Should I be Hiding Money from IVA? Consequences if you do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about an IVA (Individual Voluntary Arrangement) and the idea of hiding money has crossed your mind, you’re in the right place to get some help. This article is here to answer your important questions.

Each month, over 12,000 people visit our site for advice on stressful debt topics. Here’s what we’re going to cover:

- The basics: what an IVA is, and how it works.

- The rules: what you need to pay, and what can happen if you hide assets or money.

- The outcomes: what happens if things don’t go to plan, or if you’re made bankrupt.

- The people involved: who handles your IVA and how to contact an Insolvency Practitioner.

- The next steps: what other debt help is out there for you.

We understand how tough it is when you’re in debt; some of our team have been in the same boat. You’re not alone; we’re here to help you figure things out,

Let’s dive in.

How long does an IVA last?

The typical time span for an IVA is 5 or 6 years, but this can vary depending on which debt management plan you enter into.

Once you reach the end of an IVA, any debt that remains is ‘written off’ by your creditors. It’s part of the agreement. You pay as much as you can afford every month.

In exchange, your creditors wipe off what remains of the debt at the end of the agreement.

Who handles your IVA?

A licensed insolvency practitioner handles your IVA over the years it’s in place. They’ll provide you with advice and keep an eye on your finances as long as the IVA is in place.

Moreover, the practitioner provides advice on how much you should repay your creditors so the instalments remain affordable.

If you hide any savings or money when you’re in an IVA, the chances are that an insolvency practitioner would find out about it.

You’d risk being made bankrupt and losing any money or savings you were attempting to hide in the process!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you contact an Insolvency Practitioner?

I’ve listed how you could find and contact an Insolvency Practitioner in the table below:

| Find an Insolvency Practitioner (IP) | https://www.gov.uk/find-an-insolvency-practitioner |

| Search the bankruptcy & Insolvency register | https://www.gov.uk/search-bankruptcy-insolvency-register |

| Complain about an Insolvency Practitioner | https://www.gov.uk/complain-about-insolvency-practitioner |

Please note, the above information only applies to England and Wales

Can you hide assets and money before an IVA?

No. It’s actually illegal to hide your assets and money when you know you’re about to enter into an IVA!

You could get into serious legal trouble if you do!

Insolvency practitioners are experts when it comes to finding out about your assets and any money you have.

They perform what is essentially a thorough and complete review of your finances. The consequences can be severe once any assets or money that you hid before you entered into an IVA are found!

You risk losing everything and could be made bankrupt!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Does an insolvency service check your bank account?

No. An Insolvency Practitioner needs to see proof of your earnings and assets. However, it’s unlikely that they could see your actual bank account. But they’ll ask you to provide bank statements or payslips.

Practitioners have a way of finding out If you attempt to hide money and assets from them! Plus, as mentioned the consequences are serious which means you risk losing everything.

What happens if you hide assets at the beginning of an IVA?

An IVA is a legally binding agreement between yourself and your creditors. The contract allows you to pay affordable monthly payments to settle your debts.

Your creditors agree to ‘write off’ any remaining debt once the IVA ends.

So, when an Insolvency Practitioner first drafts an IVA proposal for you, all monthly repayments are calculated on what you can realistically afford.

This is done by factoring in the following:

- Your monthly incomeAny extra earnings you receive

- Bonuses you receive

- Your savings

- Your living expenses

It’s worth noting that the way an IVA arrangement is set up means that it’s pretty hard to hide any money from a practitioner at the outset.

This is because all sources of income and earnings are declared when you enter into the IVA. Money left over after deducting living expenses goes towards paying your creditors.

If you hide assets, or other money at the beginning of an IVA, you’d be breaching the agreement from the outset.

In short, your IVA would be doomed to fail which could have serious consequences!

What happens if you hide an inheritance?

Your circumstances could change during an IVA. It happens. Sometimes for the worse, but it could also change for the better especially as an IVA could last five to six years.

You could come into an inheritance!

In short, your disposable income could increase significantly during an IVA agreement thanks to an inheritance you receive.

An insolvency practitioner would likely discover you received an inheritance whether you tell them or not.

Again, if you attempt to hide the fact you received a windfall inheritance and don’t declare it, you risk being made bankrupt.

Not only that but the money that you inherited would be seized too!

An insolvency practitioner’s job is to keep an eye on your finances, provide you with a debt solution and deal directly with your creditors.

In short, if you have any extra money, they’ll soon know about it. It’s their job!

» TAKE ACTION NOW: Fill out the short debt form

What happens when you hide extra money?

When you enter into an IVA, you are legally required to let your practitioner know when any money comes your way.

It’s your duty to tell your IVA provider about any changes in your circumstances so they can review things!

It allows an Insolvency Practitioner to assess whether you’d need to revise your IVA arrangement. Maybe you need to pay less every month thanks to the rise in the cost of living.

Or maybe, the practitioner would raise the amount you pay every month because of the extra money you got.

It’s important to understand that an Individual Voluntary Agreement is regulated by the courts. As such, when you hide assets and any other money that comes your way, you risk losing everything!

In the worst-case scenario, you could face receiving a custodial sentence. In short, you could go to prison for hiding money and assets from an Insolvency Practitioner.

How do you pay off debts with an IVA?

You pay any excess money you have to an insolvency practitioner each month. It’s the way you pay off any debts you have with creditors.

The amount you pay takes into account how much you need to live and how much money you receive every month.

