Should I Pay Equita Bailiffs Debt or Can I Appeal?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with Equita Bailiffs can be scary. If they have contacted you about a debt, you might be worried and unsure what to do next. You’re not alone in this. Every month, over 12,000 people come to me for guidance on debt problems.

In this article, we’ll explore:

- Who Equita Bailiffs are and what kind of debt they collect.

- How you can manage your repayments.

- What to do when Equita contacts you.

- The rights you have when dealing with bailiffs.

- How you can appeal if you think the debt isn’t yours.

Being in debt can be tough. We understand how you feel and want to help. Some members of our team have been in your shoes before. They know what it’s like to deal with debt and bailiffs. Let’s dive in and learn more about dealing with Equita Bailiffs and how to handle the situation.

What should you do when Equita Limited contacts you?

If Equita contacts you about an alleged debt you should take notice. You shouldn’t dismiss a debt collector or bailiff! First, you need to find out whether they are chasing the right person.

Second, you may find the debt is too old to enforce, or that you already settled the outstanding amount with the creditor!

As such, you should respond to Equita Ltd within 7 days of receiving the Notification of Enforcement to prevent the matter from escalating.

It also means that enforcement agents won’t show up at your door if you stay in touch with them.

» TAKE ACTION NOW: Fill out the short debt form

Should you pay Equita Bailiffs?

If the debt is yours and it’s not too old to enforce, and if you can afford it, you should settle the debt straight away.

It will get rid of Equita bailiffs and save you a whole lot of stress and anxious moments!

If you pay the debt in full, make sure Equita provides you with an official receipt as proof the debt is settled.

You may not be able to settle the debt in full, but Equita states on their website that they work with debtors to sort out a repayment plan. So, contact them and ask them to set one up for you!

If they agree to a repayment plan, make sure you keep up with the payments. If you don’t, the agreed repayment plan could be cancelled and you’d have to pay the total amount owed.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if Equita bailiffs are chasing the wrong person?

It happens. Maybe the real debtor’s name is very similar to yours. Or maybe it was the last person who lived at your address who owed the money!

There are several reasons why Equita bailiffs may be chasing the wrong person. It could just be a clerical error which needs to be addressed.

The only way to correct the wrong information is to prove to Equita that you’re not the person who owes the money!

Equita Limited must put everything on hold until they’ve established you are not the debtor.

Did you already settle the debt with the original creditor?

You may have already settled the debt with the original creditor and therefore there’s no outstanding money to pay.

Again, you’d have to prove to the bailiff that the money was paid and that the original creditor received the funds!

Can Equita Bailiffs make you pay a debt that’s not yours?

No. If the debt isn’t yours, Equita bailiffs can’t make you pay it. If an enforcement agent pressures you into paying, you can file a complaint (Link to Youtube) against them for harassing behaviour.

Youtube link: https://m.youtube.com/watch?v=L-npiufsFPw

You could seek an injunction against the bailiff. You could even be entitled to compensation for the stress they caused you!

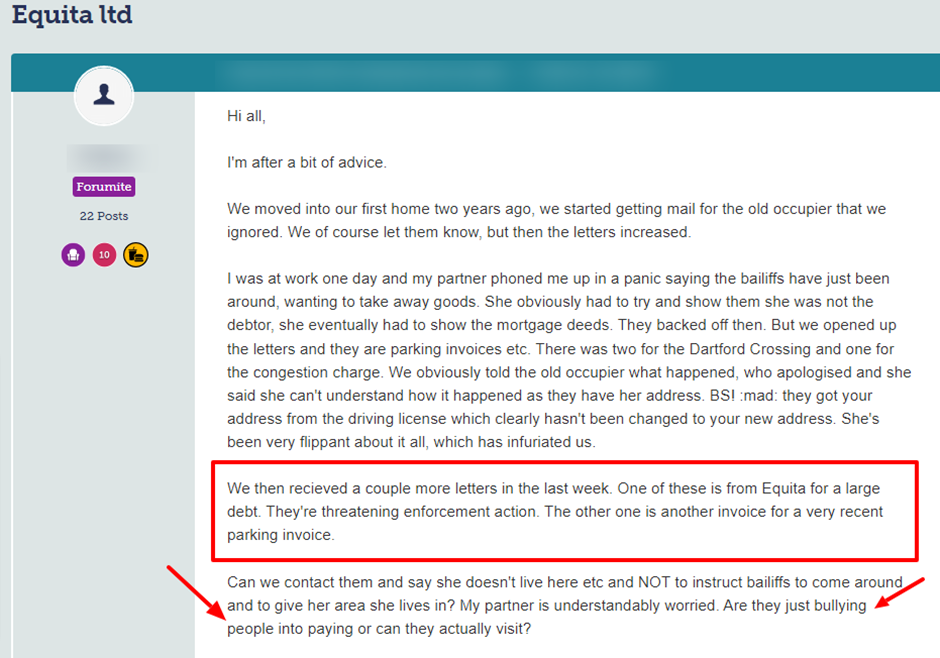

Check out what happened to an unfortunate couple who were contacted by Equita over unpaid tickets that weren’t theirs!

Source: Moneysavingexpert

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you appeal an Equita bailiffs debt?

No. As soon as enforcement agents are charged with recovering a debt, the right to file an appeal is long past. In short, you have two options once you get a Notice of Enforcement which are:

- To pay the debt at the earliest possibility

- Ask to set up a repayment plan to clear the amount you owe

What happens when you ignore Equita Bailiffs?

Things get more expensive and harder to settle when you ignore Equita Bailiffs. As with all enforcement agents and debt collectors, they are incredibly persistent!

