Do I have to pay Credit Style Debt (CST Law)?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried because of a letter from Credit Style Debt (CST Law)? You may be unsure about how to handle debt collectors. It’s normal to feel this way. Each month, more than 12,000 people come to this website for advice on similar problems.

In this article, we’ll explore:

- Who CST Law is and why they might contact you.

- How to respond when you receive a CST Law letter.

- What happens if CST Law takes you to court.

- Ways to lower your repayments to Credit Style Debt.

- Tips to stop calls from Credit Style Debt.

We know that dealing with debt can be very hard. Our team understands your situation because some of us have been there too and have faced the challenge of owing money and not knowing what to do next. We can give you the information you need to deal with this problem. Let’s find out more about how to handle debt collectors like Credit Style Debt (CST Law).

Do I have to pay credit style?

You’d only have to pay Credit Style if they can ‘prove’ the debt they are chasing you for is actually yours! So, the first thing to do when the debt collector contacts you is to request a ‘prove the debt’ letter.

Don’t just accept a verbal assurance that the debt is yours! CST Law must provide hard proof that you owe the money.

What should you do when you get a CST Law letter?

As mentioned, ask CST Law to provide proof the debt is yours. Then check if the debt is time-barred which means it’s over six years old.

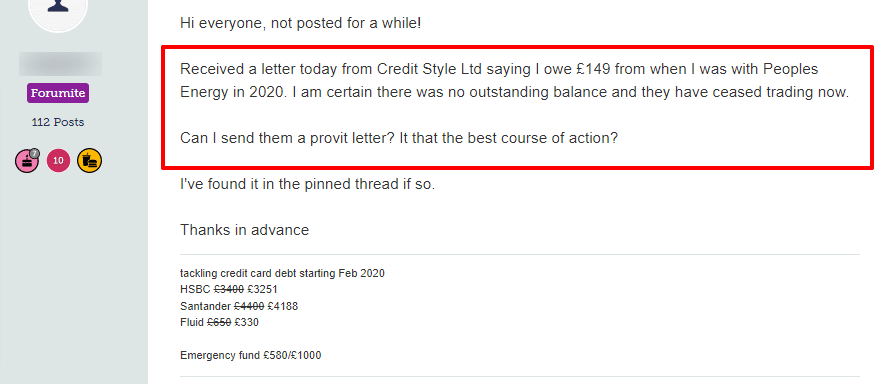

Check out the “prove it” question one concerned person posted after CST Law chased them for a debt:

Source: Money Saving Expert

Next, seek advice from one of the debt charities. Their advice could help you make the right choice in setting up a realistic payment plan if the debt is yours!

Don’t agree or sign anything with CST Law until you’ve received independent debt advice!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ignore a letter from CST Law?

No. Ignoring the problem won’t make the debt go away. It will just make matters worse for you. Plus, you could be missing out on important information which could include:

- Discovering the debt is not yours!

- Finding out the debt is time-barred!

- Ending up with a CCJ registered on your credit history!

- Missing out on an affordable payment plan!

- Having some of the debt written off!

What can CST Law do?

Like all debt collection agencies that operate in the UK, CST Law must follow the law. There are specific things a debt collector can and can’t do when chasing you for payment.

For example, CST Law can:

- Visit you at home

- Call you at times you requested

- Communicate with you in the way you asked them to

- Ask you to pay them directly

- Discuss the debt with you discreetly and politely

But there are things that a debt collection agency cannot do which are:

- Pretend they are Enforcement Agents (bailiffs) which is against the law

- Use deceitful tactics to trick you into signing an agreement

- Make out they have powers to seize your possessions

- Contact you when you asked them not to

- Act in an intimidating way

- Force their way into your house

- Discuss a debt with other people namely your family, friends, or employer

- Visit you when you’re at work

- Refuse to leave when you ask them to

- Clamp your vehicle or seize your possessions

Moreover, debt collectors shouldn’t threaten you with court action if they know they won’t follow through!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will Credit Style Debt take you to court?

Yes. You risk court action when you don’t respond to CST Law correspondence.

In short, CST Law could:

- Get a County Court Judgement (CCJ) levied against you

- Ask for Enforcement Agents (bailiffs) to recover the debt. The bailiffs could seize your possessions and sell them at auction

- Secure a ‘charging order’ which could be on your property!

Can CST Law come to my house?

Yes. A representative of CST Law has the right to pay you a visit at home. To avoid this happening, it’s best to respond to all correspondence they send you!

If a debt collector from CST Law does show up at your house, don’t let them in and ask them for their ID!

Then ask them to leave.

» TAKE ACTION NOW: Fill out the short debt form

Can you get out of paying Credit Style Debt?

There are ways you could get out of paying Credit Style Debt which I’ve listed here:

- The debt is not yours and CST Law can’t prove it is

- The debt is over six years old and therefore statute-barred

There are provisions to the statute barred rule which are:

- You haven’t paid anything towards the debt in six years

- You didn’t admit liability for the debt in six years

- No CCJ against you has already been served

If none of the above applies, the debt is statute-barred and you won’t have to pay under the Limitation Act 1980.

Can you stop Credit Style Debt from calling you?

Yes. There are rules that all debt collection agencies must follow. This includes respecting the times they can contact you. For example, you have the right to ask CST Law to only contact you at specific times.

Moreover, you can ask them to only contact you in writing!

Make sure you send the letter to CST Law registered post and keep a copy for your records. You may need it if the debt collection agency keeps contacting you when you asked them not to.

It would amount to harassment which is against the law!

How do you contact Credit Style Debt?

I’ve listed ways you can contact Credit Style Debt here:

| By telephone | 0114 290 1400 |

| Via email | [email protected] |

| In writing | Credit Style Limited, 5 Rutland Court, 161 Rutland Road, Sheffield, South Yorkshire, S3 9PP |

| Complaints telephone number | 0114 290 1400 |

| Complaints fax: | 0845 638 4712 |

| Complaints online form: | message Credit Style here |

| Complaints by post: | 5 Rutland Court, 161 Rutland Road, S3 9PP |