacted them:

Source: Money Saving Expert

However, there are laws and rules and if Jacobs crosses the line, it could be deemed harassment. You could report them but first, file a complaint with Jacob’s head office in Birkenhead!

What should you do when Jacob contacts you?

Stay calm and find out if the debt is yours! Mistakes can and do happen. If the debt isn’t yours, Jacobs must stop contacting you. So, first, ask Jacobs to ‘prove’ the debt which they must do!

Second, find out if the debt is over six years old because if it is, the debt is statute-barred. In short, it’s no longer enforceable although it could still impact your credit rating.

The long and short of a statute-barred debt is:

- You won’t get a County Court Judgement on your credit history

- You can’t be chased for payment

A debt may be statute barred if the following applies:

- You haven’t paid anything towards the debt

- You haven’t admitted you owe the debt

- There are no existing court proceedings to recover the debt

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if Jacobs proves the debt is yours?

Jacobs must provide you with authenticated proof the debt is yours. For example, an authenticated copy of an agreement you entered into. You may have to pay Jacobs if they can prove the debt is yours.

But only when you’re sure the debt is not statute-barred. Seek advice from one of the debt charities before you agree, sign or pay anything over to Jacobs Enforcement Agents!

What happens if I don’t pay Jacobs?

Things could get messy and expensive if you don’t pay Jacobs and they’ve proved the debt is yours. For instance, you could end up facing court proceedings. You could get a CCJ registered against you.

Your credit rating could be ruined by a County Court Judgement!

So, don’t ignore correspondence from Jacobs Enforcement Agents. Instead, find out whether the debt is yours and whether it’s not statute-barred. If the debt is yours and it’s still current, negotiate an affordable payment plan with Jacobs.

Negotiate a repayment plan you can afford!

» TAKE ACTION NOW: Fill out the short debt form

What can Jacobs legally do when they contact you?

There are regulations that must be followed by Jacobs. They are set out by the Office for Fair Trading (OFT). The guidelines state that:

- You must be treated fairly and proportionately

- You’re spoken to in clear and transparent terms

- You’re treated with understanding and empathy

The legislation states that debt collectors may not legally do any of the following:

- Force entry into your home without a court order

- Use deceptive tactics to get you to pay

- Encourage you to take out other loans to repay the debt

- Pretend they have more powers than they really have

- Threaten or harass you in any way

- Discuss your debt with other people which breaches your privacy

You can report a Jacobs representative to the Financial Ombudsman if you feel they are acting unlawfully.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do you contact Jacobs Enforcement Agents?

I’ve listed Jacobs Enforcement Agents’ contact details here:

| By email: | [email protected] |

| By phone | 0345 601 2692 |

| Online: | Contact Page |

| In writing | Jacobs 6 Europa Boulevard, Birkenhead Merseyside, CH41 4PE |