How Will a Debt Management Plan Affect My Job?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Struggling to pay a debt can be hard. You may be worried about things like bailiffs or debt collectors. If this is your case, you are in the right place.

Every month, more than 12,000 people visit this site for useful advice on debt topics. In this guide, we are going to learn about Debt Management Plans (DMP). We’ll answer important questions such as:

- What is a DMP, and do you have to pay for it?

- Will a DMP affect your job, and do you have to tell your employer about it?

- Can you work in a bank with a DMP?

- What are the good and bad points of a DMP?

- How long does a DMP affect your credit rating?

Some of our team have had their own debt problems, so we know how it feels to be in your shoes. We will use our knowledge to help you understand your options.

Let’s start learning together.

Do I have to declare a Debt Management Plan?

It’s unlikely that you’ll have to declare that you’re using a DMP to another party. But there can be some exceptions, especially if you’re employed in certain positions.

Will a debt management plan affect my job?

It’s unlikely that a Debt Management Plan will affect your job.

You don’t usually have to tell your employer that you’re using a Debt Management Plan to get out of debt, but you may be obligated to tell them if it’s in your employment contract.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When might your employer want to know about a DMP?

Your employer may want to know about a Debt Management Plan when you work in finance, such as working as an accountant or insolvency professional.

They could have inserted a clause into your employment contract that states you must tell them if you use a Debt Management Plan or other debt solution. You should check this to see if you need to tell your employer about the DMP. if it’s not in the contract, you’re not obligated to tell them.

Similarly, most jobs don’t include a credit check or require a good credit score, so a reduced credit rating – due to using a DMP – won’t affect most people’s employment.

But if you work in finance, you might need to tell your employer. Or if you go for a job interview, your credit file may be checked and the DMP would then be obvious to the employer.

Can debt solutions ever affect your employment?

Yes, there are debt solutions that can affect your job if you work in certain professions. The debt solutions that are most likely to affect some jobs are:

- Bankruptcy

- Individual Voluntary Arrangement (IVA)

For example, undischarged bankrupts cannot work in a number of positions, including company director, estate agent, charity trustee and insolvency practitioner.

An Individual Voluntary Arrangement (IVA) is a legally binding debt solution that can stop you from working in some professions in the financial sector. Or it can cause you to meet certain conditions to remain employed. The IVA works very similarly to a DMP.

Because a Debt Management Plan isn’t a formal insolvency solution, it has a lesser potential affect on your employment.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I work in a bank with a DMP?

It’s unlikely that a DMP will stop you from working in a bank, but it really depends on the position you will be taking within the bank.

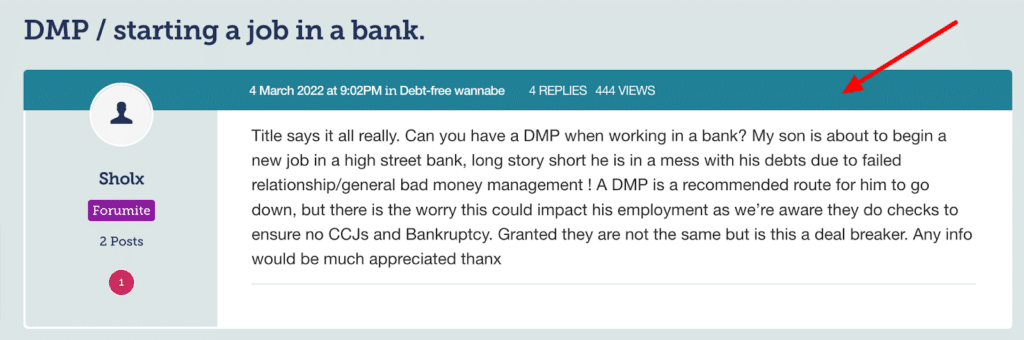

This is a question that pops up frequently on online forums. Here is just one example:

Source: https://forums.moneysavingexpert.com/discussion/6339947/dmp-starting-a-job-in-a-bank

I can’t say for certain whether your DMP will affect your position or employment opportunities within UK banks, but I do believe it’s best, to be honest if asked during an interview.

Can anybody find out I’m using a DMP?

Nobody will find out that you’re using a DMP unless you tell them or you’re forced to tell them due to a contractual obligation. Your creditors cannot discuss the DMP with anybody else, such as family, friends or employers.

The DMP doesn’t appear on a public register, which is the case for IVAs, DROs and bankruptcy. These debt solutions appear on the Individual Insolvency Register

Does a DMP appear on your credit file?

Yes, when you use a Debt Management Plan, you will be paying back less than the original repayment amount each month. Partial repayments decrease your credit score and make it more difficult to get approved for credit in the immediate future.

What happens if you go on a Debt Management Plan?

When you enter into a Debt Management Plan with creditors, it is not recorded on any register. This is because a Debt Management Plan is a non-legally binding debt solution.

You simply have to keep up with the single monthly repayment until all creditors have been fully repaid.

What are the benefits of a Debt Management Plan?

The main benefits of using a DMP are:

- You only repay what is deemed affordable based on your situation.

- You might get interest and other fees frozen.

- You only have to manage a single monthly repayment to all non-priority creditors, which can help you budget and stay on track. It might even prevent other arrears.

- They can be set up for free yourself or by debt charities who speak to creditors for you.

What are the negatives of a Debt Management Plan?

As with all debt solutions, there are also limitations to using a DMP, including:

- The creditors don’t have to agree to a DMP and they could instead chase you for full payments or take legal action. This is less likely if you prove you’re making a reasonable DMP offer.

- A DMP is a non-legally binding debt solution, also known as an informal solution. Thus, creditors can pull out of the agreement at any time if they so wish.

- Priority debts cannot be included, so it might not be suitable for some debtors.

- Using a debt management company to set up your DMP will incur fees.

And there is another drawback to using a Debt Management Plan, which is relevant to the topic of DMPs and employment…

DMP alternatives

Did you know that a DMP is just one of many different debt solutions? You might be better suited for a different solution, including options that can write off some or all of your debt.

Speak to a UK debt charity for personalised help choosing a debt solution, and start to understand your options by reading my How to Get Out of Debt guide.

Do you have to tell your employer about a DMP? (Quick summary)

You don’t have to tell your employer you’re using a DMP unless it’s stated in your employment contract. This is unlikely unless you work in trusted positions in the financial or legal sector.