How Long do I Have to Declare Points to My Insurance Company?

Let’s talk about penalty points and car insurance. This can be a worry. You may think that insurance will be much too costly after a conviction or points on your licence.

Well, we’re here to help you. Our blog is visited by over 1,000 people every month who are looking for guidance on how to manage insurance after a driving mishap.

In this guide, we will help you learn about:

- What penalty points are and why they matter.

- How to find a good insurance deal even with a conviction.

- The right time to tell your insurance company about your points.

- What happens when you do not declare your points.

- Ways to get cheaper insurance after a driving ban.

We know it’s hard to get good insurance after a conviction, but it’s not impossible. Stay with us as we take you through a journey of understanding and solutions.

Do penalty points on your licence affect insurance?

Yes, having unspent penalty points on your driving record can increase the cost of insurance premiums. Generally, the more penalty points you have, the more your premiums will be increased.

The reason for this is that insurers consider drivers with penalty points as more likely to be involved in an incident and need to make a claim. To offset the risk they take on by insuring vehicles driven by convicted drivers, they must charge more.

As a result, you might need to consider the high-risk car insurance market to find the cheapest policies.

How long do you have to tell insurance about speeding points?

Penalty points that were endorsed for speeding offences follow the same rules as other endorsed penalty points. Points when you’re caught speeding only have to be disclosed until they’re spent, i.e. after five years.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Is it illegal to not declare points?

Yes, as per the Road Traffic Act 1998, it’s illegal to withhold information from insurance companies. So you’re legally obliged to declare any unspent points on your licence.

What will happen when I declare a spent driving conviction to my insurer?

You should not be quoted higher insurance premiums as a result of disclosing spent convictions and spent penalty points.

Insurance companies are allowed to ask about these. And they often do, sometimes asking for details as far back as 10 years. But they shouldn’t use the information to increase your insurance quote.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Do I have to declare penalty points after 3 years?

Yes, driving convictions and penalty points that occurred within the last three years will still be considered unspent and you’ll need to declare them to your insurer.

How long do you have to declare points for insurance?

You must declare all driving convictions and penalty points that occurred within the last five years. Your penalty points are considered unspent until five years have passed, at which point they become “spent convictions”.

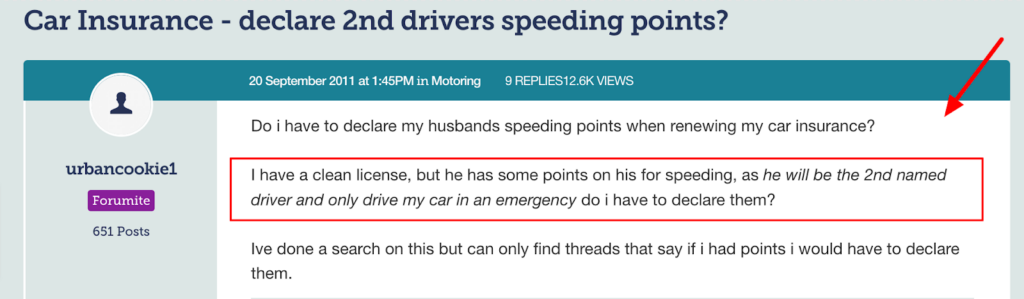

A related question is whether you have to disclose penalty points of named drivers, just like this forum user asks:

Source: https://forums.moneysavingexpert.com/discussion/comment/47078875#Comment_47078875

The answer is yes. The unspent convictions and penalty points of all drivers named on the insurance policy must be disclosed.

Can car insurance companies find out if you are lying?

It’s highly likely that a car insurance company can find out if you lied.

They can check your driving record with your permission. But it’s likely that you granted them this permission when you accepted a policy.

Therefore, they might end up checking your driving record after you took out the policy.

What are the consequences of not declaring points?

The consequences of not declaring points when applying to renew insurance or take out a new policy are:

- The insurance won’t be valid, so you’ll be driving an uninsured vehicle

- Driving without valid insurance could result in financial losses if you need to make a claim

- Named drivers will also not be insured

- Insurance companies might reject you for another policy

- Insurance providers might try and claw back part of the premiums you weren’t paying

The last potential consequence can seem quite harsh, especially considering the insurance provider wouldn’t have paid out if you did need to make a claim. But it does happen!

Do you need to declare penalty points for temporary car insurance?

Yes, you’ll be committing an offence by not telling insurance companies about unspent penalty points, even if it’s a short-term insurance policy.

What happens if you forgot to declare points on insurance?

Whether you intentionally forgot to disclose penalty points or made an honest mistake, the consequences are the same.

The main consequence is that your insurance policy won’t be valid for all named drivers, which puts you at risk of a serious financial loss if you’re involved in a road incident.

Can you pay to remove points from your driving licence in the UK?

It’s not possible to pay to have penalty points removed from your driving licence. Points are automatically removed when the time comes around, so you don’t have to do anything.

But if you were caught exceeding the statutory speed limit and you meet strict criteria, you might be offered the chance to attend a speed awareness course and avoid having three penalty points added to your licence.

One of the eligibility criteria is that this is your first speeding conviction in the last three years.

The speed awareness course has an admission fee, so it shouldn’t be used for financial gain. It can only really be used to educate yourself on the dangers of speeding and to avoid penalty points.

Want to know more about cheap convicted car insurance?

All isn’t lost if you have penalty points on your licence. It’s still possible to find cheap car insurance as a convicted driver.

I’ve discussed some of the techniques you could copy to hopefully shave money off the quotes you receive. Head to my convicted driver insurance page for the details!

Or if you have another question, why not ask me directly? It could be made into an anonymous blog that helps other readers!

How to checkpoints on your driving licence

You can check your driving licence record online to see how many penalty points you have. To do this, you’ll need your driving licence number, driving licence postcode and your National Insurance (NI) number.

You can also get details on your driving record by calling the DVLA.