How to Get Your First Plus Elderbridge Loan Debt Written Off

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re having a tough time paying off your First Plus Elderbridge loan debt, don’t worry. You’re not the only one. In fact, over 12,000 people visit this site each month for advice on money troubles.

In this article, we’ll explore:

- The story behind First Plus and who took over their loans.

- What you can do to lower your repayments.

- The facts about Elderbridge, the company now dealing with First Plus loans.

- What happens if you can’t pay and how to reply to debt letters.

- Ways to get your First Plus loan written off or to make a settlement.

We understand the stress and worry you might be feeling as some of our team members have faced money problems themselves. They know how hard it can be and they’re here to help you. Read on to find out more about how you can tackle your First Plus Elderbridge loan debt. Together, we can find a way forward that works for you.

Who took over First Plus loans?

First Plus loans were taken over by a company called Elderbridge. There are multiple accounts online to comfortably verify this as true.

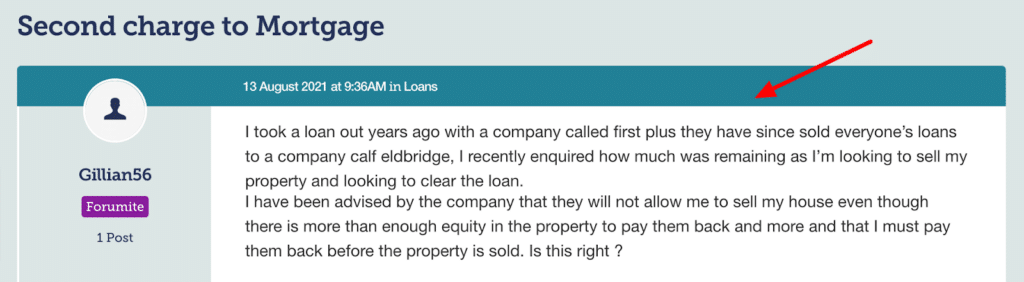

But there are also accounts of Elderbridge being difficult to deal with:

Source: https://forums.moneysavingexpert.com/discussion/6289961/second-charge-to-mortgage

How to reply to First Plus debt letters

Your can reply to First Plus Elderbridge debt payment requests by:

- Telling them the debt is too old to be enforced

- Telling them to prove you owe the debt

- Or by paying the debt as agreed

When to send a statute-barred response

The debt becomes too old to be subject to court action after six years in England and Wales and after five years in Scotland. This is known as statute-barred and prescribed, respectively. In fact, it automatically gets written off in Scotland after this time period.

When the debt is too old to be subject to court action there is no way for Elderbridge to try and get a court order to make you pay.

So if your debt is too old to be enforced – you must always check with a debt charity as there are some other boxes you need to tick – you can reply to let them know you won’t be paying for this reason.

When to send a prove-the-debt letter

If your First Plus Elderbridge loan is still legally enforceable, you can always make ELderbridge prove you owe the debt. When you request proof of the debt, they must send a copy of the original agreement you signed with First Plus.

Until they send this proof, you’re not obligated to pay the debt!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you get a First Plus loan written off?

Yes, it’s possible to get some or all of your First Plus loan written off in specific situations.

The method you use to do this will depend on your personal circumstances and the other debts you may or may not have.

Some of the ways to get some or all of your First Plus loan written off are:

- Use the statute-barred loophole discussed above

- Use a Debt Relief Order, which is a debt solution that blocks all creditor contact and then writes off all the debt after one year if your finances haven’t improved. But it cannot be used for secured loans like second-charge mortgages.

- Declare yourself bankrupt if this is the most suitable debt solution for you overall.

- Make a debt settlement offer to Elderbridge

How to make a First Plus loan settlement figure

A debt settlement offer is when you offer to make a large lump sum payment to the creditor but they have to write off some of the debt in the process. For example, if you owed £15,000 on a First Plus Elderbridge loan, you might offer them a £12,000 lump sum if they write off the remaining £3,000.

If Elderbridge accepts your debt settlement figure, you must get it in writing before making any payment. Don’t rely on the information you were told over the phone. And once you do pay, keep a copy of the offer acceptance and proof of payment.

The only downside to writing off some of your First Plus Elderbridge loans in this way is that partial repayment is recorded on your credit file. This record can make it more difficult to get approved for loans and credit cards in the immediate future.

You may need to repair your credit score first.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you ignore First Plus Elderbridge debt?

No, if Elderbridge owns your debt you shouldn’t ignore them. But there might be ways to avoid paying some or all of the debt.

If you do ignore the debt and payment requests, you could be subject to court action and eventually a County Court Judgment (CCJ).

If you continued to ignore the CCJ, you could then have to deal with bailiffs or even have the debt deducted from your wages, pension or benefits each month until it is repaid.