Whatever is left over, gets used to pay off your creditors monthly.

What is the Windfall Clause in an IVA?

You could win the lottery while an IVA is in place. Or you could come into an unexpected inheritance.

Unexpected lump sums received when you entered into an IVA are typically covered by what’s known as a ‘windfall clause’. It’s a clause that can be included in the agreement.

It’s always worth checking whether the clause is included in your IVA. Your insolvency practitioner can tell you if it is or not!

If the money you receive is more than the amount you owe to your creditors, you’d have to pay off the IVA early.

You’d also have to pay the practitioner’s fees and statutory interest out of the windfall money you receive.

That said, if the money you receive is less than £500, you’d get to keep the full amount and none of it would be used to repay your creditors.

What happens when an IVA fails?

You may find that your creditors stop ‘considering’ an IVA agreement which is referred to as an ‘IVA failure’.

Several factors could result in this happening which I’ve listed below:

- You are found to have hidden money or assets that could have been used towards repaying your creditors

- You failed to make the agreed minimum payments on time or not at all and creditors won’t accept that you pay anything less

When this happens the IVA is null and void. Your debts still stand which means creditors could start legal proceedings against you.

Also, you’d still have to pay the Insolvency Practitioner for the work they provided before the IVA failed.

If you don’t pay, a practitioner could make you bankrupt on top of everything else!

The only way to prevent an IVA from failing is to declare your extra earnings, and when you’ve left an inheritance. Moreover, you’d have to make agreed monthly payments on time.

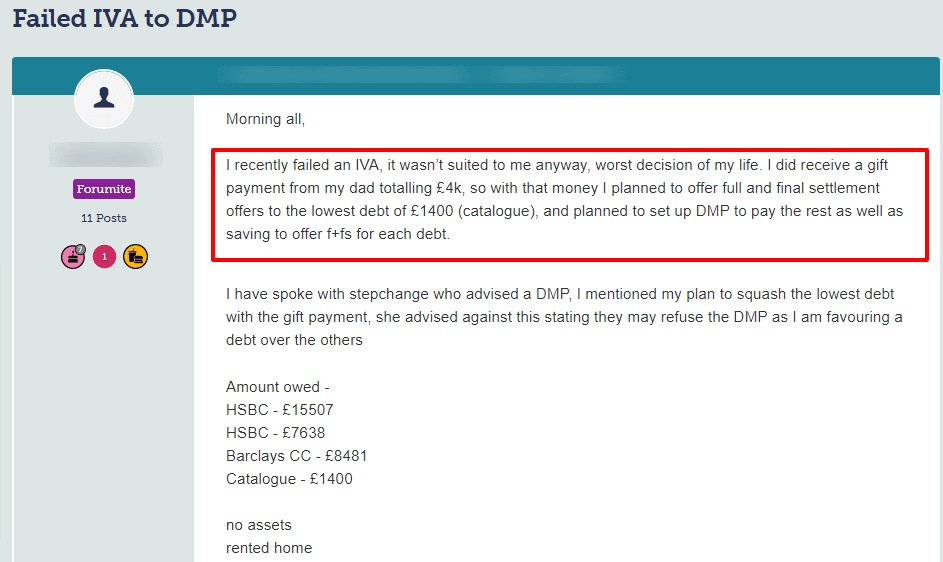

Check out what happened to one person whose IVA failed:

Source: Moneysavingexpert

Could you face court action for hiding money from an IVA?

Yes. You could be taken to court if you’re found to have hidden money, assets and an inheritance from your insolvency practitioner.

You’d have committed fraud!

You’d incur further costs and legal fees if you have to seek the services of a legal expert when it happens!

So, as you can see, not declaring assets and money to an Insolvency Practitioner can have serious consequences.

First, your IVA would be immediately terminated if it’s found you hid the money and assets!

Second, you could face court action and lose everything. And third, if the offence is serious enough, you could even get a custodial sentence for hiding things when you entered into an IVA.

What happens after an IVA Fails?

When you don’t declare all your assets and money when you enter an IVA, you have breached the terms of your agreement. In short, the agreement would likely be terminated.

When this happens, the Insolvency Practitioner handling your case sends you a ‘letter of termination’ together with a ‘failure report’.

The report will include every detail of why your IVA failed.

This is when your IVA is terminated and you can’t make any further payments. It means the money owed still stands, so you’d owe the remaining balance to your creditors.

At this stage, it’s your responsibility to make any future payments to clear the total amount owed. Otherwise, you face being made bankrupt!

What happens when you’re made bankrupt?

Individual Voluntary Agreements are legally binding. They provide protection from being hassled by creditors for payment. When your IVA fails, the protection is no longer there!

Your creditors can contact you to recover the money you owe them. Not only this, but your creditors have the power to bankrupt you as you breached your agreement with them.

Plus, your Insolvency Practitioner can also make you bankrupt because they’d have the backing of the Insolvency Practitioners Association (IPA).

Lastly, should you hide money when you’re in an IVA?

No. Definitely not. Hiding money and assets from your Insolvency Practitioner could have serious consequences.

Not only could you lose the money and assets you tried to hide, but you could face bankruptcy too. In a very worst-case scenario, you could be sent to prison for committing fraud!

It’s far better to declare all your earnings, assets, and any money you inherit so you pay off your debts and keep to your Individual Voluntary Agreement.

Thanks for taking the time to read my post. I hope the information helps you come to the right decision when dealing with money and assets in an IVA!