Can I Ignore Trace Debt Recovery Letter? UK Laws

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with a Trace Debt Recovery letter can be a worry. It’s common to feel unsure about what to do next.

Rest assured, you’re not alone. Each month, over 12,000 people visit this site looking for guidance on debt topics.

In this article, we’ll cover:

- Who Trace Debt Recovery is and why they might contact you.

- How to respond to a Trace Debt Recovery letter.

- What happens if you ignore Trace Debt Recovery.

- Ways to lower your repayments.

- Useful debt help resources.

We understand that dealing with debt collectors can be stressful and can disrupt your daily life; some of us have been in the same boat.

With our experience, we’ll help you learn more about your rights and options when dealing with Trace Debt Recovery. Let’s dive in!

Why would Trace Debt Recovery contact you?

Chances are you got a letter from Trace Debt Recovery over an unpaid parking ticket. Car park management companies often use the debt collector to chase people for payments.

So, in short, you may have been given a Parking Charge Notice by a car park management company which remained unpaid. Unfortunately, it happens mainly because parking tickets on private land often end up in the bin.

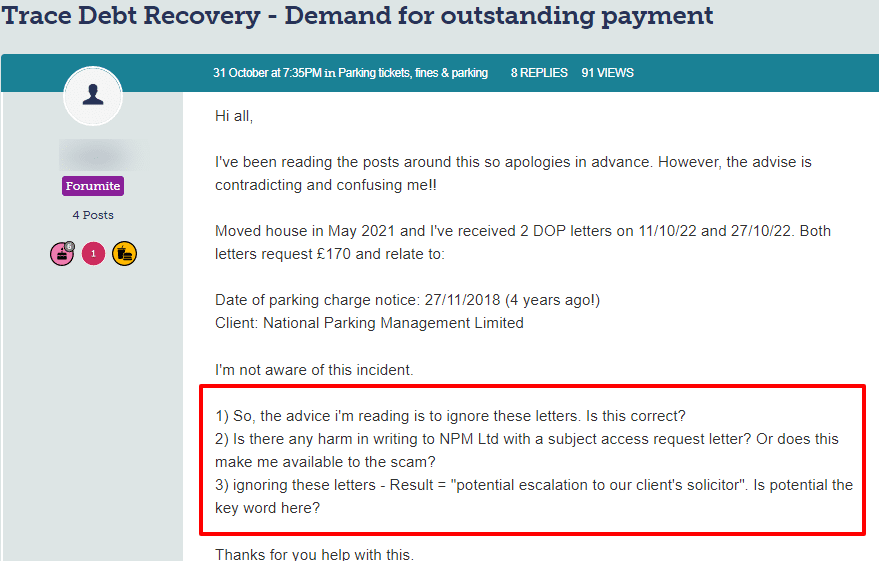

Take a look at what happened to the person below:

Source: Monesavingexpert

The belief is that parking tickets on private land are not enforceable, which is true, to begin with. But, if the car park management company takes you to court and you’re ordered to pay, the fine is enforceable!

This is where a debt collection agency like Trace Debt Recovery comes into the picture. Moreover, they are persistent when they contact you.

Should you pay Trace Debt Recovery?

Not necessarily. As mentioned, first ask Trace to prove the debt is yours. Then establish it’s not statute-barred. Only after Trace Debt Recovery has proved the debt is yours and that it’s still current should you pay.

You should seek advice from a debt charity if you’re unsure about anything. Plus getting advice before you negotiate a payment plan with Trace is always a good move.

Another thing to bear in mind is that you may be able to settle things with the original creditor rather than deal with the debt collection agency!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How should you respond to a Trace Debt Recovery letter?

You should never ignore correspondence you get from Trace Debt Recovery. They could be contacting you over an unpaid parking fine or they could be enforcing a High Court order!

So, the first thing to do is find out whether the debt is really yours. You should write to Trace asking them to ‘prove’ it is! Send the letter by registered post to make sure the debt collector gets it.

Next, find out when the parking ticket was issued. If it’s at least six years old, Trace can’t make you pay. Unless there’s a Court Order issued or a CCJ has been levied against you!

Trace Debt Recovery must provide you with authenticated proof the debt is yours.

Don’t just take their word for it!

» TAKE ACTION NOW: Fill out the short debt form

What happens when you ignore Trace Debt Recovery?

You could be missing out on things when you ignore letters from Trace Debt Recovery. Moreover, a bad situation could suddenly become a lot worse when you ignore a debt collector.

For example, you could be missing out on:

- Discovering the debt isn’t yours or its statute barred

- Being offered an affordable plan to get the debt resolved

- Having some of the debt wiped off

However, ignoring Trace when they contact you could lead to:

- Having to face court proceedings if it hasn’t already happened and there’s a CCJ and court order for you to pay!

- Having Enforcement Officers show up at your home

- Having to pay a lot more than the original debt

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can Trace Debt Recovery do?

Trace Debt Recovery must abide by the law and the Code of Practice when they contact you. I’ve listed what debt collection agencies can and cannot legally do here:

- Contact you over an unpaid debt by letter, email, phone

- Visit you at your home address

- Discuss a debt with you discreetly and politely

- Ask you to pay them directly

A debt collection agency cannot do any of the following when they contact you:

- Force entry into your home

- Talk to other people about your alleged debt problem including neighbours, family, friends, or your employer. It breaches privacy laws

- Pretend they are bailiffs and therefore have the same powers as an enforcement agent which is unlawful

- Make out the documents they show you are court-issued

- Talk in legal terms to confuse you

- Seize any of your possessions

- Clamp your vehicle

- Apply pressure for you to take on another loan to pay a debt

Who uses Trace Debt Recovery?

As mentioned, their core business is recovering unpaid parking tickets. Their client base includes:

- NCP Car Parks

- Councils

- Residential properties

- Hospital car parks

That said, the debt collection agency only works with car park operators who are recognised by the British Parking Association (BPA) and the International Parking Community (IPC).

Can you prevent Trace Debt Recovery from contacting you?

You can’t prevent Trace from contacting you, but you can write to the debt collector telling them when and how to contact you. For instance, if you prefer to be contacted by letter, Trace must respect your wishes.

If Trace Debt Recovery refuses to respect your wishes, it could be seen as them harassing you which they are not allowed to do! It’s deemed unlawful to be harassed by a debt collection agency!

How does Trace Debt Recovery find you?

The car park management company that issued the fine will pass all your details onto Trace. However, if you’ve moved house, Trace Debt Recovery has the tools to track you down over an unpaid parking fine.

How do you contact Trace Debt Recovery?

I’ve listed the contact details for Trace Debt Recovery here:

| Phone number | 0333 577 4447 (Contact Centre) |

| Website | https://thetracegroup.co.uk/ |

| Payments | 03300 080 477 (24-hour automated payment) |

| Address | Trace Debt Recovery UK Ltd PO Box 1448 Northampton NN2 1DW |

| Opening hours | 9am to 5pm, Monday to Friday |