What’s the Difference Between a Debt Management Plan vs IVA?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Struggling to understand the difference between a Debt Management Plan (DMP) and an Individual Voluntary Arrangement (IVA)?

You’re in the right place. Every month, over 12,000 people visit our site for advice on topics like this.

In this easy-to-understand guide, we’ll:

- Explain how a DMP works and how to set one up.

- Share who might find a DMP helpful.

- Discuss the good and bad parts of a DMP.

- Describe how an IVA works and how to start one.

- Talk about who might benefit from an IVA and what its pros and cons are.

You might worry about not being able to pay or about debt collectors knocking on your door. Our team has faced the same worries, so we’re here to help you find the best solution for your situation.

Let’s dive in!

Is a Debt Management Plan the same as an IVA?

No, a Debt Management Plan and an IVA are two different debt solutions. The two have some similarities, but they have key differences and aren’t the same debt solution.

What is better, IVA or Debt Management Plan?

Neither the IVA or the DMP is better than the other. An IVA and DMP both have benefits and limitations. The best debt solution can only be identified based on individual circumstances and preferences.

You can get free help working out which debt solution is most suitable and advantageous to you by speaking with a UK debt charity. This is the better option than asking online forums where people don’t know your circumstances and aren’t qualified to give you a solid answer.

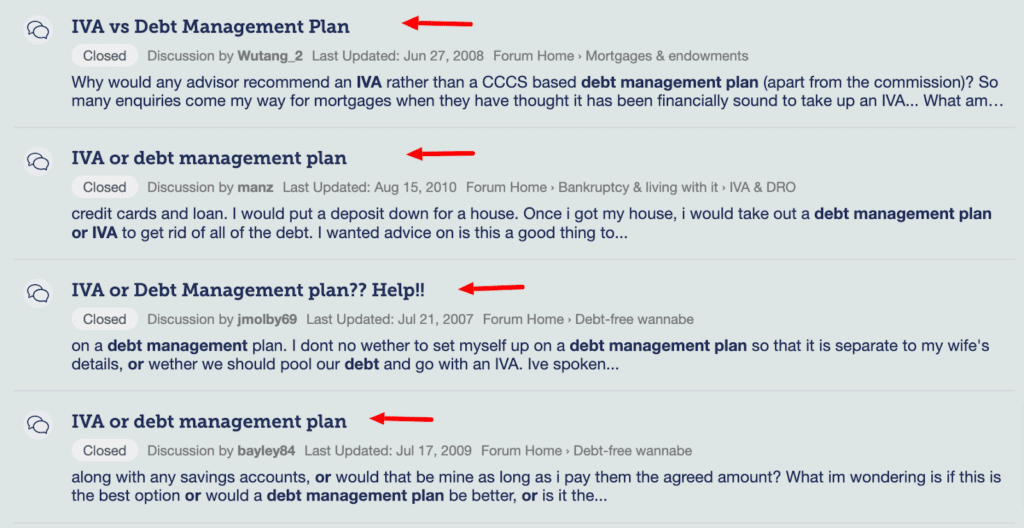

Yet, the question keeps cropping up online:

Organisations like National Debtline and StepChange will provide free and personalised debt advice. They can even help you set up a Debt Management Plan or IVA (via a partner) if this is judged to be your best option.

But it’s still good to have an understanding of how these debt solutions work and differ. You might decide that one isn’t right for you from the outset…

How do you set up a Debt Management Plan?

You have three options to negotiate and set up a Debt Management Plan with creditors:

- Negotiate with them directly yourself, known as a DIY DMP

- Get a debt charity to negotiate with creditors for free on your behalf

- Use a debt management company to negotiate with creditors on your behalf

Creditors aren’t obligated to agree to the DMP but they are encouraged to listen to proposals and the reason for the DMP offer.

Most people use a debt charity to get a DMP because they don’t feel confident negotiating with their creditors directly, and because debt management companies charge fees.

You might see some debt management companies suggest they will secure you a better deal, but there isn’t any widespread data to suggest this is always true.

If you did decide to use a debt management company, always research the company and never feel pressured to enter into the DMP. And make sure you’ve been assessed for other debt solutions first.

» TAKE ACTION NOW: Fill out the short debt form

Who is suitable for a DMP?

The eligibility criteria to use a DMP is minimal due to it being an informal debt solution.

