Do I Need to Declare Penalty Points to Insurance Straight Away?

If you have penalty points on your licence, you might be worried about your car insurance. You’re not alone. Every month, over 1,000 people visit this blog looking for guidance on insurance after a conviction or points.

This article will help you understand:

- What penalty points are and how they work.

- How to find affordable car insurance even with a conviction or points.

- The right time to tell your insurance about your points.

- What happens if you don’t declare your points to your insurance.

- How to check and manage the points on your licence.

We understand your worries. Getting penalty points can be stressful, and the thought of high insurance costs can add to this stress.

It’s important to be honest with your insurance company about your points. We’ll guide you through the process and help you find the best solution.

Do I need to declare points to insurance?

Yes, you must declare unspent driving convictions to prospective insurers when you apply for a car insurance policy.

Do you have to tell insurance about points straight away?

If you look online, you’ll find conflicting information on whether you need to tell an insurer about new penalty points immediately. Some reputable sources say you don’t – including MoneyHelper – whereas other sources say you do.

The reason this isn’t black and white is that the terms and conditions of individual car insurance policies differ.

Some insurance providers add to the terms and conditions that they must be notified of new driving convictions and penalty points, whereas others don’t ask for this.

So, it’s best to check the terms of your current policy to see if you have to tell insurance companies about new penalty points straight away. Or call them if you’re not 100% sure. It’s always better to be sure than sorry in this situation.

You must tell your insurance provider if you’re disqualified from driving straight away.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How long do you have to declare points to insurers?

You’re only obligated to disclose driving convictions that are unspent, which typically means you only have to disclose driving convictions that occurred within the last five years.

Some insurance companies will ask about driving convictions and the points on your licence that you received within the last ten years. They will also ask about other criminal convictions.

Although the insurance company is allowed to ask this question, there are two important things to know:

- You are not obligated to tell an insurer about convictions that are spent.

- The insurer cannot increase your car insurance premiums based on any spent convictions that were disclosed.

Do insurers know if you have points?

Insurance companies don’t immediately know if you have penalty points on your record.

But that’s not the full story…

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Can insurers find out if you have points?

Yes, insurance companies can check your driving record if they so wish.

They must get your permission to do this, but it’s likely you give them permission to check your record when you apply for a policy.

Will my insurance company check if I have points?

A vehicle insurance company is likely to check if you have penalty points and unspent convictions.

They might not do this straight away when you apply for the policy. But they could do it in the weeks or months after.

Do insurance companies get notified of points?

Insurance companies won’t be automatically updated if one of their insured drivers receives a driving conviction and penalty points.

But they might find this information out if they decide to check your driving record.

What happens if I don’t declare points on insurance?

If you don’t disclose unspent convictions and penalty points, your insurance policy won’t be valid and you’ll leave yourself vulnerable to legal claims and financial loss if you needed to make a claim.

The unspent convictions and points of all named drivers must be disclosed to keep a policy active.

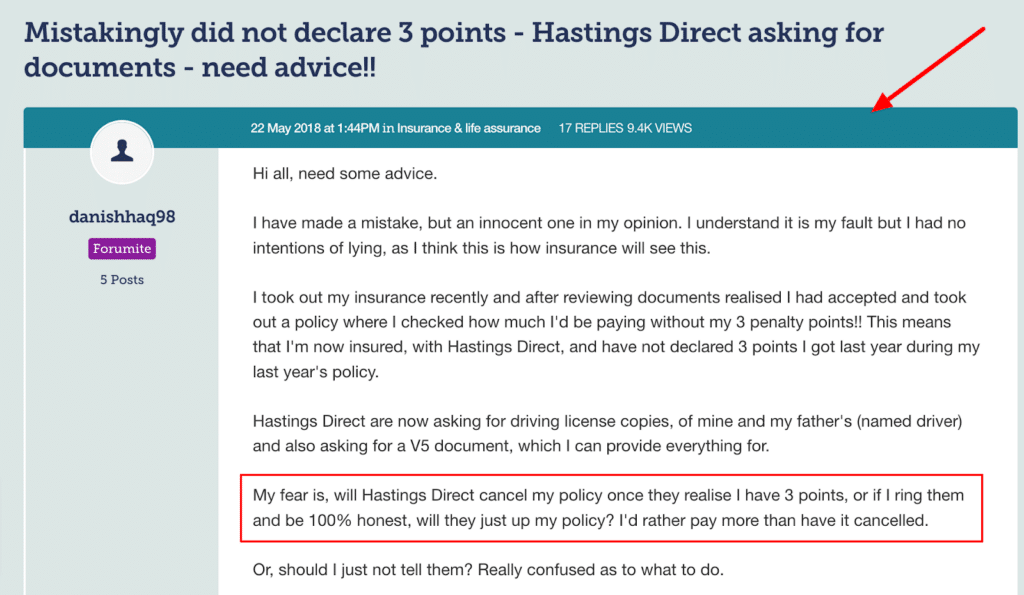

What happens if I forget to tell my insurance company about points?

But what happens if you make an honest mistake and forget to tell your insurance company about points when you renew the policy?

This situation isn’t that uncommon. Here’s one familiar account posted to a well-known online forum:

So, what’s likely to happen?

The insurance provider will probably tell you that the policy isn’t active and wouldn’t have been active should you have needed to make a claim. They will adjust your insurance premiums going forward to ensure the policy now covers you, which means an increase in payments.

On top of this, I have known instances where the insurance company tries to backdate payments to recover the money you weren’t paying. This is despite the fact that the insurance company wouldn’t have paid out because it didn’t know about your penalty points.

Doesn’t seem fair, does it?

How will penalty points affect my insurance quote?

Yes, an unspent driving conviction and the penalty points you received as a result will negatively affect your insurance quotes.

Because you have points on your licence, you’re considered a riskier driver compared to a driver that has no points on their licence. Generally speaking, the more points you have the greater the risk you’ll be perceived.

The insurance company will believe you’re more likely to be involved in a road incident than someone with no penalty points. Consequently, they want to offset the risk of insuring you by making you pay more to be insured.

This is quite common. Just think of a house in a flood zone and one not in a flood zone. The insurance company will ask the homeowner of the property in the flood zone to pay more in insurance because there is more chance their home will be flooded and they will make a claim.

The same logic applies to car insurance.

How do I get cheaper car insurance if I have penalty points?

There might be ways to get cheaper car insurance if you have unspent penalty points on your licence. You could do one or more of the following:

- Insure a vehicle that is typically less expensive to insure because it’s less powerful

- Search away from the mainstream insurance market for more understanding companies. They may market their policies with different terms, such as convicted driver insurance or disqualified driver insurance.

- Get help from a car insurance broker who specifically helps people with penalty points on their records.

How long does it take for points to come off your licence?

Penalty points remain on your driving record for either four or eleven years from the date of the offence or the date of the conviction.

Whether they stay on your record for four or eleven years depends on the type of offence committed.

However, this should not be confused with the length of time it takes for the motoring conviction to become “spent”. In the majority of cases, a driving conviction becomes “spent” after five years.

How long do points stay on your licence in Scotland?

In Scotland, penalty points are valid for three years but stay on your driving record for four years.

How long do points stay on your licence in Northern Ireland?

In Northern Ireland, penalty points stay on your driving record for four or eleven years – the same as in England and Wales.

How to check the points on your licence

You can check how many points you have on your driving record by either:

- Visiting the UK government’s website and entering your details. You’ll need your National Insurance number, your driving licence number and the postcode on your licence.

- By calling the DVLA, you’ll also need to verify who you are, possibly with the same details listed above.