What if I Don’t Pay EDF Debt Collection Agency?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

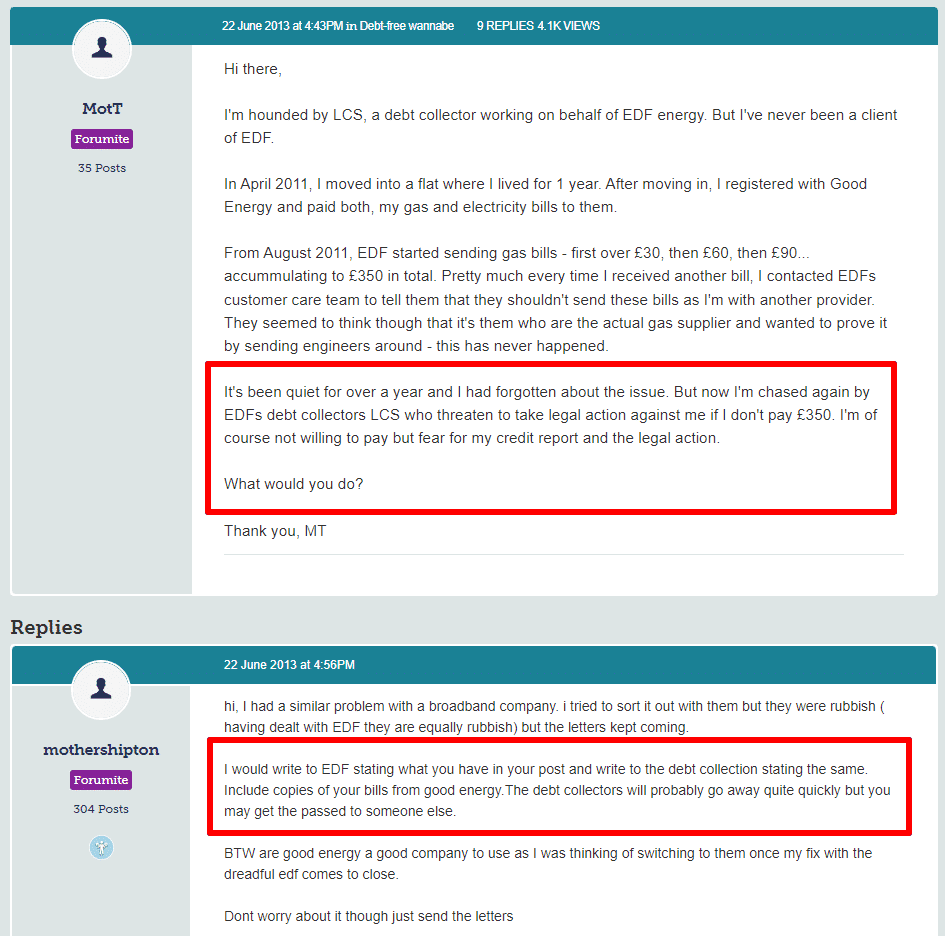

Are you worried about a debt you owe to EDF? Or perhaps you’re concerned about the actions of debt collectors?

You’ve come to the right place. Each month, over 12,000 people visit our site for advice on topics like this one.

In this easy-to-understand guide, we’ll explore:

- Who EDF is, and whether it’s a debt collection agency

- Who collects debts for EDF and how they do it

- The possible outcomes if you don’t pay EDF, including the risk of a County Court Judgement (CCJ) or a visit from bailiffs

- Tips on how to deal with bailiffs at your door

- Ways to possibly lower your repayments to EDF

Our team knows firsthand how hard it can be to deal with debt and debt collectors. We’re here to help.

Let’s take a closer look at what happens if you don’t pay EDF or the debt collectors working for them.

Why Is EDF Chasing You for a Debt?

If you have run up an energy debt with EDF, and have ignored the reminders you will have been sent, the company may pass your debt on to a collection agency. EDF will first try to get you to pay by sending you details of the debt, and a final reminder. At this point, it is a good idea to try and settle the debt, so that collection agencies don’t become involved, and your credit score is not harmed. Don’t think that you can just ignore your EDF debt if you move home. Although it will be difficult for collection agencies to trace your new address, they will eventually.