You can typically use a DMP as long as your repayment to each creditor is at least £5 per month, although this isn’t set in stone. You can only include non-priority debts, however.

With a DMP it’s more of a case of whether this is the right debt solution for you, rather than if you can use it or not.

What are the advantages of a Debt Management Plan?

The general benefits of using a Debt Management Plan are:

- They can be free to set up with many charities offering to help.

- You repay with one monthly payment, which has been calculated as affordable based on your situation.

- You may be able to have your interest frozen during the course of the DMP, which helps you pay the debts off faster.

- Merging debt repayments into one monthly repayment makes it easier to budget, which may prevent further arrears.

What are the disadvantages of a Debt Management Plan?

The main drawbacks of using a Debt Management Plan are:

- It’s an informal debt solution, so creditors can withdraw from the agreement at any time and ask for full repayment or take further (legal) action to recover the money.

- A DMP can only be used to repay non-priority debts, so you won’t be able to use it on all types of debt.

- Your credit score will be decreased due to partial repayments. Although, this could still be better than failing to make any repayments and getting into further arrears.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you set up an IVA?

Individual Voluntary Arrangements can only be negotiated and set up by accredited insolvency practitioners.

You must receive professional debt advice before trying to get an IVA, which is available from debt charities. These charities can even help you negotiate an IVA with suitable creditors via trusted commercial debt management companies.

Alternatively, you can go straight to the debt management company. There are fees for their services and the ongoing management of the IVA. But the fees are usually taken from your monthly payment rather than an extra expense.

When they make your IVA proposal to creditors, it must include all your debts so you show that you treat all applicable creditors equally.

These creditors then vote on whether to accept or reject the IVA proposal. If it’s accepted, all creditors are included in the IVA – even the ones that voted against it.

Who is suitable for an IVA?

To use an IVA you must have at least two applicable creditors. However, an IVA is usually only beneficial if you have significant debt that you won’t be able to pay back over a reasonable time period.

You will need to have regular income to get your IVA accepted, such as employment or pension payments.

Your debt adviser will assess your suitability for an IVA against other debt solutions to ensure you’re making the smartest move.

What are the advantages of an IVA?

The main benefits of using an IVA are:

- You are committed to making affordable repayments based on your financial circumstances.

- Any remaining debt when the IVA ends is written off.

- Homeowners can keep their home, but they may need to release equity to end the IVA if possible.

- Because the IVA is legally binding, your creditors cannot change their minds.

What are the disadvantages of an IVA?

The main disadvantages of using an IVA are:

- Using an IVA damages your credit rating.

- You’ll be placed under spending restrictions and must report to your IVA supervisor.

- You will have to pay ongoing fees, although these are taken from your monthly payment.

- You might have to release equity from your home to end the IVA. And you’ll have to pay in any windfall into the IVA as well.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How are IVAs and DMPs similar?

Although these debt solutions aren’t the same, there are some similarities between an IVA and DMP.

Both debt solutions allow you to make a single monthly repayment based on your financial circumstances, which makes the payment affordable to you. These monthly payments are then proportionally split between creditors.

And both solutions are often used to repay the same types of debts, such as unsecured loans and credit cards.

What is the difference between a Debt Management Plan and IVA?

Debt Management Plans and IVAs have several differences. The main differences between these debts solutions are:

- An IVA is legally binding, whereas a DMP is not so creditors can change their minds

- A DMP can be set up independently and for free, whereas an IVA must be set up by paying an insolvency practitioner

- IVAs are mostly used by people working jobs, whereas this isn’t always the case with a DMP

- An IVA may require you to release equity from a property or make a lump sum payment, but this isn’t part of the DMP repayment process

- An IVA can write off some of your debt, whereas a DMP doesn’t but can get your interest frozen.

» TAKE ACTION NOW: Fill out the short debt form

Debt Management Plan Vs IVA (Quick summary)

A Debt Management Plan and IVA are two different debt solutions that allow you to repay multiple applicable creditors via affordable monthly repayments.

But a DMP is an informal solution and an IVA is legally binding for all parties. The repayment process is usually longer and more complicated in an IVA.

The only way to know which one is better for you is to get personalised debt advice from a debt charity like StepChange.

Explore even more options!

But a DMP and IVA aren’t your only options.

You may be better off using a Debt Relief Order or even petitioning for bankruptcy. I discuss all your debt solution possibilities in my How to Beat Debt guide. Check this out and remember that free help is widely available.