Do I Pay Elderbridge TV Licence Debt (tvlspp payment)?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you have a TV licence debt with Elderbridge? Are you unsure about what to do next? Don’t worry; you are in the right place. Every month, more than 12,000 people visit our site for advice on debt issues, just like this one.

In this article, we’ll help you understand:

- Who Elderbridge is and why they might be contacting you.

- What a TV Licence simple payment plan (tvlspp) means.

- Ways to lower your payments and manage your debt.

- What happens if you don’t pay your TV licence debt.

- How you can stop Elderbridge from contacting you.

We understand how stressful dealing with debt can be; some of us have had to deal with debt collectors ourselves. We’re here to provide clear, helpful advice to make your situation easier.

So, let’s dive in and start addressing your concerns about Elderbridge and your TV licence debt.

Why would Elderbridge contact you?

Getting mail, emails, text messages or phone calls from Elderbridge debt collectors could send you into a panic. Once you’ve calmed down, you should respond sooner rather than later.

The quicker you reply, the sooner you resolve the problem. Maybe Elderbridge is chasing the right person and is the debt too old to enforce?

If you don’t get in touch, you may never know and end up with a County Court Judgment for a debt that’s not even yours!

Is the debt statute-barred?

The first thing to check when Elderbridge contacts you is if the debt is still current or whether it’s statute barred.

Courts won’t take on cases that involve statute-barred debts. Plus, Elderbridge is known to buy older debts, so it’s always worth checking!

If it turns out the debt is too old to enforce, you can’t be made to settle the amount owed on a TV Licence!

Under the Limitation Act, the original creditor/debt collector has run out of time to get paid. However, although the debt can no longer be enforced, it doesn’t vanish and remains on your credit file till it expires!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you ignore Elderbridge debt collectors?

No. As mentioned, you won’t find out if the debt is statute-barred or if it’s not even yours when you ignore things.

However, if the debt is yours and it’s still current, ignoring Elderbridge won’t make the problem go away. Debt recovery companies are persistent. It’s how they make their living!

Also, some collection agencies are known to use questionable tactics to get you to settle debts. This includes harassment and intimidation, both actions are unlawful which doesn’t seem to matter to certain debt recovery companies!

In short, ignoring debt collectors just makes the situation and experience a lot more stressful!

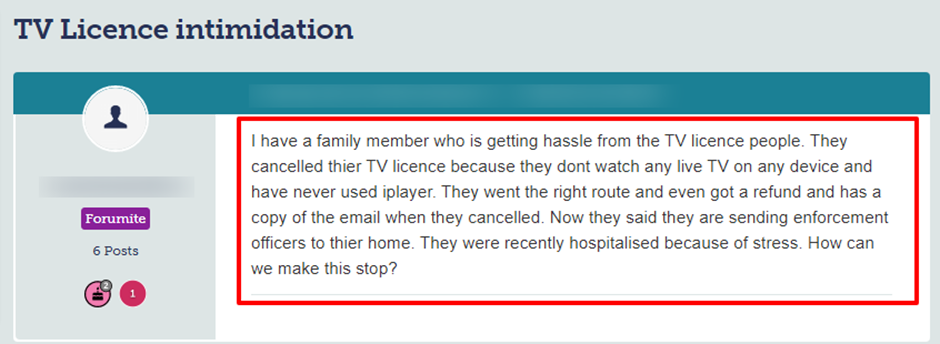

Just look at what happened to one unfortunate person who cancelled their TV Licence the right way. Yet, the threat of enforcement officers visiting them seemed to be on the cards!

Source: Moneysavingexpert

When is a TV Licence debt statute-barred?

A debt must meet specific criteria to be statute barred. For example, it must be at least six years old. Plus the following must apply:

- You or any of your representatives haven’t admitted owing money in six years

- You or any of your representatives didn’t settle any of the debt in six years

- There’s no Order to Pay

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is the debt yours to settle?

You should also check all the details of an apparent debt are correct. Collection agencies are known to make mistakes! Especially if they don’t have the right person’s details and current address on file.

Elderbridge may have already proved the debt is yours, but if they haven’t, it’s your right to ask them to ‘prove the debt’. It’s their obligation to do so and not yours to prove.

You should never just accept a verbal confirmation from Elderbridge. They must send you a copy of an agreement or contract. Moreover, it has to be authenticated by the original creditor/provider.

Even when you know it’s yours, you should send them a “prove it” letter because Elderbridge can’t escalate things until they do!

For example, it allows you to gain a little time if you need to sort things out if you need to!

What happens if Elderbridge can’t prove the debt?

If Elderbridge can’t prove you have a TV Licence debt, they can’t force you to settle the debt. Furthermore, if they start legal proceedings without proof of owing the money, you can inform the judge.

Tell the judge you’re still waiting for Elderbridge to provide you with an authenticated copy of a credit or other agreement!

A judge would find it challenging to rule in the debt collector’s favour if they can’t prove things!

What if the debt is proven?

You’ll have to settle the amount if Elderbridge proves you owe money on a TV Licence. There’ll be no getting out of it.

However, you should seek advice from one of the debt not-for-profit organisations if you’re struggling with money and debt collectors. They would provide support and help on how best to proceed and offer essential help regarding affordable payments.

