Do I have to Pay HMCTS Debt Collection for Historic Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a letter from the HMCTS Debt Collection for an old debt? You might be feeling anxious about what to do next.

You’re not alone. Every month, our website is visited by over 12,000 people who want to understand and manage their debts.

In this article, we’ll explain:

- Who the HMCTS Historic Debt Team is, and if they are real

- What happens when you can’t pay an old court fine

- How to lower your repayments and settle court fines

- If you can ignore HMCTS debt collection and what happens if you don’t respond

- How to contact the HMCTS Historic Debt Team and seek debt advice

We know how scary it can be when dealing with debt collectors; some of us have been in your place. Don’t worry; we’re here to help you understand your options.

Why does HMCTS chase old court fines?

The HMCTS historic debt team chases old court fines because a great number of them were going unpaid. A study found the fines were not being settled because of the following:

- They were sent to the wrong addresses

- The court fines weren’t posted at all

How long can you be chased for unpaid court fines?

The HMCTS Historic Debt Team could chase you for an unpaid fine that was issued ten-plus years ago. In fact, reports suggest the team has met with a great deal of success since it was created in 2016!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you ignore HMCTS debt collection?

No. It’s never a good idea to ignore correspondence from the HMCTS Historic Debt Team.

However, you should also check whether the letter is genuine by contacting the team directly sooner rather than later!

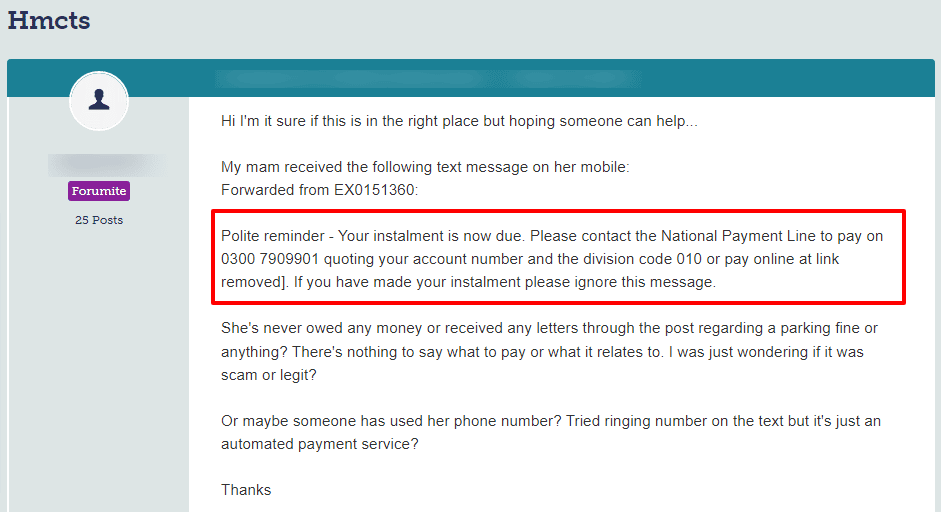

Check out the question someone asked on a popular forum about HMCTS:

Source: Moneysavingexpert

What happens when you don’t respond?

When you don’t respond, the situation just gets worse rather than better. Plus, you could end up with enforcement agents visiting you at home!

Moreover, the government debt team should take your personal circumstances into account. They could be open to any offers to settle an unpaid fine in instalments if you can’t afford to settle the full amount!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when you can’t pay an old court fine?

The HMCTS historic debt team should take your personal situation into consideration when you can’t settle an old fine in full. Lots of people are in financial hardship these days, so you’re not alone.

You should seek debt advice from a charity and you should calculate how much you can realistically afford.

That said, you must make sure the amount you propose to pay every month is something you can afford.

A default on an agreed payment arrangement to the HMCTS Historic Debt Team could make matters worse!

Does the HMCTS team have to accept your proposal?

No. The HMCTS Historic Debt Team is not obliged to accept a payment arrangement to settle the amount owed in instalments.

For example, if the debt is passed to an enforcement agency, it’s too late to pay the team directly. Any payments made at this stage are dealt with by the enforcement agents.

It means you may have to pay additional fees to cover the cost of the enforcement agents! So, the original unpaid court fine could increase making it harder to settle.

Which enforcement agencies does the HMCTS team use?

The HMCTS Historic Debt Team tends to use three approved enforcement agents which I’ve listed below:

- Collectica Limited

- Excel Enforcement Limited

- Marston Holdings

So, when you get a debt letter from any of the above with ‘HD’ or ‘HMCTS HD’, it relates to an unpaid court fine. It’d be a mistake to ignore it.

Will your details be sent to enforcement agencies straight away?

No. The HMCTS historic debt team typically attempts to resolve things with you first. You’d receive a ‘Further Steps Notice’ which details what happens when you don’t settle the amount owed.

You shouldn’t ignore the notice because it allows you the chance to settle what’s owed. Plus it stops things from going any further.

It’s worth noting you can file an appeal within 10 days of receiving a Further Steps Notice.

How do you contact the HMCTS Historic Debt Team?

As mentioned, it’s always best to check whether a debt letter from the historic debt team is genuine. You should do this by contacting the team as soon as possible.

Moreover, staying in touch with them means the matter won’t be escalated to an enforcement agency!

You can contact the HMCTS Historic Debt Team in the following ways:

| By telephone | 0300 123 9252 |

| In writing | Historic Debts team, Port Talbot Justice Centre, Harbourside Road,Port Talbot, SA13 1SB |

| Advice | https://www.gov.uk/government/news/hm-courts-tribunals-service-advice-to-debtors-on-unpaid-historic-fines |