In short, Equita Limited will not give up and will take the matter further when you ignore them.

More importantly, by ignoring correspondence and notices from enforcement agents you could miss out on determining important things.

This includes:

- Discovering the debt is not yours

- The debt has already been settled

- It’s too old to enforce because it’s statute barred which is covered by the Limitations Act

So, in short, even when you know the debt isn’t yours, you should never ignore a Notice of Enforcement from Equita bailiffs!

If the debt is yours and you ignore things, it’ll be that much harder to settle. Plus, the amount you owe will increase because bailiffs add their costs to the debt.

You’d end up paying the following on top of what you already owe:

- A fee for sending you the Enforcement Notice which is a whopping £75 (Compliance)

- A fee for visiting you at your home address which is another £235 (Enforcement)

- A fee for seizing and selling your possessions to recover the amount owed which is £110 or 7.5% of an amount over £1,500

When happens if a debt is too old to enforce?

A debt becomes statute barred when it’s 6 years or more old! Under the Limitations Act, you can’t be forced to pay a debt when it’s statute barred.

But for this to be the case, the following must apply:

- You had no contact with the credit or admit owing the money in 6 years

- No County Court Judgement exists against you relating to the debt

What’s the process used by Equita Bailiffs to recover debts?

Equita’s enforcement agents first obtain an order from a Judge to recover the amount you owe. They then send you a Notice of Enforcement asking you to settle the debt.

The Notice also informs you of their intended visit to your home in seven days.

If you don’t respond to the Notice before the seven days are up, an Equita enforcement agent will turn up on your doorstep. They will ask you to pay the amount owed on their first visit!

Can an Equita bailiff just show up at your home?

No. As previously mentioned, enforcement agents can’t visit you without prior warning. Unless they are collecting specific debts such as unpaid taxes, Stamp Duty and Criminal fines!

In short, Equita must send you a Notice of Enforcement at least seven days before their intended visit.

The seven days warning allows you the time to either pay or contact the bailiffs to set up a repayment plan. If the debt is yours, that is!

How should you deal with an Equita Bailiff visit?

You don’t have to let an Equita enforcement officer into your home. They could insist that you let them in, but you should NEVER let them in!

Instead, ask the bailiffs to provide you with all the relevant court-issued documents along with their official IDs. You should ask them to push these through your letterbox or under the door!

If they can’t provide you with all the right documentation and IDs, ask them to leave which they must do! Then call their head office straight away and if you think the agents aren’t genuine, call the Police!

What sort of ID should an Equita Bailiff produce?

The sort of ID an enforcement agent from Equita should produce when asked could include:

- Badges or ID card proving they’re from Equita Limited

- A detailed breakdown of the alleged debt you owe

- The Warrant of Recovery or other relevant documents authorising them to visit or enter your home

Enforcement agents can’t break down your door to gain entry, but in some cases, they can ask a qualified locksmith to open a locked door. The cost of this service is added to the amount you owe!

What can you do if Equita seize some of your possessions?

If Equita bailiffs seize some of your possessions, their intentions are to sell them to recover what’s owed. However, you could settle the debt and recover the items they took.

You could also opt to purchase the items yourself which is another way of retrieving your seized possessions.

That said, you could have grounds to insist the items are returned if you can show that Equita enforcement agents didn’t follow the right procedure to enter your home.

What can’t an Equita bailiff do?

All bailiffs must abide by a Code of Practice which stipulates how they must act, what they can do, and what they are not allowed to do.

For example, an Equita bailiff cannot:

- Contact you at unreasonable hours of the day or night

- Contact you where you work when you told them not to

- Harass or bully you

- Confuse you with legal jargon

- Refuse to leave your house when you asked them to (harassment)

- Force entry into your property although in some cases bailiffs can force entry but only with the help of a qualified locksmith

- Seize certain items which include your pets!

Can you stop Equita Bailiffs from contacting you?

No. Once a court issues an order and bailiffs get involved in the recovery of an unpaid debt, there’s no way of stopping the process that follows.

The only way to prevent the matter from escalating to a bailiff’s visit is to contact Equita and settle the amount you owe.

It’s not an option that many people can afford these days. Especially if they are already struggling with their finances.

If you can’t pay the amount owed in full, speak to Equita. They claim on their website to work with you to come up with an affordable repayment plan that also ‘suits’ them!

However, you should contact one of the leading UK charities first to get free debt advice first. There are debt solutions available, but you need to choose the one that suits your unique needs.

If you choose the wrong debt solution, it could make your financial situation even worse and therefore, harder to resolve.

Can you file a complaint against Equita Bailiffs?

Yes. If Equita bailiffs act unlawfully, you have the right to file a complaint with their head office. Give them time to make things right but if they don’t, you can opt to take the matter further.

You can file an official complaint with their trade association. In most instances, an enforcement officer will refer the complaint to an original creditor. That said, you could take the matter further and appeal a court’s decision.

As members of CIVEA, Equita must respond to complaints within 10 working days. If you’re not satisfied with their actions or response, you can escalate things to CIVEA.

If the matter involves high court enforcement, you can file a complaint to the High Court Enforcement Officers Association (HCEOA).

How do you contact Equita Limited Bailiffs?

I’ve listed ways you can contact Equita Limited Bailiffs in the table below:

| Website | https://equita.co.uk/ |

| Phone number | 01604 628 360 |

| Postal address | Equita Ltd, 42-44 Henry Street, Northampton, NN1 4BZ |

| [email protected] | |

| Online payment | https://equita.co.uk/customer-portal/make-a-payment/ |

| Online Enquiry for Outstanding Account | https://equita.co.uk/contact-us/outstanding-account/ |