But let Elderbridge know what you’re doing so they don’t escalate the matter!

Debt collection agencies must allow you the time to find the right plan to suit your needs.

Should you pay Elderbridge?

You should only pay Elderbridge when you’re satisfied the debt isn’t statute barred and that it’s yours to settle!

If the debt collector has proved you owe the money, you’ll need to pay what’s owed! But should only offer to repay what you can afford!

However, you should seek advice from a debt expert before you admit or sign anything. Their advice could be invaluable when it comes to negotiating a fair repayment schedule with Elderbridge!

Will Elderbridge accept a direct debit payment?

Yes. Elderbridge could agree to a repayment schedule that involves you settling what’s owed by DD. It may be the best way to repay what’s owed.

However, you can’t miss a scheduled payment otherwise you may be asked to settle the full amount!

What is the TV Licence simple payment plan?

The Simple Payment Plan was set up to help people who are struggling financially. It allows you to make TV Licence payments every fortnight or monthly over 12 months. It’s not the same as any other current TV Licence plan!

Do you need a TV Licence?

The laws regarding TV Licences are confusing, to say the least. I mean, do you need a licence if you only watch programmes on your favourite device?

The answer is, yes you need a licence to watch live TV, record programmes or download them on your BBC iPlayer!

If you don’t have a licence, you could be breaking the law.

But the rules are blurry which often leads to people falling foul of the law.

What happens if you don’t pay?

When you don’t pay your TV Licence you could risk prosecution and a fine of up to £1,000. Plus, there’ll be legal costs too!

That said, when your overdue account is sent to Elderbridge, things could get even more expensive! Especially if a judge issues an Order to Pay the outstanding.

In short, the debt collection process begins which can prove stressful!

Why is there an Elderbridge tv licence debt tvlspp on the bank statement?

Chances are a judge issued an Order to Pay the debt and Elderbridge applied for an attachment on your bank account. It’s their way of recovering the outstanding debt!

If you failed to attend a hearing or respond to Elderbridge, this could happen and you’d not even know! Why? Because you didn’t realise how far the debt collection process had gone!

Will Elderbridge take you to court?

If Elderbridge purchased the debt, they have control over what happens next. They’ll send you lots of threatening letters and one of them will be a Letter Before Action (LBA).

An LBA lets you know that Elderbridge is about to begin legal action to recover what you owe. It could be an idle threat or the debt collector could be serious about starting legal proceedings!

You need to consider things carefully before refusing to acknowledge these letters. The threat could be real or maybe not!

Can you stop Elderbridge from contacting you?

No. Elderbridge has the legal right to contact you about an apparent debt. However, they must follow the law when they do!

That said, you can write to Elderbridge telling them how to contact you. For instance, you can send a letter by recorded delivery saying you only want to be contacted by letter!

The debt collector must oblige but if they continue to call you or contact you in other ways regarding debts you owe, it could be seen as harassment.

Harassing behaviour on the part of Elderbridge is unlawful!

You’d have the right to report them to the Financial Ombudsman Service (FOS).

What can debt collectors do?

Debt recovery companies can do any of the following without breaking the law:

- Contact you by phone, letter, email or text

- Discuss an apparent debt with you politely and discreetly

- Ask you to settle the amount owed directly to them

Debt collectors must be fair and show empathy when assessing your personal circumstances when discussing an alleged debt with you. If they’re rude or they harass you, they’d be breaking the law!

What can’t a debt collector do when they contact you?

A debt recovery company cannot do any of the following when they contact you about an alleged debt:

- Force their way into your home, clamp vehicles or seize your possessions

- Infer they are enforcement officers and therefore, have the same powers which they do not

- Show you official papers and other documents that appear to be court-issued

- Pressure you into borrowing more money to pay off their debt

- Harass you with constant phone calls, texts, and emails

- Visit you when you are at your place of work

- Discuss an apparent debt with your employer, friends, neighbours or a family member

- Threaten you

Elderbridge must respect privacy laws and your rights as a consumer. If they don’t you could report them to the Financial Ombudsman Service and The Office for Fair Trading.

Will Elderbridge give up chasing you?

No. It’s unlikely that Elderbridge would stop chasing you, debt collectors seldom give up!

Today, they have tracing tools so even if you moved several times, they could still catch up with you. That said, it might take them a while, which could see the debt being statute barred!

Can you complain about Elderbridge?

According to The Office for Fair Trading (OFT), debt recovery companies often use worrying tactics when pursuing debtors.

Many of them fail to follow OFT guidelines which set out how a debt collector must behave. I’ve listed some examples below:

- Treat debtors fairly without using threatening or aggressive tactics

- Be clear and transparent when discussing an alleged debt

- Be empathetic to people who are experiencing financial hardship

- Factor in a debtor’s personal circumstances when dealing with the debt

It’s worth noting that you may have to complain using the debt collector’s full company name.

How do you contact Elderbridge Debt Collectors?

I’ve listed ways to contact Elderbridge in the table below:

| By telephone | 0345 8400 244 |

| By fax | 0345 650 6217 |

| Via email | [email protected] |

| Online | www.elderbridge.co.uk |

| By post | Elderbridge Ltd. PO BOX 908 Newport, NP20 9NX |

| Opening times | Monday to Friday: 9 am to 5.30 pm |