What Happens if You Don’t Pay EDF

A number of actions may be taken by EDF Energy if you do not pay your energy bills. I have listed many of them below. However, what happens next depends on the level of debt, etc.

- Reminding you that your bill has not been paid and requesting payment.

- Interest charges and late payment fees may be added to your account.

- They may restrict your energy supply by installing a prepayment meter, which requires you to pay for your energy consumption in advance.

- Unpaid debt may be reported to credit reference agencies, which may impact your credit score.

- Recovering the debt by engaging a collection agency or by taking legal action.

Do you have to pay EDF debt collectors?

You might not have to pay EDF debt collectors.

If you genuinely can’t afford your debt repayments then looking into whether you could have your written off might be just what you need.

If you want to find out whether you qualify for having debt written off or payments lowered then fill out the short form below.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will You Get a CCJ if You Don’t Pay EDF?

EDF Energy may take legal action against you if you fail to pay your energy bills. You may be served with a County Court Judgment (CCJ).

A CCJ is a court order that requires you to repay a debt. A CCJ will appear on your credit report, negatively affecting your credit score and affecting your ability to obtain credit in the future. Further enforcement actions, such as sending in the bailiffs or attachment of earnings orders, may occur if you do not pay the debt specified in the CCJ.

Generally, EDF Energy will take legal action only if other attempts to recover the debt have failed, and you have been given ample opportunity to pay the debt. If you are having trouble paying your bills, EDF Energy will work with you to find a solution in most cases, rather than begin the legal debt enforcement process.

Can EDF Send Bailiffs to Your Home?

EDF Energy may ask the court to use bailiffs to recover debts owed to them if you have not made satisfactory arrangements to repay them. There is, however, a legal procedure EDF Energy must follow before sending bailiffs to your home.

In the event that bailiffs are contacting you on behalf of EDF Energy, it is imperative that you verify their identities and verify that they have the appropriate documents and authorisation to act. Furthermore, bailiffs are subject to strict rules and guidelines regarding their actions, and they have limited powers.

How To Deal With Bailiffs at Your Door

It can be stressful and intimidating to deal with bailiffs at your door, but you should remain calm and take the necessary precautions to safeguard yourself and your possessions. If you find yourself facing bailiffs at your door, I have listed a few steps you should consider taking, below.

- You should ask to see the bailiffs’ identification and certification documents. Verify that they are legitimate and authorised to carry out enforcement actions. In addition, you can contact the court or creditor to verify their identity.

- While dealing with bailiffs can be frustrating, it is important to remain calm and polite. Confrontations or arguments may escalate the situation, so avoid them.

- You don’t have to let bailiffs into your home: Bailiffs don’t have an automatic right to enter. It is your right to deny them entry, and you should not allow them in unless they have a warrant of entry or court order.

- Take legal advice or speak to the creditor before signing any documents or agreements presented by the bailiffs.

- If you have questions about your rights or feel threatened by the bailiffs, seek advice from a qualified professional.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What a Bailiff Can and Can’t Take

In order to recover money owed to a creditor, bailiffs have certain powers, and this includes taking goods from your home to be sold to pay your debt. Nevertheless, certain items are not allowed to be taken, and I have explained these kinds of items, below.

- Home essentials, such as beds, cookers, and refrigerators, cannot be taken by bailiffs.

- Tools and equipment you need to do your job or run your business cannot be taken by bailiffs.

- Bailiffs are not allowed to take items belonging to someone else, such as your partner’s belongings, or children’s toys.

- Bailiffs cannot take items with a total worth less than the debt owed.

- Bailiffs are not allowed to take items that are necessary for a person’s disability or medical needs.

Now, let me explain the kinds of items that a bailiff can and will take from your home.

- Bailiffs can take your vehicle, such as a car, motorcycle, or van if you own it or have an interest in it.

- It is possible for bailiffs to seize luxury items, such as jewellery, designer clothing, or expensive electronics.

- To recover a debt, bailiffs can seize any cash or money in your bank account.

Bailiffs must follow strict rules and guidelines when taking goods from your home. If they intend to confiscate goods, they must give you notice, and provide you with an inventory of the items they will be taking. As you should realise by now, it makes sense to try and get out of debt, before bailiffs are sanctioned to visit your home.